Bitcoin Transaction Fees Rise to 28-Month High as Hashrate Drops Amid Price Rally

October 30, 2020 @ 14:39 +03:00

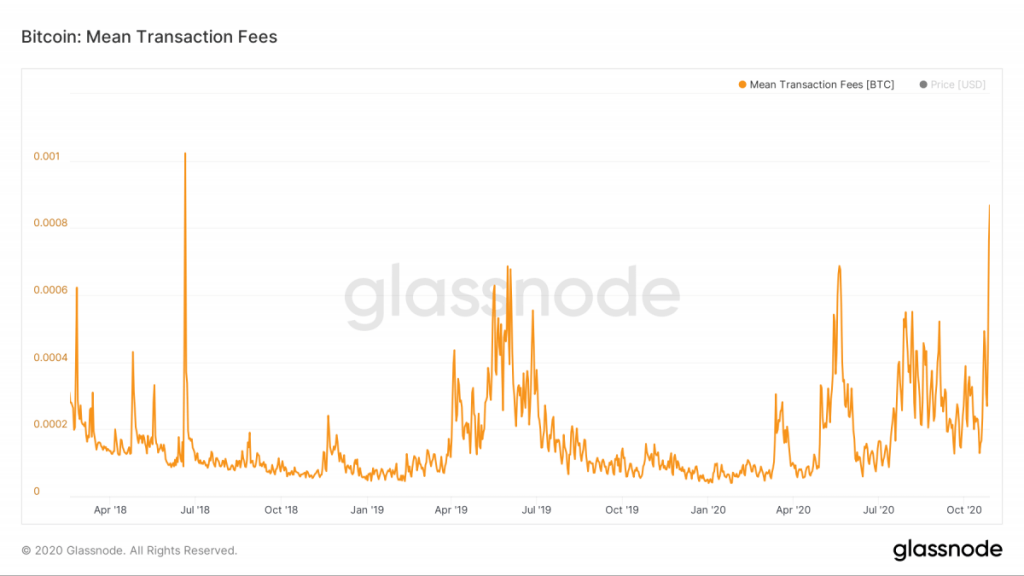

As of Wednesday, the mean fee per transaction, or the average transaction cost, was 0.00086764 BTC (BTC, +1.09%), the highest since June 2018, according to data source Glassnode. In dollar terms, the average transaction fee was $11.66. Average fees in bitcoin terms have increased by 573% in the past 12 days alongside the cryptocurrency’s price rally from $11,200 to $13,800.

“Bitcoin mempool [memory pool] is back in focus in the wake of rising transaction volumes, causing congestion in the network and consequently driving fees higher,” Denis Vinokourov, head of research at the London-based prime brokerage Bequant, told CoinDesk.

Mempool is the collection of unconfirmed transactions. When bitcoin transactions are executed, they are first sent to the mempool, where they wait for approval by miners. Bitcoin miners can process only 1 megabyte (MB) worth of transactions per block mined roughly every 10 minutes.

When the blockchain experiences a rise in traffic, it causes delays and a backlog of transactions. As demand outstrips supply, miners increase their revenue by prioritizing transactions with higher fees. That, in turn, forces other users to offer higher fees to avoid long waiting times.

Network congestion is usually seen during price rallies. As noted earlier, bitcoin has chalked out a significant rise over the past 12 days. During that time frame, network congestion, as measured by the total number of unconfirmed transactions in the mempool, worsened by 1,800%.

As of Tuesday, there were 121,340 unconfirmed transactions in the mempool with a total block size of 66.8 MB. According to data source blockchain.com, that’s the highest level since the bull market frenzy of December 2018.

Hashrate drop contributes to congestion

The recent slide in bitcoin’s hashrate looks to have played a big role in causing network congestion along with a general price-driven pickup in activity. In other words, the mining power dedicated to approving transactions and mining blocks has gone down amid the price rally, boosting waiting times and network congestion. The seven-day moving average of bitcoin’s hashrate has declined from 146 exahashes per second (EH/s) to 120 EH/s.

Bitcoin Transaction Fees Rise to 28-Month High as Hashrate Drops Amid Price Rally, CoinDesk, Oct 30