FxPro: Surge in U.S. employment can return demand for risky assets and Dollar

January 04, 2019 @ 17:13 +03:00

Very strong employment data from the U.S.:

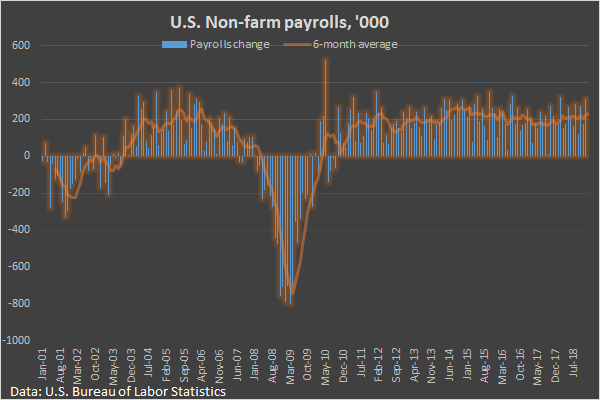

- Non-Farm Employment +312K vs expected +181K

- Manufacturing Employment + 32 vs expected + 20K

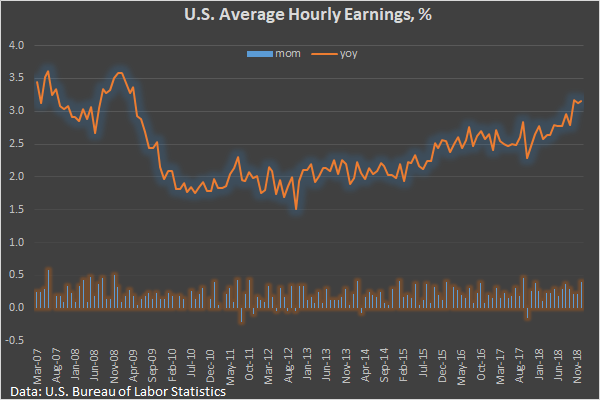

- Average hourly earnings +0.4% m/m, 3.2% y/y, much better expected +0.3% m/m 3.0% y/y

The rise of unemployment from 3.7% to 3.9% should not be misleading, as it was together with the growth of the Participation Rate on the same 0.2 percentage point.

This is a positive news for the dollar, which added 0.4% in the first minutes after the publication.

Such strong growth has the potential to mitigate fears around the growth of the US economy by supporting the demand for risky assets.

Now the main question is how Powell will comment these figures at 15:15 GMT. Will he seize the chances to set up markets for two rate hikes in 2019, although the markets are not expecting no changes or even cut?

Alexander Kuptsikevich, the FxPro analyst