The Crypto market clings to the last line of defence

December 15, 2021 @ 12:42 +03:00

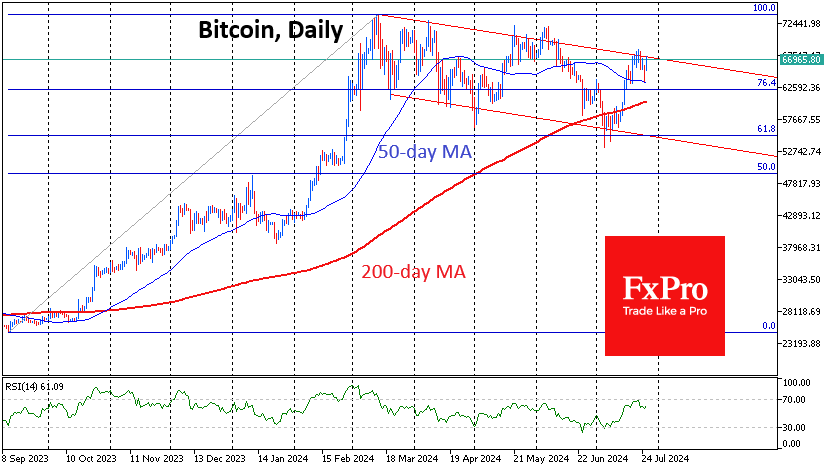

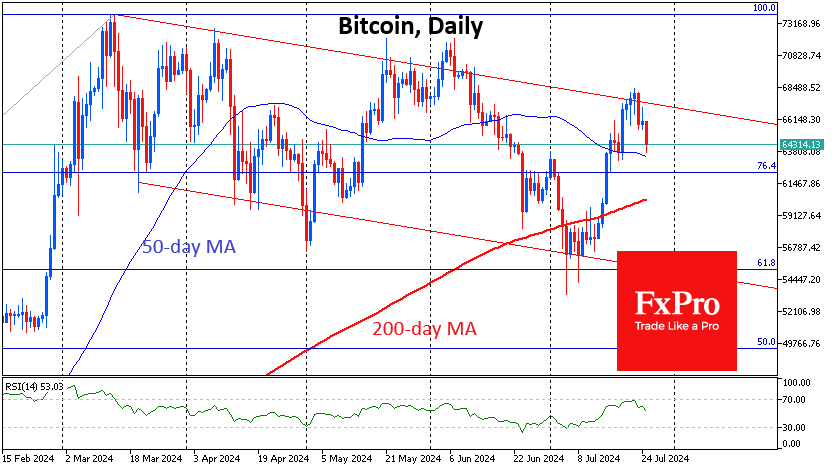

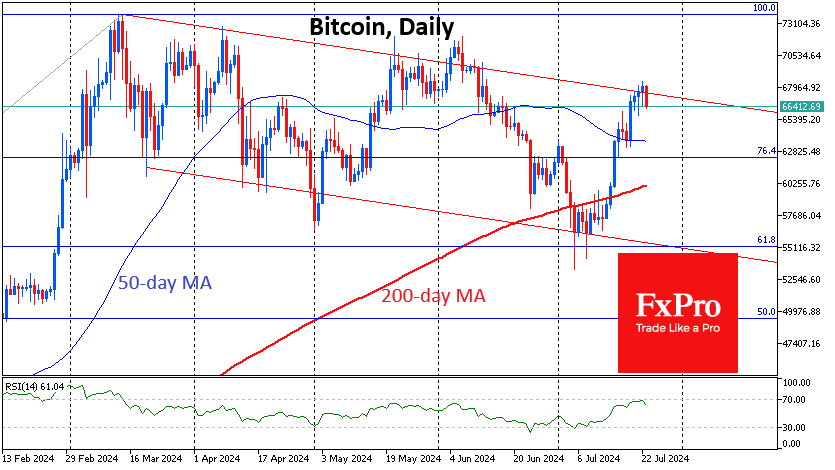

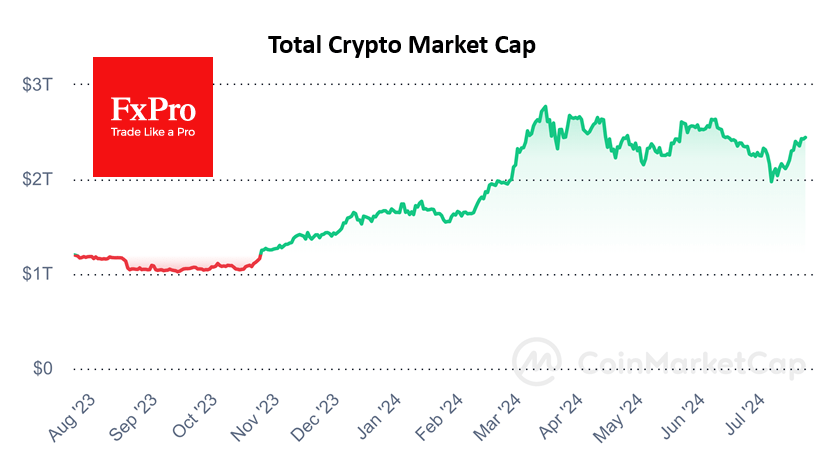

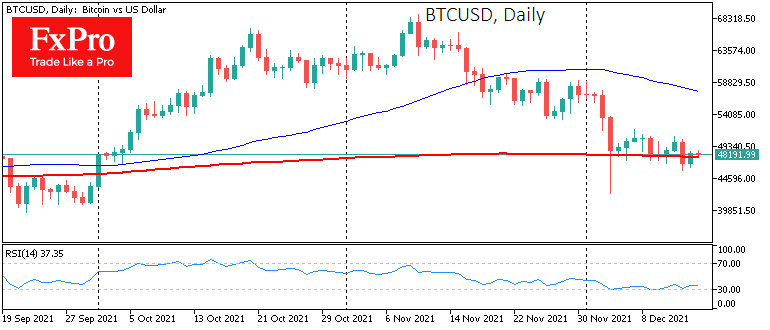

Bitcoin continues to cling to its 200-day simple moving average, calming the entire crypto market. In the past 24 hours, the total value of all cryptocurrencies rose 3.3% to $2.19 trillion. The Fear and Greed Index rose 7 points to 28, which it was a week ago.

Bitcoin has stabilised near the $48K level, keeping almost equal chances for gains and declines. A meaningful move away from the 200-day moving average line in one direction or the other promises to kick-start a strong momentum.

Today the financial markets are wary of the words of the Fed Chairman and the comments of the FOMC. Deviations from expectations can affect the whole financial world, including bitcoin. And through it, the entire spectrum of cryptocurrencies.

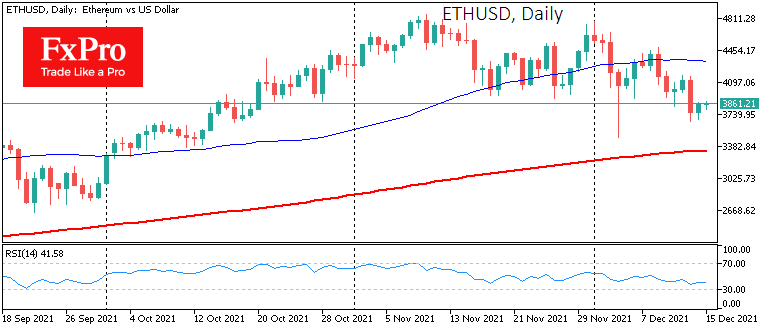

Ether has been showing close to zero momentum since the start of the day, remaining at $3850. On the chart, it is easy to see the activation of the bears near the 50-day moving average: a sharp breakdown in early December when this line became a resistance.

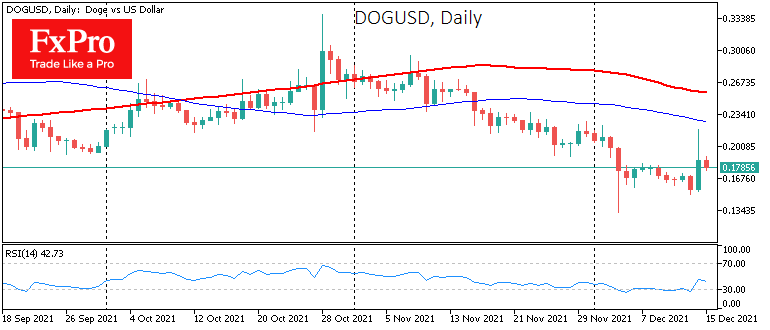

The significant exception was the DOGE. The coin soared more than 40% after Musk tweeted that Tesla was considering selling merchandise for this coin. The explosive growth here is more of a secondary effect of its low liquidity and knee-jerk reaction to the message of Twitter’s chief influencer. Overall, there is also a downtrend here, which has taken 40% off the price from November 8th.

However, taking a step back, it is still worth remaining cautious about expectations from the Fed and market dynamics after the announcement. Bitcoin’s technical support and Ether’s attempts to hold near $4000 are more likely to be buyers’ last hope of maintaining the illusion of a bull market.

Overall, however, cryptocurrencies have been in a downtrend for more than a month now. These are not sharp dips and short squeezes but methodical selling by funds, as they are very similar to the dynamics of traditional markets. Other coins, where there are few market professionals, have a general downward trend.

The FxPro Analyst Team