FxPro Daily Insight for February 24

February 24, 2020 @ 22:26 +03:00

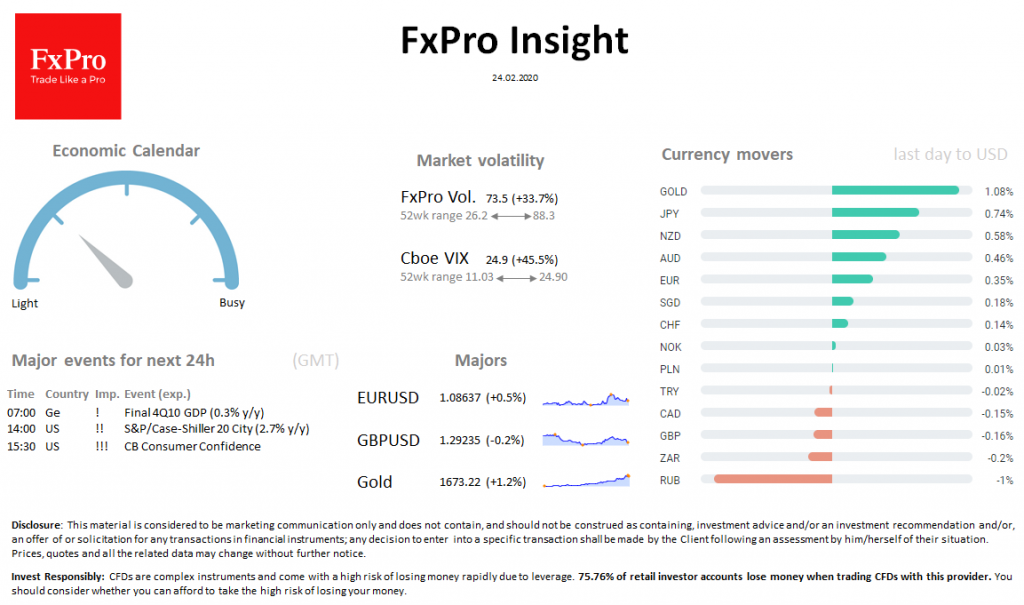

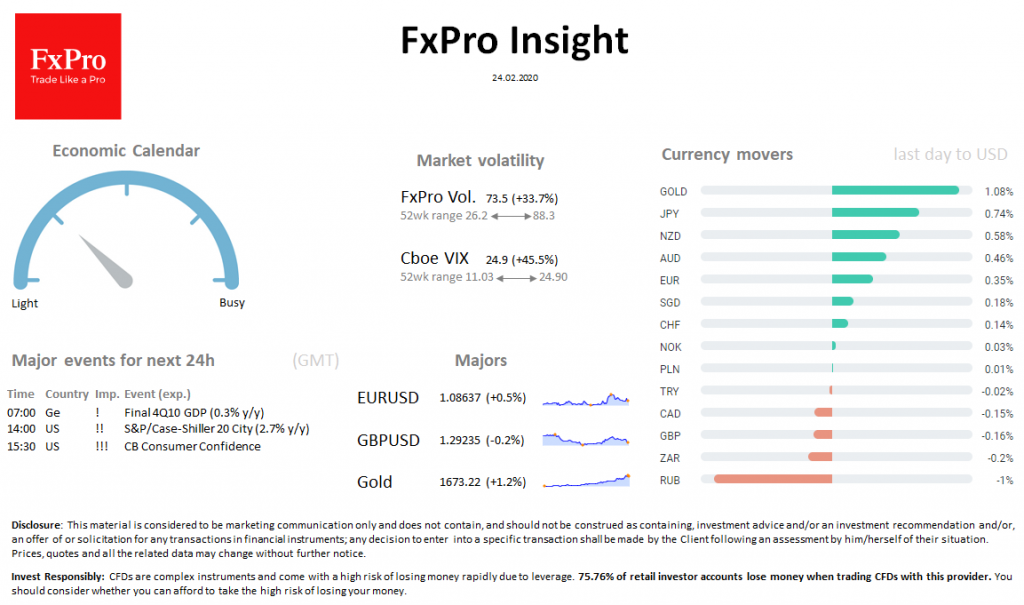

The mood in world markets is close to panic after the weekend reports about the spread of coronavirus far beyond China. S&P500 loses 3.5%, FTSE100 closed with a drop of 3.3%.

The growth rate of infected people is growing sharply in Italy, South Korea and Iran, these fears have been reinforced by weak US data. DXY retreats from 3-year peaks for a second trading session. A rare combination of dollar growth and US indices gave way to an even less usual weakening of both. EURUSD is developing a rebound, having received support after decline below 1.08. Data came out of Europe better than expected on Friday and Monday, and worse from the US has also fueled this move.

USDJPY fell to 110.3, reversed sharply from levels above 112 at the beginning of the day on Friday.

Brent crude fell more than 5.7% intraday to $54.6. By the end of the day, oil recaptured part of the loss, trading at $55.40 at the time of writing.

Gold jumped to $1689 (+ 2.8% intraday) but adjusted to $1670 in the afternoon.

Market overview

07:00 Ge ! Final 4Q10 GDP (0.3% y/y) 14:00 US !! S&P/Case-Shiller 20 City (2.7% y/y) 15:00 US !!! CB Consumer Confidence