Dollar rebounds, yen drops as traders cling to stimulus hopes

March 10, 2020 @ 13:30 +03:00

The dollar rebounded on Tuesday after huge losses against the yen and the euro, as investors turned hopeful that policymakers would introduce co-ordinated stimulus to cushion the economic impact of the coronavirus outbreak.

The moves helped reverse some of Monday’s gyrations, but at 104 yen per dollar the Japanese currency was not back above the 105 seen before this week. The dollar started to recover as U.S. stock futures rose and bond yields gained, following U.S. President Donald Trump’s announcement that he would hold a news conference on Tuesday about economic measures in response to the virus.

Analysts said it was too early to call a bottom in the dollar, which plunged on Monday after a price war between Saudi Arabia and Russia triggered the biggest daily rout in oil prices since the 1991 Gulf War and Treasury yields dropped further. Against a basket of currencies, the dollar rose 0.5% to 95.865. It rallied 2.2% against the yen to 104.6, considerably higher than Monday’s 101.18 low.

The yen also fell against the euro and the Australian dollar, after Bank of Japan officials indicated they were ready to ramp up stimulus if necessary, before a policy meeting next week.

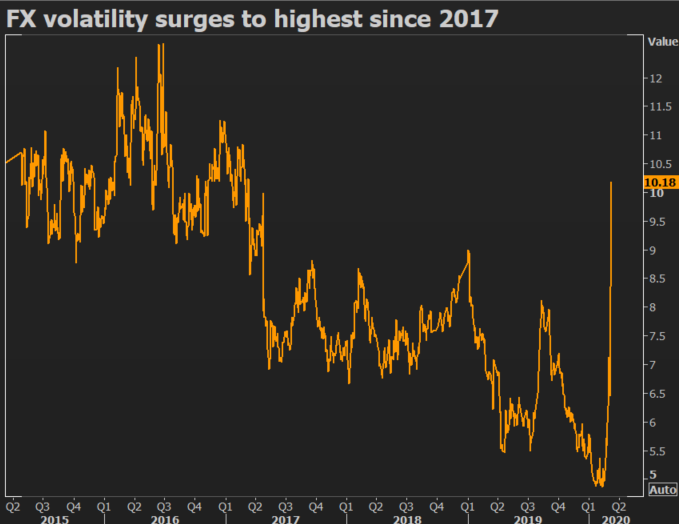

The dollar rose 0.8% to 0.9329 Swiss franc on Tuesday, recovering after three days of heavy selling pushed it to its lowest in almost five years. Data suggest the Swiss National Bank is now intervening to weaken its currency. Against the pound, the U.S. currency rose 0.5% to $1.3060. Volatility has doubled in FX markets from the levels of late February, reaching its highest since early 2017, according to one index.

Commodity-linked currencies that tumbled on Monday following the crash in oil prices recovered slightly. The Norwegian crown added 1.9% versus the euro to 10.76, away from record lows but still off the 10.4 levels seen last week.The Canadian dollar rose 0.3% to C$1.3658. The Russian rouble gained 3.6% and the Mexican peso 0.6%.

Dollar rebounds, yen drops as traders cling to stimulus hopes, Reuters, Mar 10