New Fed’s strategy increases attention to employment

August 27, 2020 @ 17:51 +03:00

Powell presented an update of the Fed’s strategy, which increases attention to employment rather than inflation. As widely expected by markets, the Fed has unanimously adopted a 2% average inflation targeting strategy.

This means that if inflation falls below the target, the Fed will be tolerant of inflation rising above the target for “some period of time”. Powell, however, denies the Fed’s commitment to any specific formulas or inflation indicators.

Overall this is negative for the dollar and positive news for stock and commodities. In the previous 10 years, the average price growth rate was 1.7% for headline CPI and 1.9% for Core-CPI (ex food and energy). Applying the new strategy in the immediate aftermath of the global financial crisis would have meant that rates had to be kept near zero way after 2014.

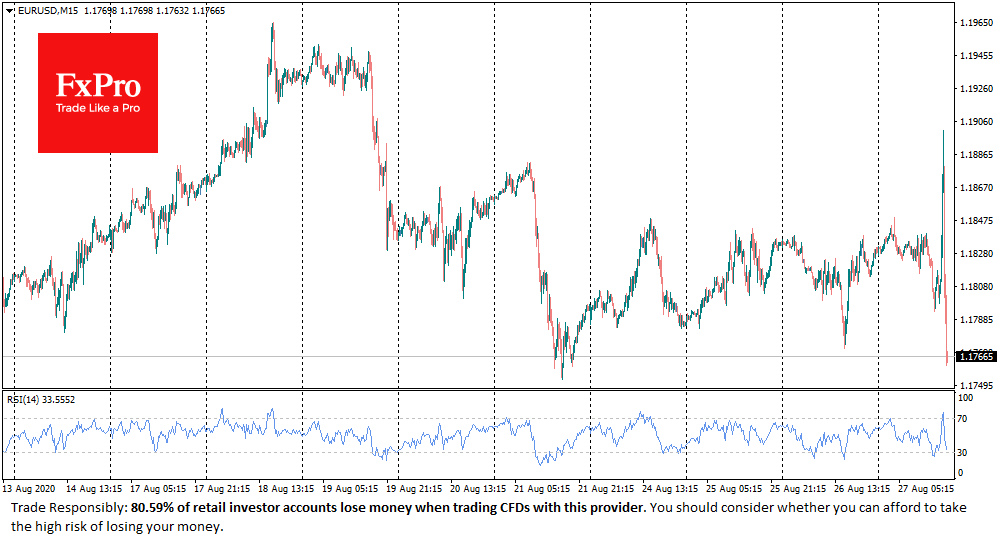

The market’s first reaction fits well with the fundamentals of the Fed’s strategy change: the dollar rushed down (EURUSD touched 1,1900), while stock markets and commodities fired up (gold jumped to $1975). However, a full reversal of the movement took place within minutes. As the changes were expected, market participants started to “sell the fact”, returning EURUSD below 1,1800 and gold collapsed to $1915.

In the long-run, however, it may have the potential to weaken the dollar.

The FxPro Analyst Team