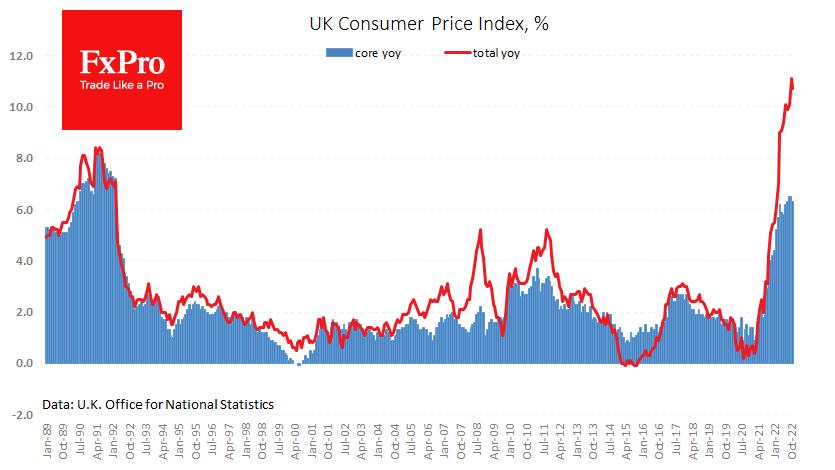

Following the soft US inflation report, the UK published its November data which was also weaker than expected. The consumer price index rose by 0.4% last month against expectations of 0.6%, and the year-on-year increase slowed from 11.1% to 10.7%. Equally important, core inflation slowed from 6.5% to 6.3%, while the previous two months’ pace was expected to be maintained.

As always in the economy, the slightly faster-than-expected price deceleration has two sides. This news supports risk appetite as it will dampen expectations on how fast and high the Bank of England will raise rates.

The bad news is that the slowdown in the annual rate is due to a high base effect while prices continue to rise. A 0.4% increase in prices for the month brings the annual rate to 4.8%, which is also well above the central bank’s target and will force it to hold the Key Rate above inflation. The 6.1% y/y wage increase rate also supports the stability of the inflation spiral, encouraging a pass-through of inflation to end-users.

A slowdown in core inflation could also be a manifestation of weak demand. Receiving similar signals further down the line, the Bank of England may be forced to turn quickly to policy easing, which risks making the pound a victim of the currency market like the Japanese yen earlier this year.

The FxPro Analyst Team