FxPro Daily Insight for March 27

March 27, 2020 @ 19:21 +03:00

Market overview

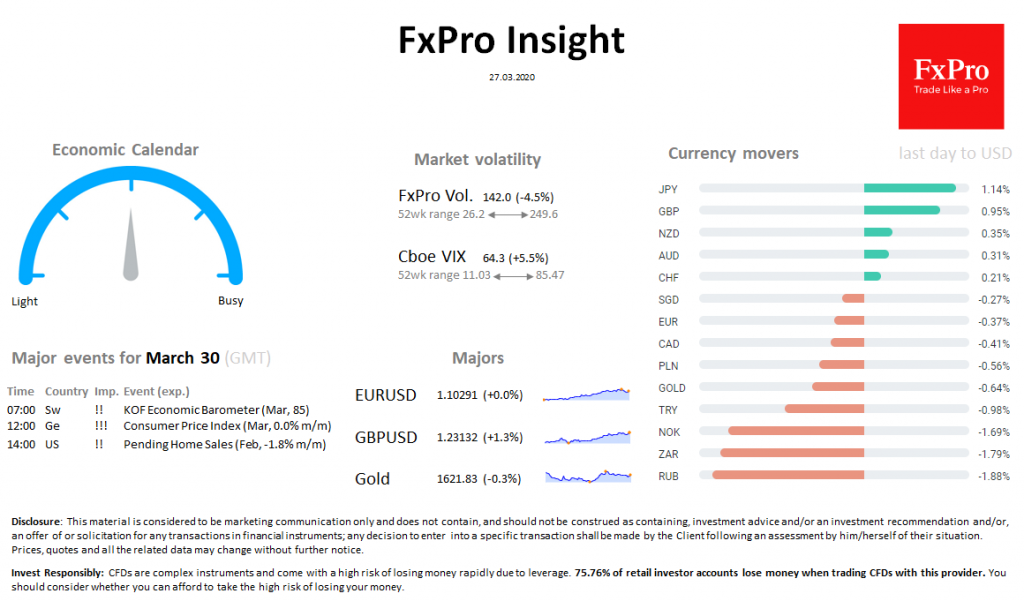

US indices are losing 3.5% on Friday after 6.4% growth a day earlier. The market rebound due to injections of liquidity from the Central Bank and massive incentives stalls amid signals of a weakening economy.

DXY loses the 6th consecutive trading session following the massive Fed’s QE and swap lines. EURUSD climbed to 1.1050. GBPUSD develops a sharp rebound, trading at 1.2400, starting the week at 1.1450. Commodity currencies are again weakening towards USD.

Gold is still having difficulty rising above $ 1,630.

Brent is losing more than 5% to $ 27.50 due to speculation around a sharp drop in demand and the lack of OPEC’s desire to cut production.

The global tipping point with the spread of coronavirus has not yet arrived, maintaining a shaky foundation under market recovery.

Important events for March 30, GMT (Exp.): 07:00 Sw !! KOF Economic Barometer (Mar, 85) 12:00 Ge !!! Consumer Price Index (Mar, 0.0% m/m) 14:00 US !! Pending Home Sales (Feb, -1.8% m/m)