FxPro: Euro and Pound in decline on softer region data

February 05, 2019 @ 18:46 +03:00

The contrast of economic data between the US and Europe grows more prominent, as European statistics begin to look considerably despondent.

Business sentiments in Europe are weakening, while the Sentix Investor Confidence index hits its lowest levels in 4 years. The Producer Price Index in December of last year sees a slow down of annual growth to 3.0% against the 4.9% two months prior.

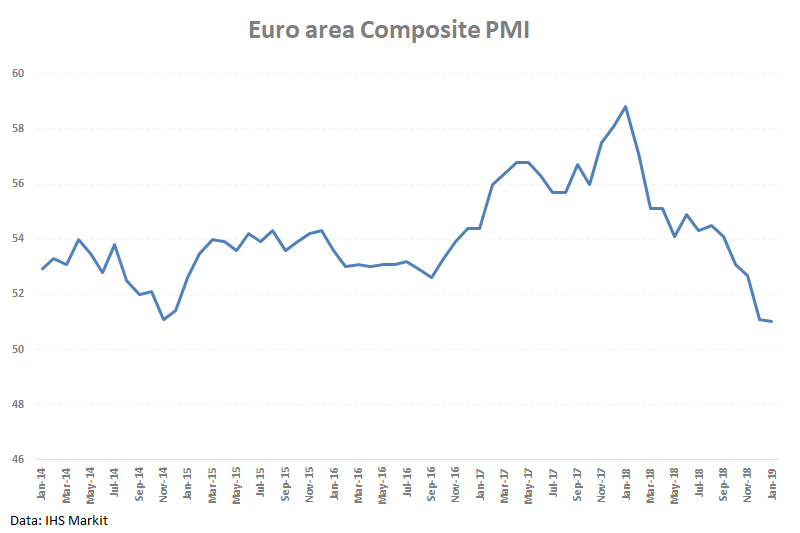

The latest PMI data released on Tuesday was better than expected at 51.0, however, still at its lowest since mid-2013.

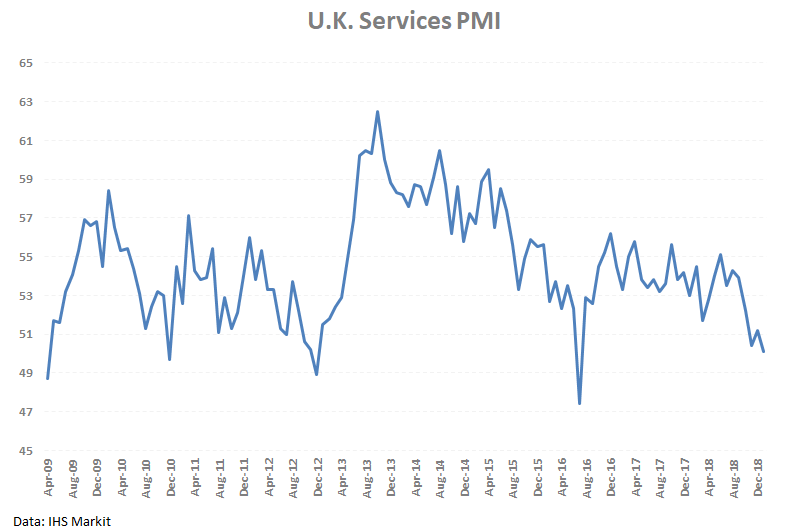

A similar picture is observed in the UK where the Services PMI dropped to 50.1 against the 51.2 in the previous month (where 50 is the mark that separates growth from a decline). This new data from the UK is yet another reminder of how Brexit uncertainly is influencing the business activity.

However, British consumers rush to the stores, clearly concerned about the rise in prices once the country leaves the EU.

In this setting, the EURUSD pair pressured against the dollar to 1.14 completely returned its gains after the recent FOMC meeting. The GBPUSD pair went through that barrier last Friday and came down to a 2 week low of 1.30.

The US ISM non-manufacturing PMI Index is due to be released today and on average the analytics are expecting a decrease from 57.6 to 57.2. However, even if these predictions fall through, there are no signs that America’s business activity is slowing down, which in turn will continue to support the dollar.

Alexander Kuptsikevich, the FxPro analyst