Dow futures fall more than 200 points on record retail sales drop, increased China tensions

May 15, 2020 @ 15:59 +03:00

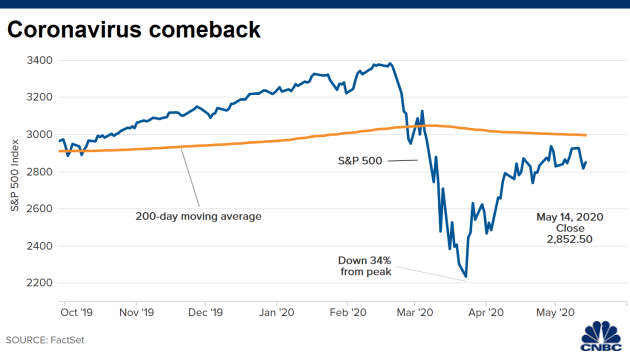

Stock futures fell on Friday on the back of a record plunge in U.S. retail sales and rising trade tensions between China and the U.S. Dow Jones Industrial Average futures fell 247 points, or 1.1%. S&P 500 futures lost 1.1%. Nasdaq-100 futures slid 1.4%.

U.S. monthly retail sales fell by 16.4% in April, a record. Economists polled by Dow Jones expected a decline of 12.3%. The Trump administration has moved to block semiconductor shipments to Chinese company Huawei. The Commerce Department said it would “strategically target Huawei’s acquisition of semiconductors that are the direct product of certain U.S. software and technology.”

The Dow rallied more than 300 points while the S&P 500 gained over 1% on Thursday. The Nasdaq Composite advanced 0.9%. Gains in bank and energy stocks lifted the major indexes while shares of major tech companies such as Apple and Alphabet added to their recently massive gains.

Despite those gains, however, Wall Street was headed for its biggest weekly decline since late March. The Dow and S&P 500 both ended Thursday’s session down more than 2% for the week. The Nasdaq had lost nearly 2% week to date.

Those would be the averages’ worst weekly performances since the week ending March 20. The Dow, S&P 500 and Nasdaq all fell at least 12.6%.

Weekly jobless claims for the week ending May 9 totaled nearly 3 million, according to data from the Labor Department. That brings the total number to more than 36 million since the coronavirus crisis began.

More than 4.4 million coronavirus cases have been confirmed globally, according to data compiled by Johns Hopkins University. In the U.S. alone, there have been over 1.4 million known infections.

The Dow and the S&P 500 remain more than 29% above an intraday low reached on March 23. The Nasdaq Composite has surged about 35% in that time.

Dow futures fall more than 200 points on record retail sales drop, increased China tensions, CNBC, May 15