Fed has prescribed growth to the dollar; euro and pound are on the verge

August 01, 2019 @ 12:29 +03:00

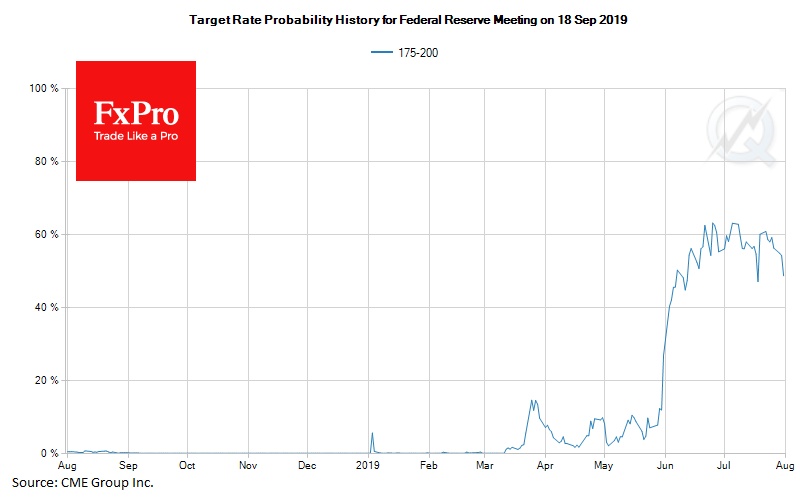

Market focus It must be said that this meeting could become a turning point for both the US currency and the markets as a whole. During the two previous cycles, the federal funds rate decreased by more than 5 percentage points. Now, the Fed does not have so much room for manoeuvre, since the decline has to be made from a starting point of 2.25% -2.50%. As the FxPro Analyst Team said, Powell tried to convince the markets that the current situation was different from the two previous cycles but this was apparently in vain. If the economic data of the next weeks will not present unpleasant surprises, it will develop into an acceleration in the growth of the dollar quotes.

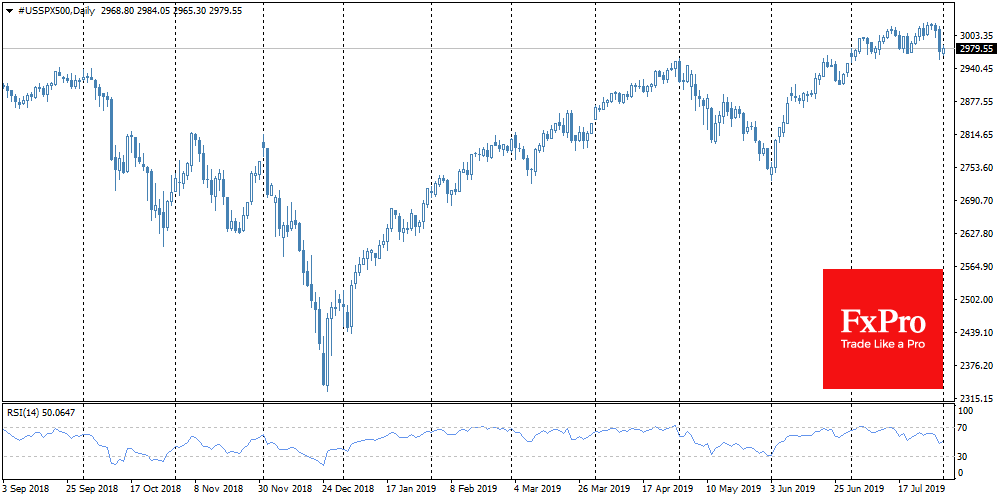

Yesterday, the markets were full of hopes that the Fed would cut the key rate to a target range of 2% – 2.25%. Well, the expectations were justified, warning that such a gesture should not be considered the beginning of a long series of rate cuts. Although this may not be the last drop in 2019, the markets have already lost their optimism. Due to broken plans for the outcome of September’s meeting, the rate of the American currency, as well as the dollar index, began to grow. On the other hand, the main stock indexes showed a drop of more than 1% at the same time.

Today, the Asian markets are moving in different directions: China’s indices are losing ground, while the Japanese Nikkei won back yesterday’s losses, accompanied by the yen weakening, after the Fed’s decision was published.

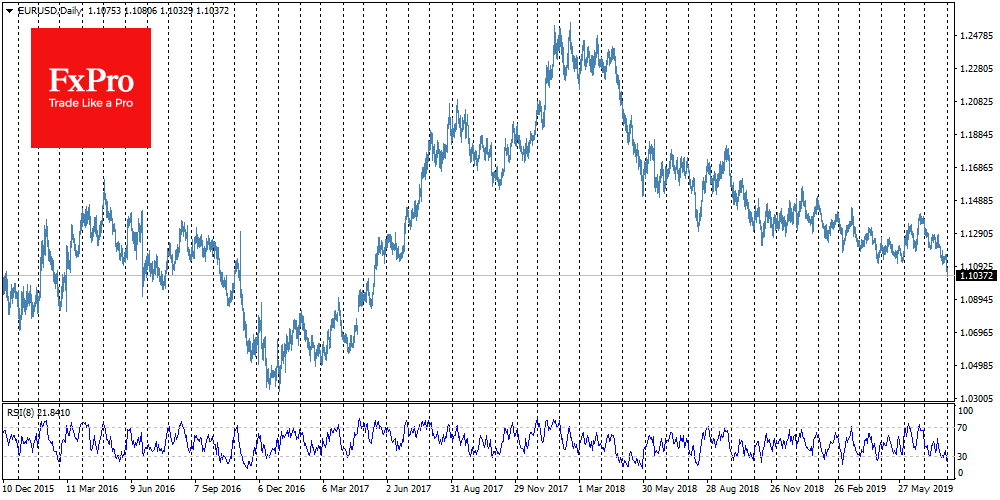

EURUSD The US uptrend was strengthened by EURUSD falling below an important support level on 1.1100. Now, the pair is at 1.1050, dropping to the lowest levels since May 2017. The breakdown of the support line could lead to increased pressure on the euro. At the same time, around break at 1.1000 is able to accelerate this weakening.

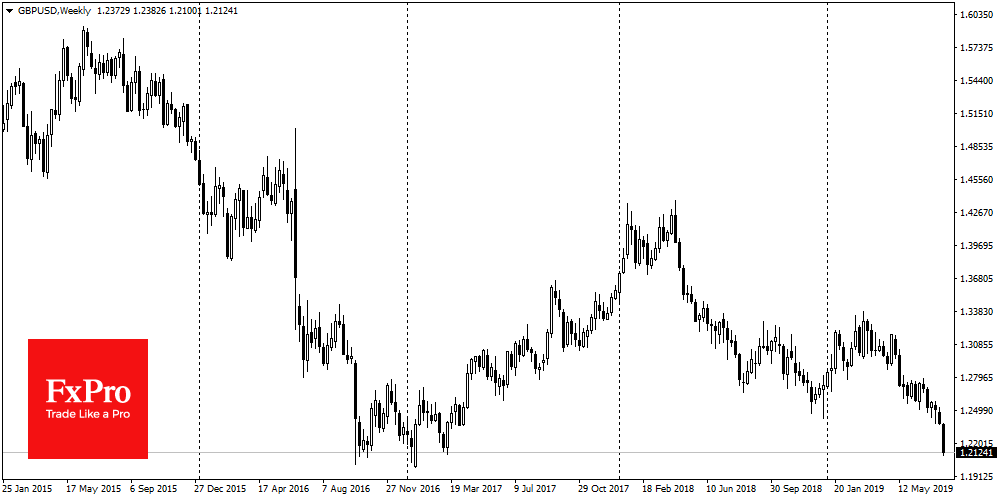

GBPUSD Today, during the Asian trading, GBPUSD came close to 1.210. At the moment, sterling is being traded near the lows, which was reached only after the Brexit referendum in 2016. Thus, the failure under the mark of 1.210 could trigger a new wave of stop-order triggering and an uncontrolled decline. In light of this, the Bank of England has double responsibility at today’s rate meeting. Carney and his colleagues need to be very careful in choosing words, in order to not provoke an uncontrollable decline in the national currency, since that can bring stock markets down.

The FxPro Analyst Team