AUDUSD rallies as a sign of market optimism

June 02, 2020 @ 14:55 +03:00

The Australian dollar, often seen as an indicator of the growth of the Chinese economy. This week its growth snowballing with Monday gains exceeded 2% and another 0.8% so far on Tuesday.

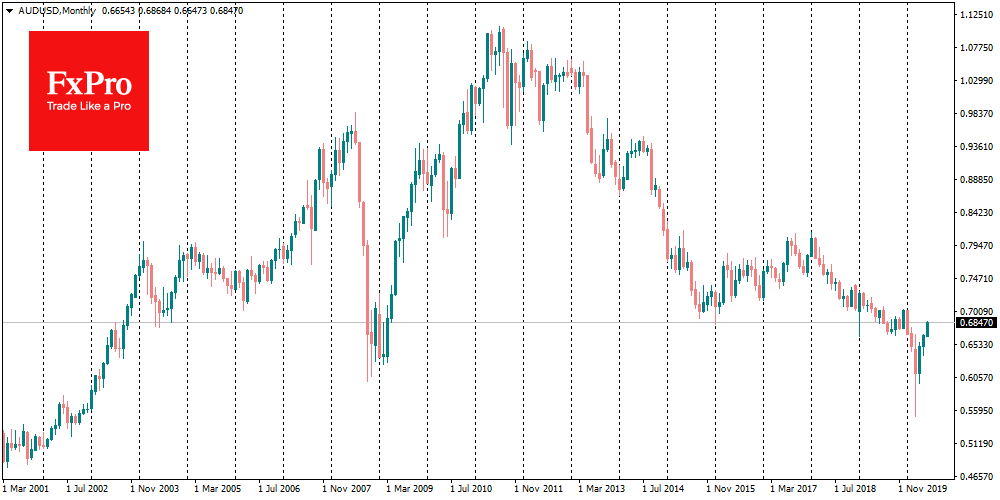

The pair ultimately played the March collapse to 18-year lows at the end of May and is trading near 0.6850, the highest level since January. As in 2009, the pair was the first to recover, relying on the rapid return of demand for commodities in China.

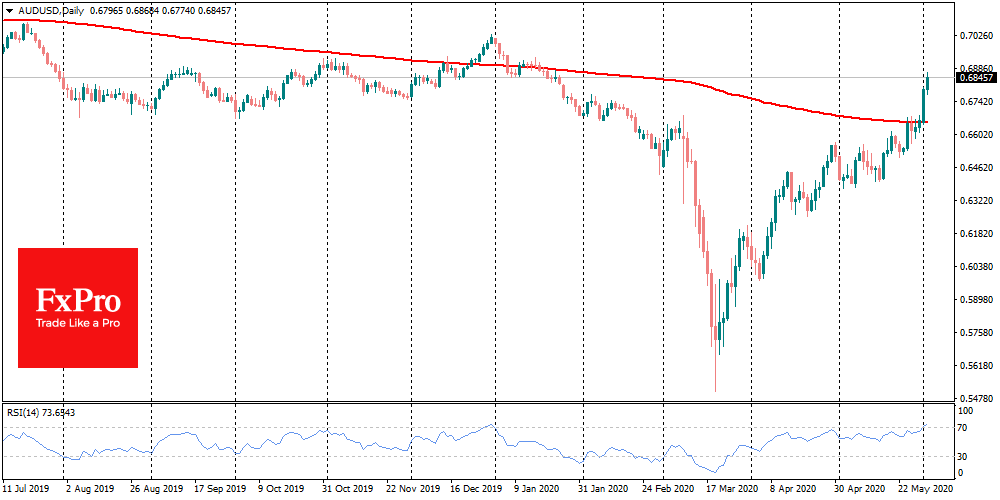

Besides, the pair also enjoys the growth momentum due to the technical factors. AUDUSD exceeded its 200-day average by the start of the month, which was an important signal for the prevalence of bullish sentiment.

Fundamentally, the Aussie was also helped by the RBA’s position. The Australian Central Bank ruled out the negative rates, prefer, if necessary, to increase QE. This is a more flexible tool in which markets believe more than negative rates. On the other hand, fans of technical analysis may already be alarmed, as the pair reached the overbought level by RSI, which makes it vulnerable to corrective pullback on signs of a rally stop.

The FxPro Analyst Team