UK inflation genie is out of the bottle?

February 17, 2021 @ 14:56 +03:00

There are growing fears in the markets that the inflation genie is out of the bottle. So far, these fears can be discerned in the form of stronger-than-expected inflation and steadily rising long-term bond yields worldwide, including Britain.

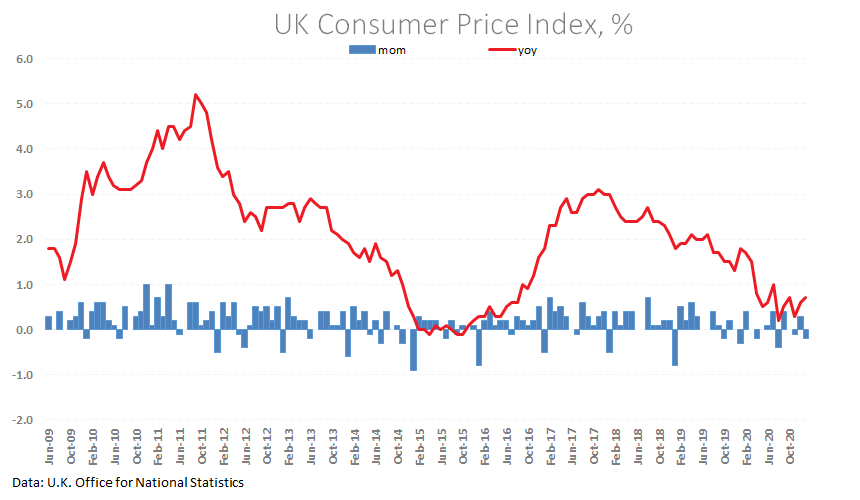

New data for the UK further supports this hypothesis. Last month’s set of price data exceeded expectations. The CPI index accelerated to 0.7% y/y in January, and the retail price index rose to 1.4% y/y.

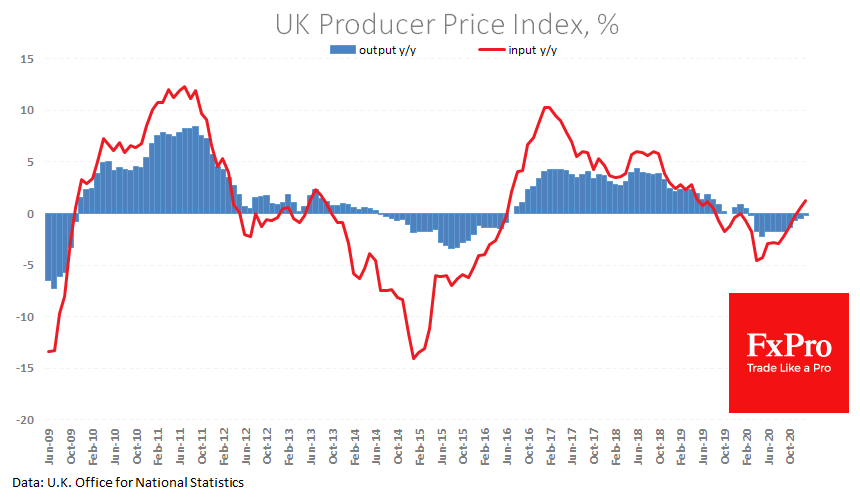

Early inflation indicators such as PPI set the stage for an acceleration in price growth in the coming months. Producer selling prices added 0.9% in three months, and purchasing prices added 2.3%. Retailers will soon pass rising costs onto consumers as sales steadily rise (+6.4% YoY ex-fuel).

A rebound in inflation is often a favourable sign of economic recovery. The flip side of the coin is that accelerating inflation before the economy fully recovers may force the Bank of England to abandon its soft policy, therefore delaying a quick recovery.

The FxPro Analyst Team