Time to buy Crypto after capitulation?

November 10, 2022 @ 12:46 +03:00

Market picture

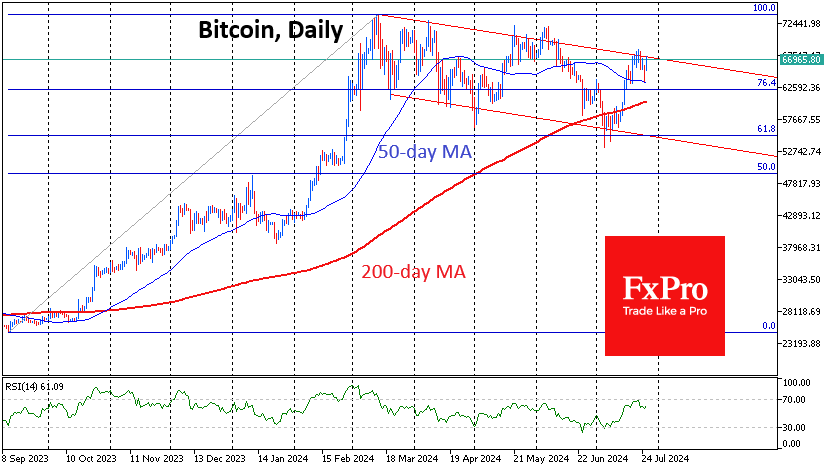

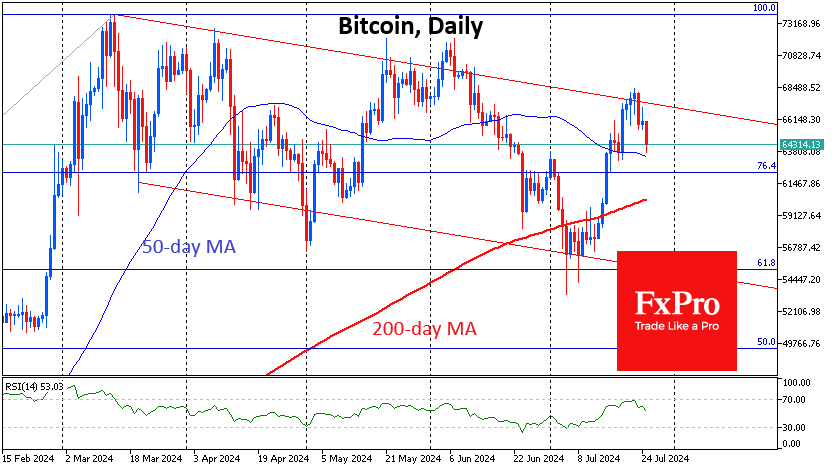

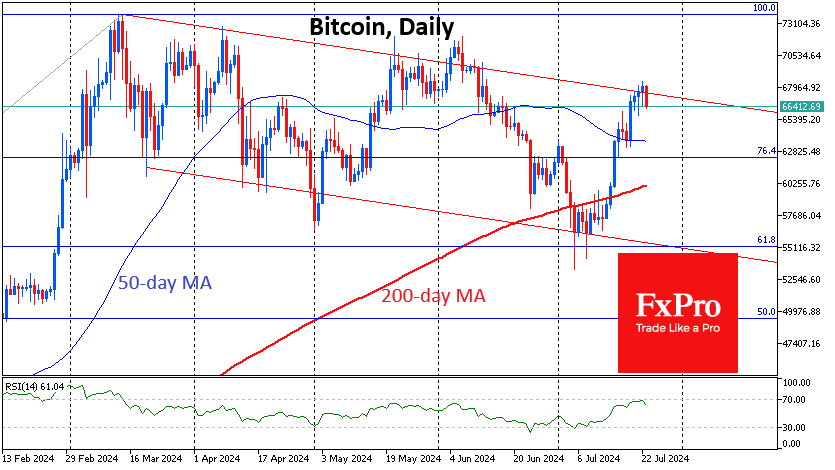

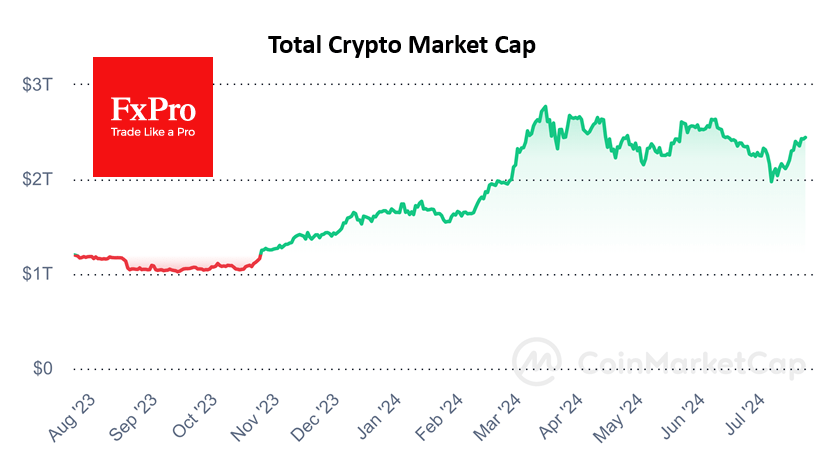

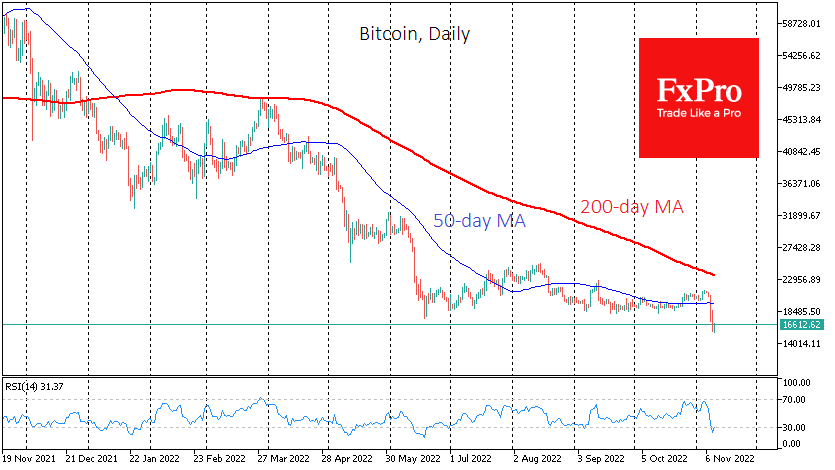

Bitcoin rewrote two-year lows on Thursday morning near $15,550, losing more than 27% from Saturday’s local highs. CoinMarketCap estimates the total capitalisation of the crypto market to be at 839bn, down 6.7% from levels 24 hours ago and 21% below Saturday’s peaks.

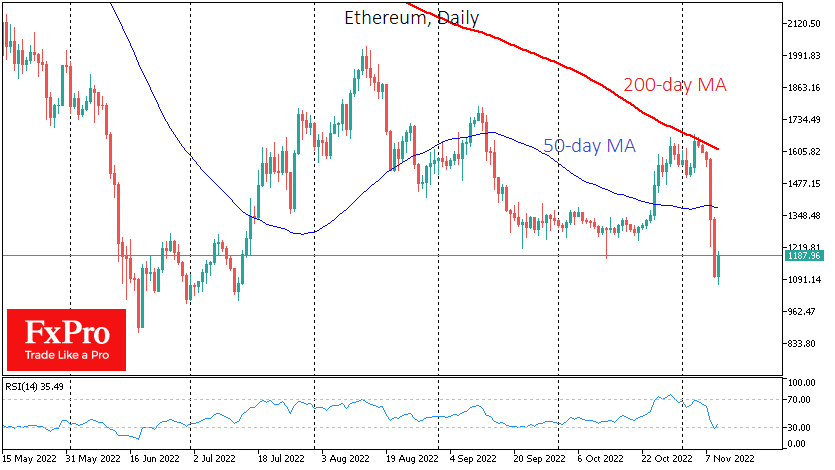

Ethereum is now a third cheaper than levels at the end of last week, and its sell-off started noticeably from the 200-day moving average, which had previously acted as resistance in April. Near the $1070 mark, there is a noticeable strengthening of buying, as in July.

The crypto market is now in a panic liquidation phase, occurring amid a raid on cryptocurrencies, which can be compared to the bank run in the early 20th century. The fundamental difference is that banking was already an established business back then, although regulation was in its infancy. The current crisis may be the catalyst for crypto regulation.

If we look at the situation from a market speculator’s perspective, we are in the process of capitulation. Such moments often precede long-term reversals. But it is worth realising that despite Bitcoin’s 5% rebound from the start of the day and the double-digit rise in yesterday’s casualties, the sell-off may not yet be over.

In our view, the crypto market is now in the same phase where it was in late 2018 when the bulk of the decline was behind it, but the best speculative buying moment was still a year away.

News background

The prolonged, almost 5-month sideways slide has relaxed market participants. The sharp fall in crypto assets took traders by surprise. Investors have been forced to sell off cryptocurrencies to cover losses on loans secured against them due to margin calls. The FTX exchange itself, along with Alameda, may also have been selling off assets.

The most significant drop in the top-100 crypto was Solana, which collapsed by 49%, as one of the largest holders of SOL was Alameda Research, the investment company of FTX exchange head Sam Bankman-Fried.

Marathon Digital CEO Fred Thiel said his mining firm was the second-largest public company in the world (11,300 BTC) in terms of bitcoins stored, thanks to its retention of mined BTC. MicroStrategy remains the leader, with around 130,000 BTC stored in its wallets.

According to a survey by Nickel Digital Asset Management, 92% of professional investors are optimistic about the outlook for the cryptocurrency market, despite its decline.

The FxPro Analyst Team