Fed will not protect Nasdaq from falling

March 04, 2021 @ 14:04 +03:00

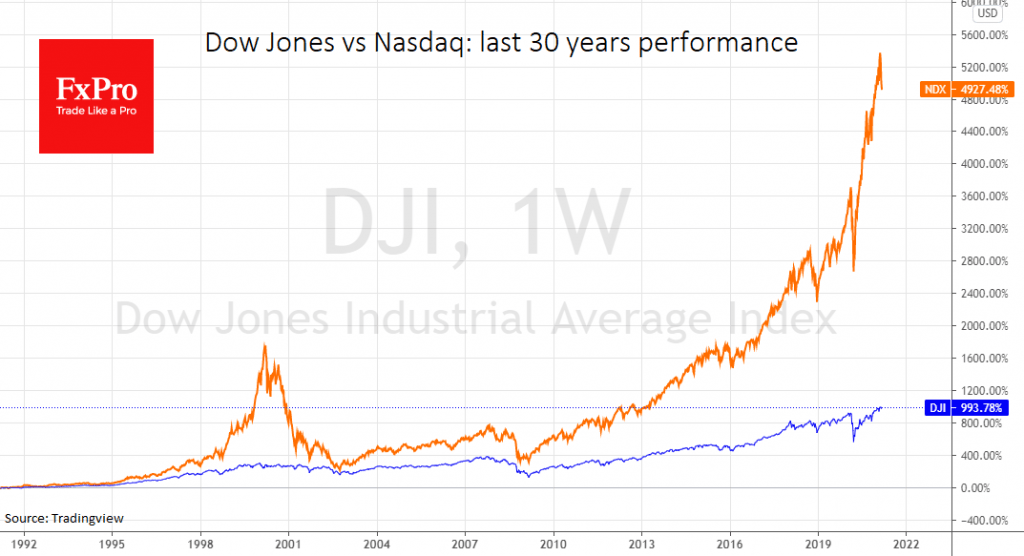

Pressure on US technology companies remained the dominant trend on Wednesday evening. Against this backdrop, the Nasdaq lost another 2.7%, the Dow Jones 30 was down 0.4%, and the S&P500 maintained its intermediate position, retreating by 1.3%.

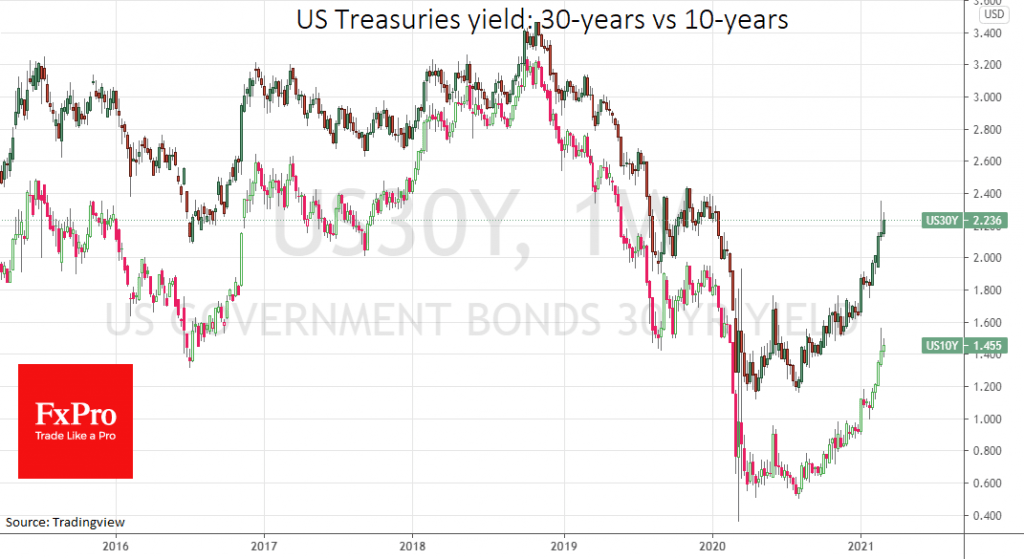

However, investors should note that this decline hardly compares to the broadest pullback markets experienced precisely a year ago. The pressure for some stocks was initiated after government bond yields became markedly higher than dividend yields for the S&P500. This is especially true for high-tech companies where dividend earnings are either very modest (around 0.5% for Apple per year) or non-existent (Amazon, Google, Tesla), despite their long history and huge market cap.

Therefore, growth companies that dominate the Nasdaq index are losing their appeal as long-term bond yields continue to rise. Yields on 10-year Treasuries have risen again to 1.5%, 30-year bonds now yield 2.28%, which is close to last week’s peak of 2.35%. This increase not only reinforces the contrast with dividends but also potentially tightens funding conditions for the markets.

Simultaneously, the dollar continues to strengthen in pairs with safe-haven currencies, CHF and JPY. Meanwhile, risk-sensitive GBP, AUD and CAD have stabilised in very narrow ranges this week.

There is still pressure on gold, which dipped below $1700 yesterday, while oil managed to recover to early week levels.

This uneven weakening of the stock markets and commodities means the Fed will not enact further policy easing, which causes Nasdaq stocks to underperform. Other developments might indeed turn out to be something of a repeat of the deflating dot-com bubble of 2000-2002 when the Nasdaq lost 83% of its peak compared to the 38% of the Dow Jones 30.

Emerging and commodity markets were the first to bubble, having already turned fundamentally to growth in 2001. The Fed kept policy soft, which not only fanned the sails of inflation, the housing boom and overseas markets but also weakened the dollar. All this could be a sign of the coming months or even years, in a slightly modified form.

The FxPro Analyst Team