Global debt surged to a record $250 trillion in the first half of 2019, led by the US and China

November 15, 2019 @ 15:01 +03:00

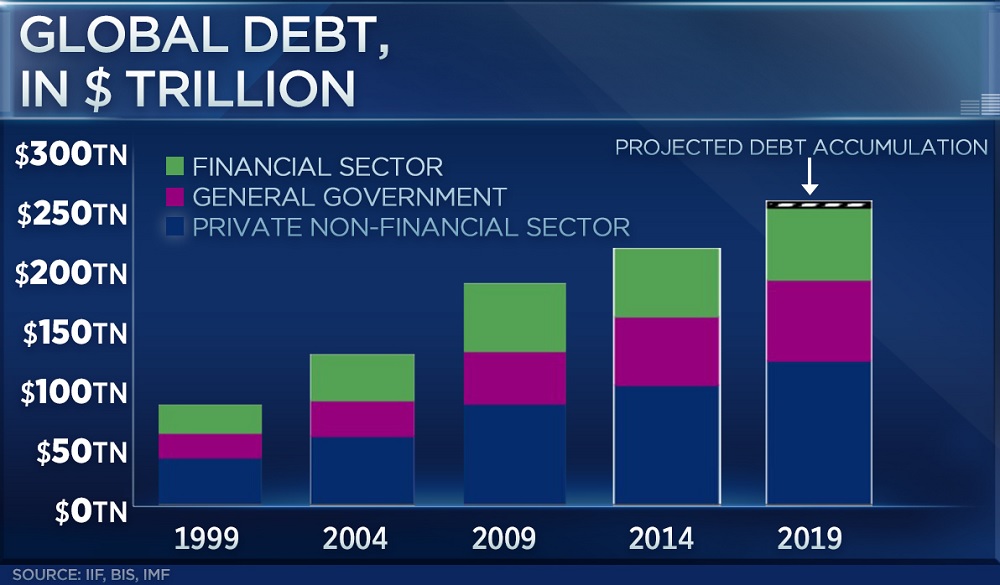

Global debt hit a record high of over $250 trillion in the first half of this year, led by a surge in borrowings in the U.S. and China, according to a new report. The report, released by the International Institute of Finance (IIF) on Thursday, showed that global debt surged by $7.5 trillion in the first six months of 2019. The IIF said the overall number hit $250.9 trillion at the end of this period, and will exceed $255 trillion by the end of 2019.

“China and the U.S. accounted for over 60% of the increase. Similarly, EM debt also hit a new record of $71.4 trillion (220% of GDP). With few signs of slowdown in the pace of debt accumulation, we estimate that global debt will surpass $255 trillion this year,” the IIF said in the report. Rising debt across the world has been a big concern for investors and has also been flagged as the next breaking point by a number of economists. Record-low interest rates make it extremely easy for corporates and sovereigns to borrow more money.

The International Monetary Fund (IMF) last month escalated its warnings about high levels of risky corporate debt, which have been exacerbated by persistent low interest rates from central banks. The IMF warned that almost 40%, or around $19 trillion, of the corporate debt in major economies such as the U.S., China, Japan, Germany, Britain, France, Italy and Spain was at risk of default in the event of another global economic downturn.