German, US inflation slowed requiring more easing

November 12, 2020 @ 19:41 +03:00

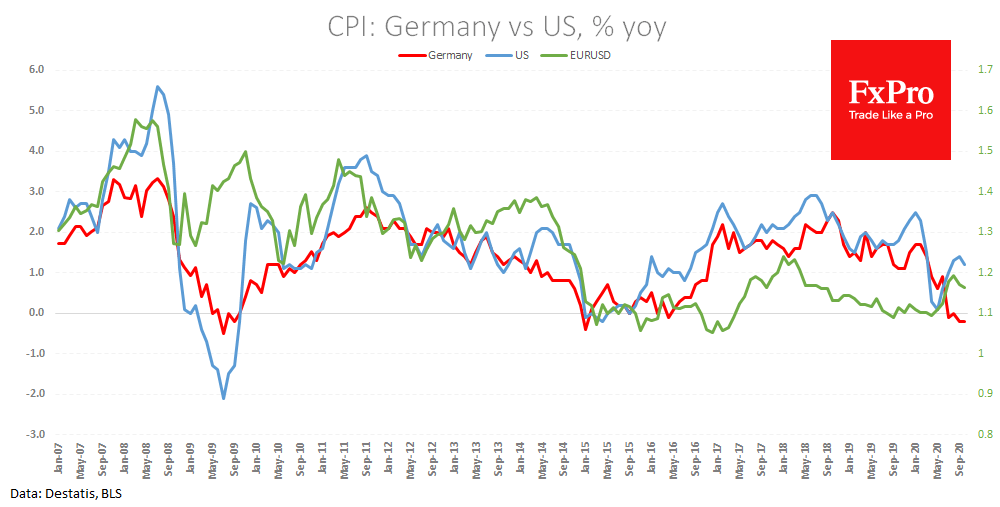

Inflation data for Germany and the USA published today highlighting the general trend (slowing) and the significant differences in the current state of the European and US economies.

In October, prices in Germany were -0.2% YoY and in the USA, +1.2%. A 5% weakening of the dollar index over the past 12 months seems helped the US to maintain a higher inflation level.

The inflationary picture in the eurozone requires more work from the ECB than the situation in the US requires from the Fed. From this comparison, monetary policy in Europe should be considerably more eased, putting pressure on EURUSD.

However, this approach acts on the premise of “all things being equal”. In life, things are never equal. The Fed often acts more proactively, both in the softening of policy and the consideration of tightening. On the other hand, the wheel of the ECB has traditionally been spinning longer and with slower stops. So investors and traders should look at the bigger picture, which is somewhat complicated.

The FxPro Analyst Team