Analysts Are Too Optimistic About the Economy & Stock Market; Here’s Why That’s Dangerous

June 16, 2020 @ 11:50 +03:00

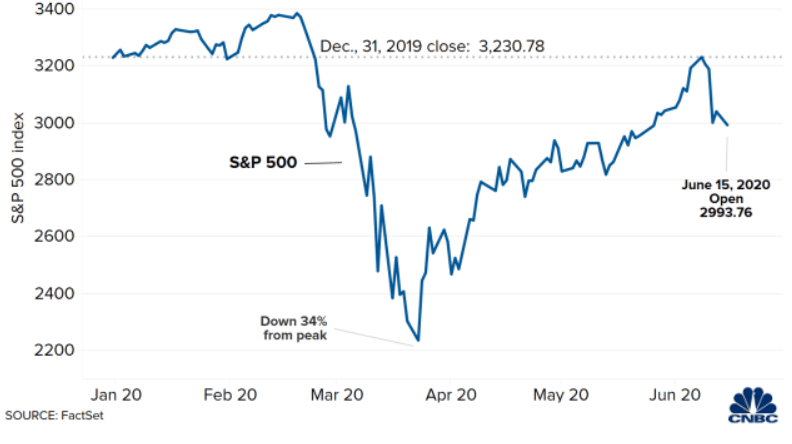

The S&P 500 plunged 6% last Thursday as investors fretted the possibility of a second wave of infections. But analysts are still bullish about the U.S. stock market. Morgan Stanley is confident that the recovery from the pandemic will be short and sharp. It believes that the unprecedented fiscal and monetary stimulus will be enough to spur the recovery.

Morgan Stanley expects the global economy to bottom out in the second quarter and contract by 8.6%, before growing 3% in the first quarter of 2021. Its base case includes a second wave of infections in the fall, with U.S. cases starting to increase again in mid-July. But it says these outbreaks will be manageable and only result in selective lockdowns.

The investment firm also raised its stock market forecast. Morgan Stanley equity strategist Michael Wilson maintains a positive view of the U.S. equity market because it’s early in a new economic cycle and bull market. Wilson raised the bank’s bull, base, and bear targets for the S&P 500 to 3,700, 3,350, and 2,900 for the period up to June 2021. He expects the index to approach 3,250 by the end of 2020.

While Morgan Stanley’s outlook is optimistic, the reality appears less rosy. New cases of coronavirus and hospitalizations have increased in several U.S. states over the past week, including California, Florida, North Carolina, Alabama, and Texas.

Reports of another outbreak in a Beijing district have further scared investors. Chinese economic data were weaker than expected, suggesting that the road to recovery from the pandemic could be a long one.

The recovery likely won’t be V-shaped like Morgan Stanley is hoping. Unfortunately, the economy probably won’t return to normal. Millions of jobs losses could become permanent.

A study released in May by the Becker Friedman Institute at the University of Chicago estimates that 42% of recent layoffs in the U.S. will be permanent.

A new study from Bloomberg Economics estimates that 30% of job losses in the United States from February to May result from a reallocation shock. The analysis suggests that the labor market will initially recover quickly, but then stabilize with millions still unemployed.

Jobs in the hospitality sector are among the most threatened, alongside retail, leisure, education, and health.

Indeed, stock market valuations have risen rapidly from the depths of the pandemic-induced selloff in late March. Stocks looked overvalued relative to many measures.

A correction looks healthy at this point, as stocks are clearly in a bubble. But a big crash might be coming as the stock market rally might have just been a false rally.

Analysts Are Too Optimistic About the Economy & Stock Market; Here’s Why That’s Dangerous, CCN, Jun 16