Consumer optimism and trade deal are pushing up U.S. stocks

February 15, 2019 @ 20:49 +03:00

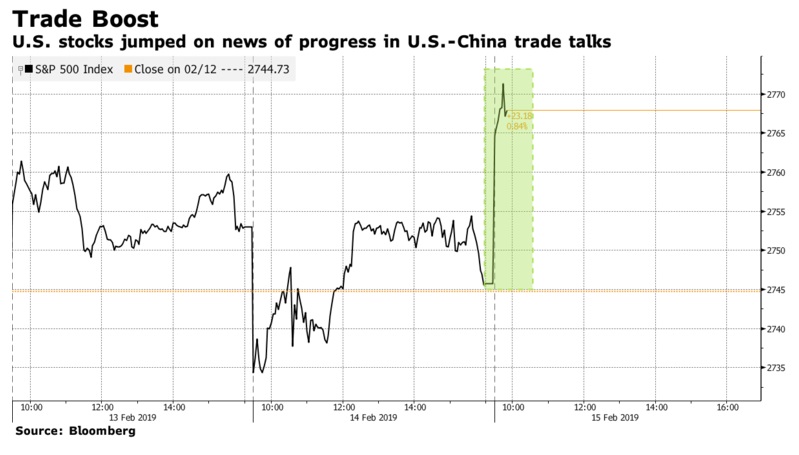

Equities surged as the U.S. consumer outlook brightened and positive developments in China trade talks overshadowed lingering concerns about global growth. Treasury yields climbed with the dollar. The S&P 500 Index hit a 10-week high Friday, led by energy and financial shares, on reports that the U.S. and China had reached consensus in principle on the main topics in their trade negotiations. Talks are set to resume next week.

U.S. consumer sentiment rebounded from a two-year low, fueling the rally and bolstering the case that yesterday’s dire retail sales figures were out of sync with reality. The Nasdaq 100 Index’s gains were less robust, with chip-equipment maker Applied Materials plunging on a weak forecast. Trade continues to dictate sentiment as the two sides race to reach a deal that would avert a tariff increase on Chinese goods by March 1. At the White House Friday, President Donald Trump said that the U.S. is “a lot closer” to a deal with China and that he might “extend the date.”

The S&P 500 Index increased 0.8 percent as of 11:34 a.m. New York time. The Dow Jones Industrial Average rose 1.3 percent. The Stoxx Europe 600 Index gained 1.4 percent to the highest in more than four months. The U.K.’s FTSE 100 Index rose 0.5 percent. The MSCI Emerging Market Index fell 0.8 percent. The yield on 10-year Treasuries gained one basis points to 2.66 percent. Germany’s 10-year yield fell less than one basis point to 0.10 percent. The Bloomberg Commodity Index gained 0.8 percent to the highest in more than a week. West Texas Intermediate crude rose 2 percent to $55.51 a barrel. Gold climbed 0.2 percent to $1,315.83 an ounce.

U.S. Stocks Surge on Trade, Consumer Optimism, Bloomberg, Feb 15