Fragile market growth: investors are quickly switching to sales

June 17, 2020 @ 12:08 +03:00

American Nasdaq crossed 10000 again yesterday, while Dow Jones and S&P 500 added 2.0% and 1.9% on Tuesday respectively. However, it is worth taking a closer look at this growth to realize that it is worth being careful. The intraday dynamics of the indices and the behaviour of the popular currencies indicate negative underwater currents.

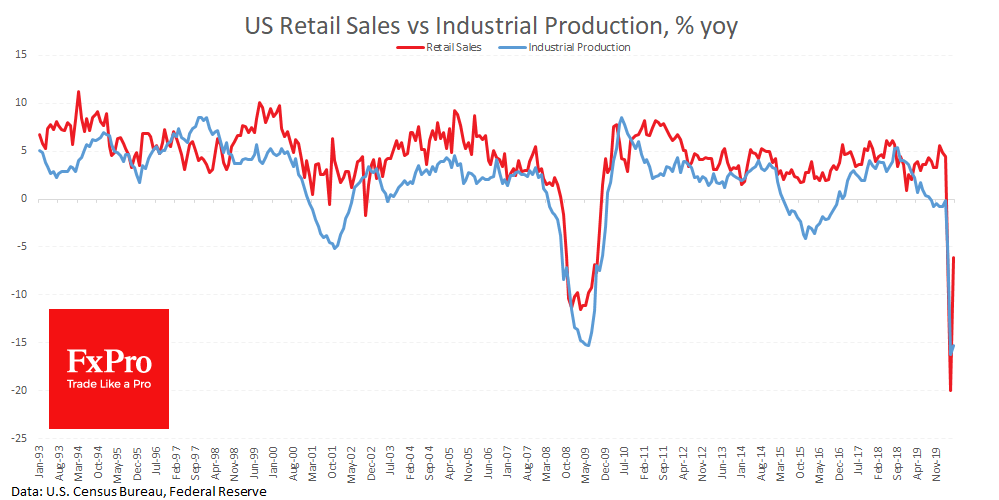

Purchasing in equity markets strengthened after the publication of data on the sharpest increase in retail sales in the U.S. in history. But this rally wasn’t sustainable. During the day, S&P slid by 2.4% after the release of industrial production data and Powell’s speech. The head of the Fed reiterated the idea that it would take years to analyze the consequences of coronavirus in the economy. And before that, it was reported that industrial production grew by 1.4% in May. What a contrast to the 17.7% growth in consumer spending! Americans have quickly returned to shopping, increasing speculation around the V-shaped recovery, while the production dynamics are still taking the L-shape.

Interestingly, in China, it was just the opposite: the rapid recovery of production activity contrasts starkly with the sluggishness of retail sales and the cautiousness of the service sector.

These figures are a reminder that weak sectors often endure the most severe downturns and take longer to recover during a crisis. At the same time, new support measures for consumers continue to be discussed in the U.S.A. Going further, this dynamic will exacerbate the U.S. trade imbalance: people will have money to buy goods, but most of it will come from abroad, creating jobs there.

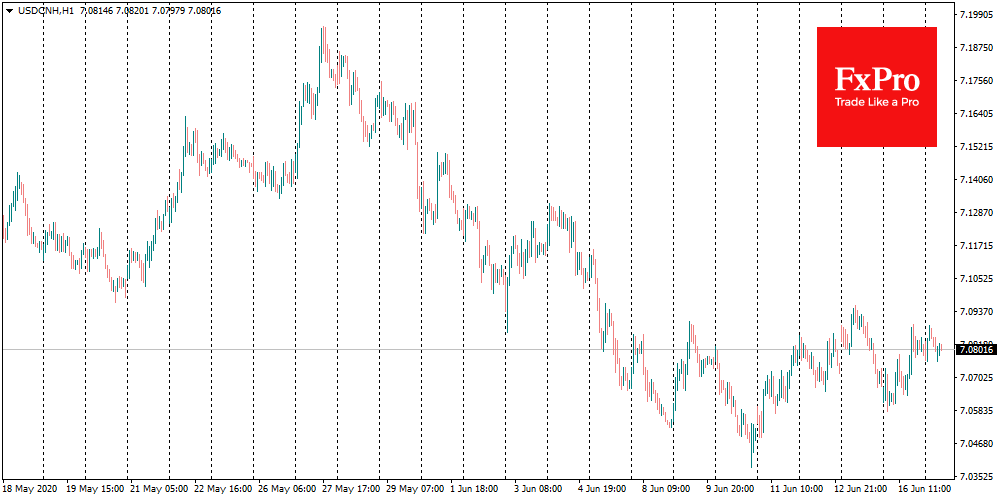

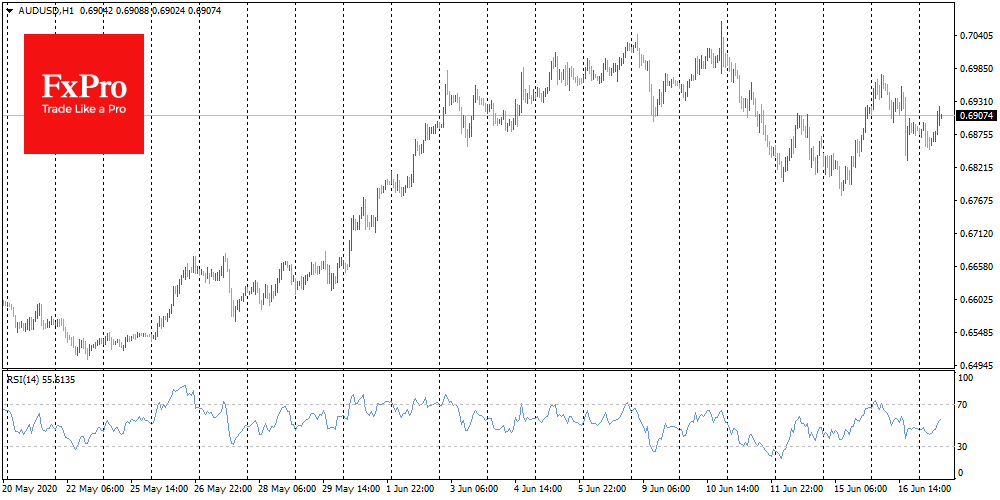

Among other worrying factors, it is worth mentioning the currency market. The Chinese yuan, the Australian dollar, and the Japanese yen are signalling at least waiting approach, if not a decrease in demand for risk assets. USDCNH has been around 7.08 for the last ten days. Its decline before that was an additional sign of bull confidence in the markets. Now, its dynamic demonstrates the divergence with the U.S. markets.

The Australian dollar was struck on Tuesday night, losing 1.7% in the day to 0.6830. It was noticeable how quickly investors switched to sales as if they did not believe in further currency recovery. The level of 0.7000 still seems to be the key to understanding investor sentiment. By trading below this mark, AUDUSD signals investors’ concerns about the growth dynamics of the entire Asia-Pacific region. USDJPY is stuck at 107.30, preferring to take a look around and even has some tendency to decline.

The FxPro Analyst Team