Weaker US sales, prices data open the door for even more dovish Fed

November 17, 2020 @ 17:56 +03:00

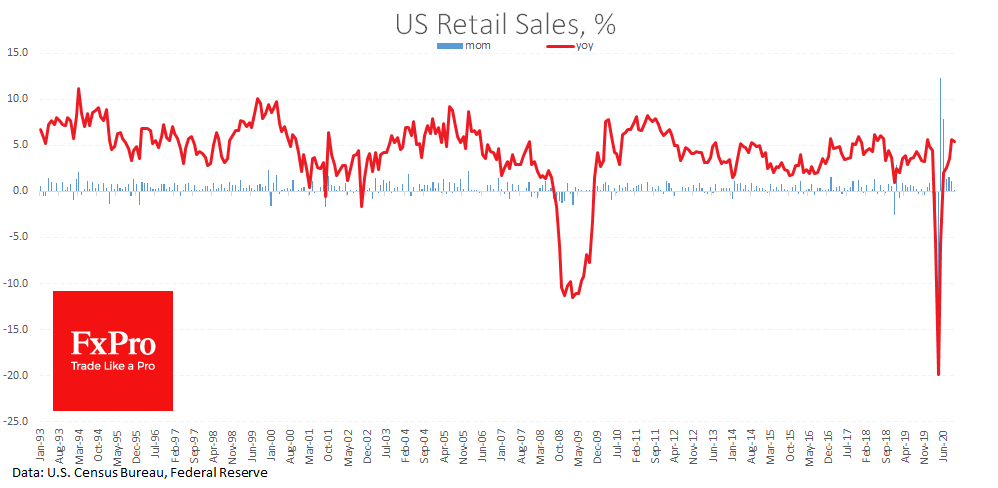

US retail sales in October fell short of expectations, adding 0.3% vs forecasted +0.5% and +1.6% a month earlier. Separately, the import price index declined by 0.1% m/m against expected growth of 0.2%.

Weaker US economic data increased pressure on the dollar, sending EURUSD close to 1.1900 and USDJPY to 104.0, as a sluggish economic recovery increases the chances of an expansion of the Fed’s QE program in December.

Seven FOMC members are scheduled to speak later today, which could increase market volatility. If we hear a coordinated signal from the Fed members, the dollar and markets will be able to take a big step.

For EURUSD, this step could be a move beyond 1.1900 or to receive another downside impulse. For the stock market, a continuation of the rally or a reversal to decline is on the cards. The Fed is often on the side of a weak dollar and strong markets, but now that the markets have gone too far in this direction, won’t the Fed want to cool them down?

The FxPro Analyst Team