Dow drops more than 900 points: reaction of Warren Buffett

February 24, 2020 @ 20:14 +03:00

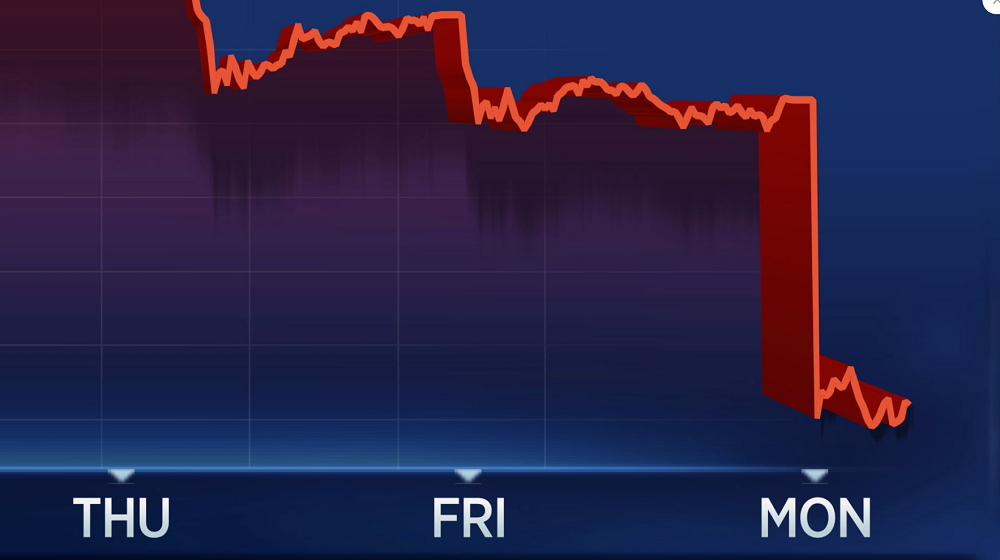

Stocks fell sharply on Monday as the number of coronavirus cases outside China surged, stoking fears of a prolonged global economic slowdown from the virus spreading. The Dow Jones Industrial Average traded 932 points lower, or 3.2%. The S&P 500 slid 3.1% while the Nasdaq Composite traded 3.6% lower. At its low of the day, the Dow was down 997.04 points. The 30-stock Dow is also negative for 2020. Monday’s drop put the Dow on pace for its biggest one-day point drop since February 2018, when it lost more than 1,000 points.

Airline stocks Delta and American were both down more than 7% while United traded 4% lower. Shares of casino operators Las Vegas Sands and Wynn Resorts dropped at least 3.8% each. MGM Resorts slid 4.7%. Chipmakers were also down broadly. Nvidia shares were down more than 6% while Dow-component Intel traded 3.4% lower. AMD dipped 7.6%. The VanEck Vectors Semiconductor ETF (SMH) was down by 4.2%. Apple and its suppliers took a hit as well. Shares of the iPhone maker were down by 4.3%. Skyworks Solutions and Qorvo dropped more than 3% each.

Overseas markets fell sharply. The European Stoxx 600 dropped more than 3% while Korea’s Kospi index slid 3.9%.In Hong Kong, the Hang Seng index fell 1.8%. The Cboe Volatility Index (VIX) — considered to be the best fear gauge on Wall Street — jumped more than 6 points, or about 37%, to 23.51.

Legendary investor Warren Buffett said the coronavirus spread has softened up the U.S. economy, but noted it its still healthy. “Business is down but it’s down from a very good level,” Buffett told CNBC’s Becky Quick on “Squawk Box.” “You look at car holdings —railcar holdings, moving goods around. And there again, that was affected by the tariffs too because people front-ended purchases, all kinds of things.” Buffett added he still recommends buying stocks for the long term.

Dow drops more than 900 points as coronavirus cases outside of China surge, CNBC, Feb 24