FOMC supports dollar defending its rate-hike plan

August 23, 2018 @ 11:13 +03:00

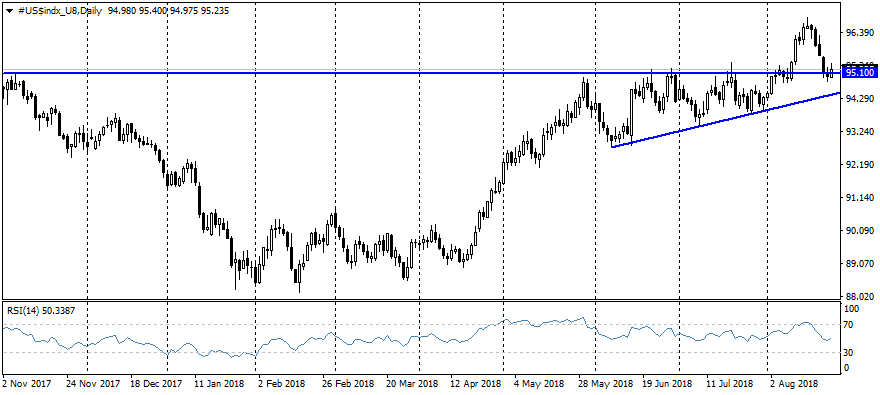

The American dollar adds to major competitors after publishing FOMC minutes of the previous meeting. The dollar index adds 0.4% in response to the protocols to the July meeting, when the Committee members have discussed further policy of interest rate tightening. This news helped the American currency to turn to growth after five trading sessions of decline. The Fed’s support came just when the dollar index, DXY, tested the former level of resistance of the trading range that now became support. FOMC comments have returned the expected probability of raising rates in September to 96%, same as one week earlier after the decline to 93.6% in the first half of the week. FOMC sticks to its hiking plan despite Trump’s comments.

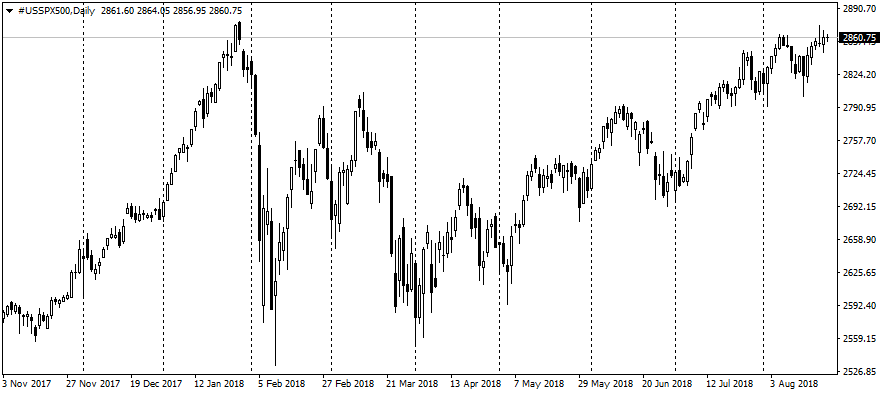

The dollar also received support overnight on the news that the punitive 25% tariffs for goods in the amount of $16 bln. were introduced by China and the US, bringing the total amount of goods that fell under tariffs to 50 bln. These measures have been announced earlier, but the markets have not been able to avoid weakening on their return to such a painful topic. Moreover, this week, Washington will discuss the possibility of imposing elevated tariffs for Chinese imports of up to $200 billion worth goods. MSCI index for Asia-Pacific region ex Japan has lost 0.1% since this morning; the futures for S&P500 demonstrate the same decline.

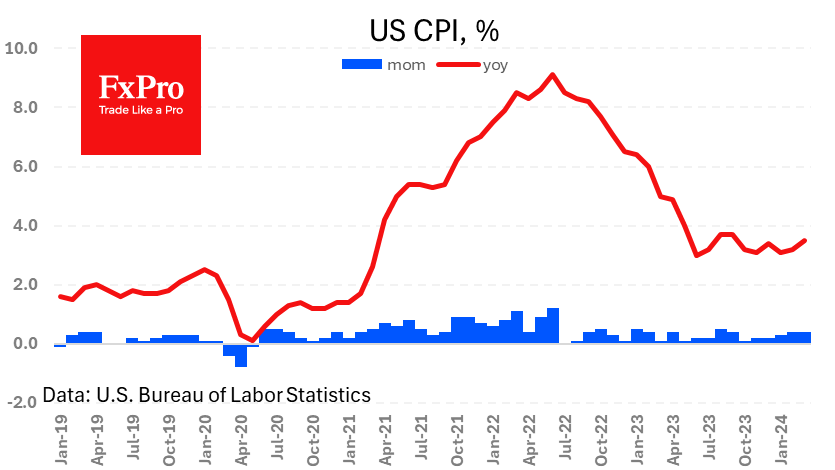

The introduction of import tariffs threatens to increase the inflationary pressure in the United States. If the country’s economy maintains a steady rate of growth, the Fed can begin to increase interest rates more actively to return inflation to the target rates. In this regard, the importance of macroeconomic statistics, which will come out in the coming months in the U.S., can further affect the FOMC plans for the forthcoming year. Interest rate expectations often act as a key driver for currencies.

The EURUSD pair, which was as high as 1.1620 on Wednesday, experienced a decline to 1.1550 on Thursday morning, losing 0.3% after the publication of the Fomc Minutes. The British pound sank to 1.2870 from its highs near 1.2830 a day earlier. The Asian currencies are again under pressure due to the return of the trade conflict between China and the United States into the investors’ focus. The Chinese yuan is traded at 6.87 per dollar, adding 0.7% in the last 24 hours. The Japanese yen weakens to the dollar the third day in a row to 110.80.