Major market trends

November 09, 2018 @ 16:40 +03:00

US indices have rapidly risen after the US elections, allowing to dismiss the decline in October. The Thursday-Friday correction does not look so scary now, as long as the S&P500 remains above the 200-day average

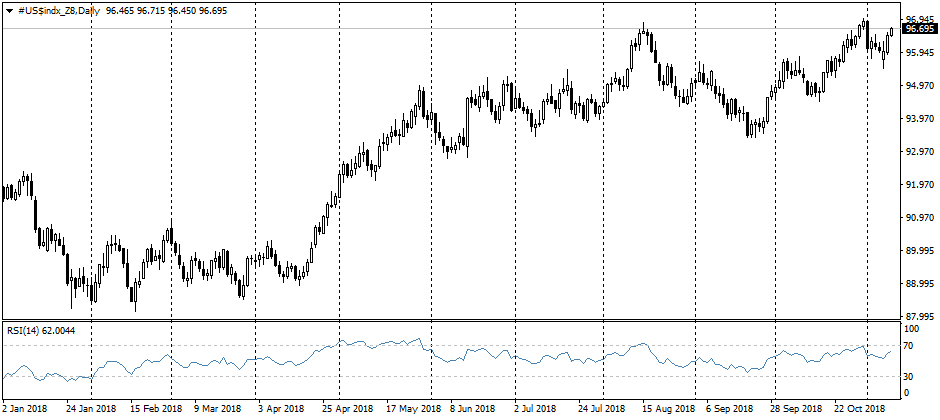

The US dollar has also returned to the growth after a slight hitch against most competitors, as the US Fed confirmed confidence in the economy strength. The raising interest rates are in focus. This attitude of the Fed is enhancing the divergence with many central banks of other countries where economic data is not so strong

Falling oil is gaining momentum again. The trend for a sharp decline persists for more than a month. During this period, the prices of the main brands (Brent and WTI) lost more than 20%, formally entering the bear market. The reason, as in 2014, is overproduction of oil and unwillingness to lose its market share

Disputes over the Italy budget are in no hurry to retreat. The single currency and government bonds once again have come under pressure: the issue may remain in the market’ focus next week.