The aftershock of the crypto market?

November 14, 2022 @ 12:42 +03:00

Market picture

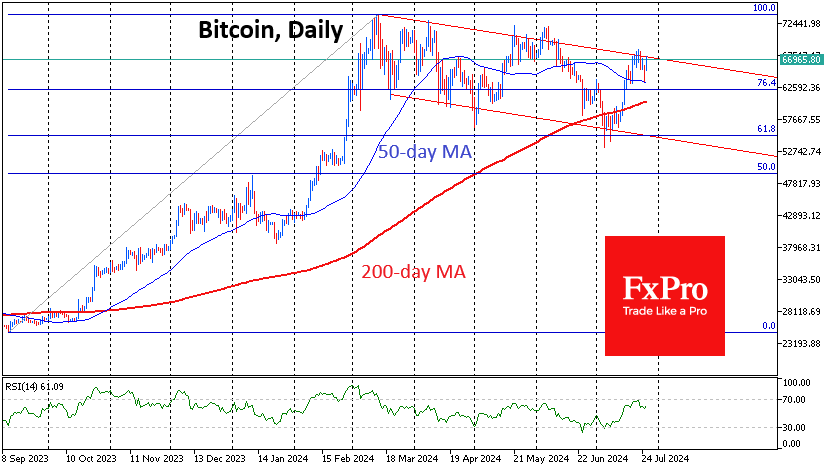

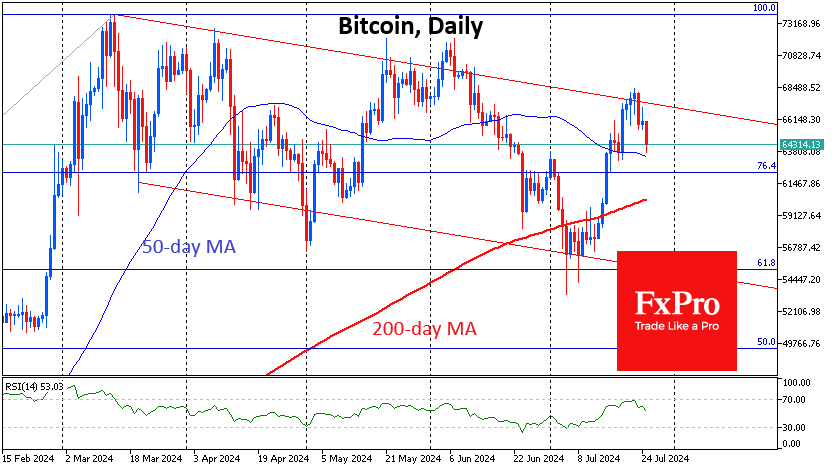

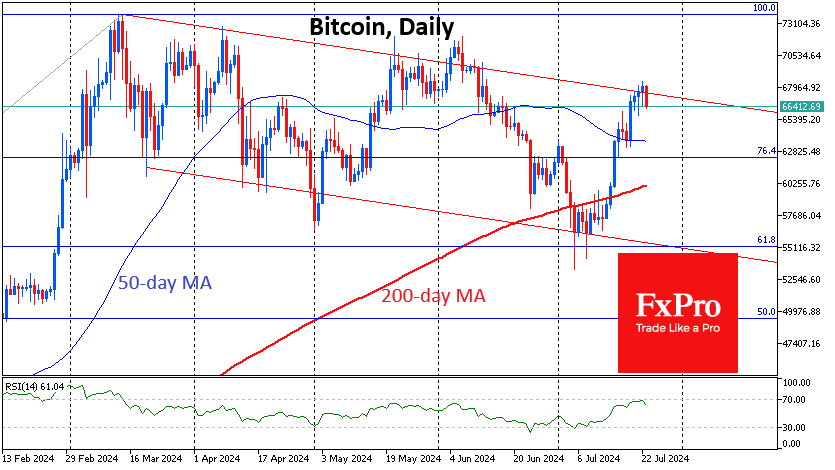

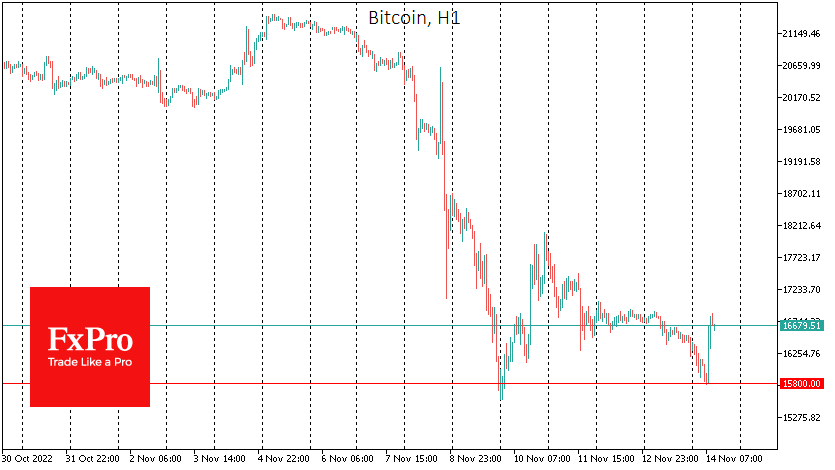

Bitcoin is trading just below 16K by the start of active European trading on Monday, losing 23.6% to levels of seven days ago. Ethereum collapsed 25% to $1190. Other top altcoins in the top 10 fell from 20% (BNB) to 29.6% (XRP).

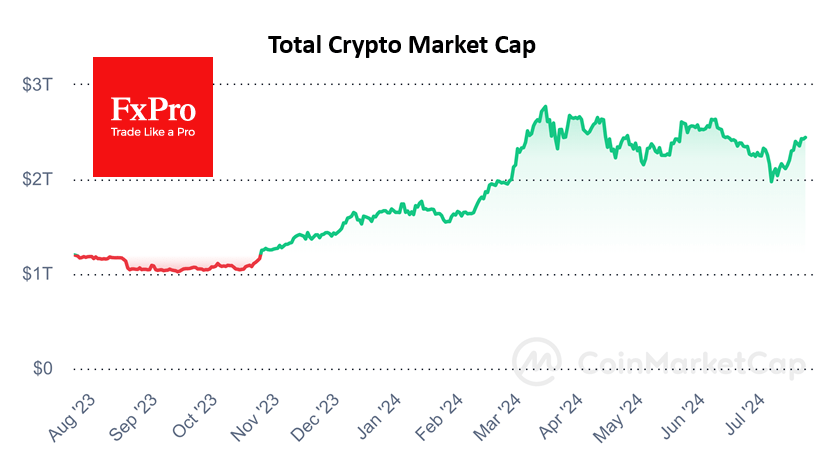

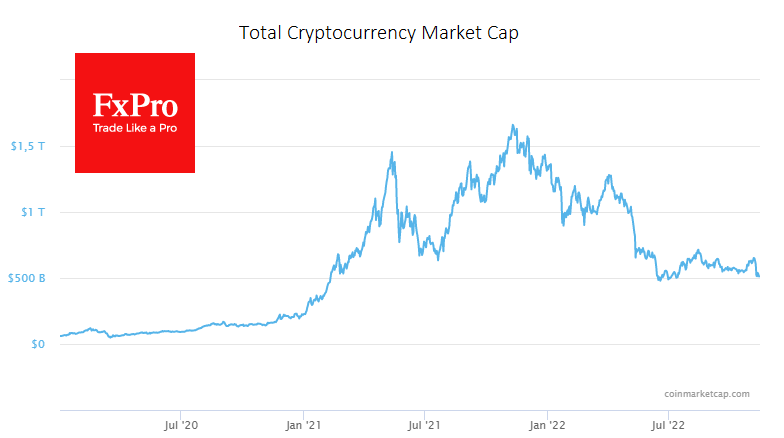

The total capitalisation of the crypto market, according to CoinMarketCap, fell 27% over the week to $757bn, to its lowest level since December 2020.

Bitcoin and the overall crypto market collapsed to two-year lows last week amid the bankruptcy of cryptocurrency exchange FTX and related companies. We continue to compare what is happening to the banking crises of the early 20th century, which led to the formation of modern securities market regulation with more transparency for investors but less anonymity.

Bitcoin was down to $15.8K by Monday morning, repeating lows set from Wednesday to Thursday. This is a timid attempt by speculators to form a ‘double bottom’, a reversing pattern in tech analysis. But we also draw attention to the impressive selling hitting the crypto market on bounces from increasingly lower highs.

This behaviour still indicates a huge interest in selling, creating risks for a new, deeper downside slippage. This could be the $12-14K range in a reduced liquidity environment.

The collapse of FTX is likely to cause more reputational damage to second-order altcoins, pushing back the new alt-season for some time. However, the top two dozen cryptocurrencies with working projects remain a good long-term bet for a diversified crypto portfolio.

News background

According to Glassnode, the share of profitable bitcoin addresses online has fallen to 50% – the lowest since March 2020. Short-term investors who have held BTC for less than six months have once again capitulated. Miners were also part of the reset, data from the CryptoQuant platform shows. Long-term investors, who now control up to 35.4% of the total BTC supply, also suffered significant losses.

The current situation in the cryptocurrency industry echoes the 2008 financial crisis, and more companies could collapse in the coming weeks, warned Binance CEO, Changpeng Zhao. He said the market has yet to feel the effects of the crisis around FTX.

JPMorgan believes the collapse of FTX will help the cryptocurrency industry recover and prompt regulators to speed up regulation of the sector.

The FxPro Analyst Team