Solana and Ethereum Poised to 25-30% Correction

December 15, 2023 @ 15:04 +03:00

Market Picture

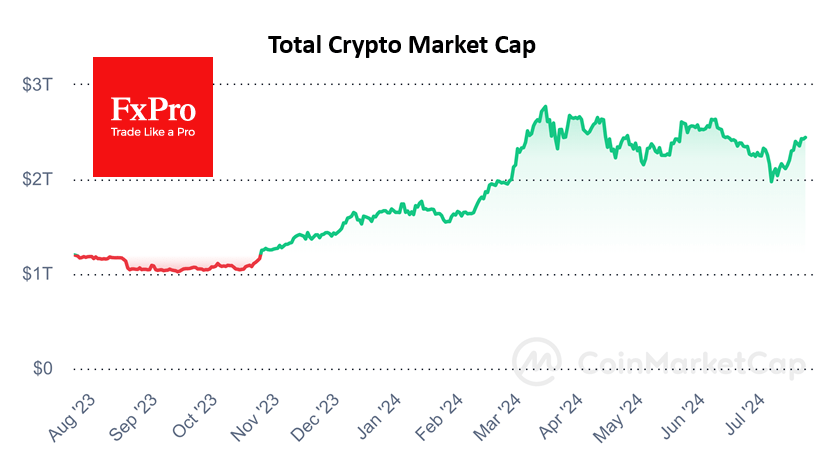

Greed remains the main driving force of the crypto market in recent days, and the corresponding index is on its way to the extreme greed zone. Its cap has risen by 0.3% in the last 24 hours. Bitcoin has seen about zero change, with trampling around $42.8K.

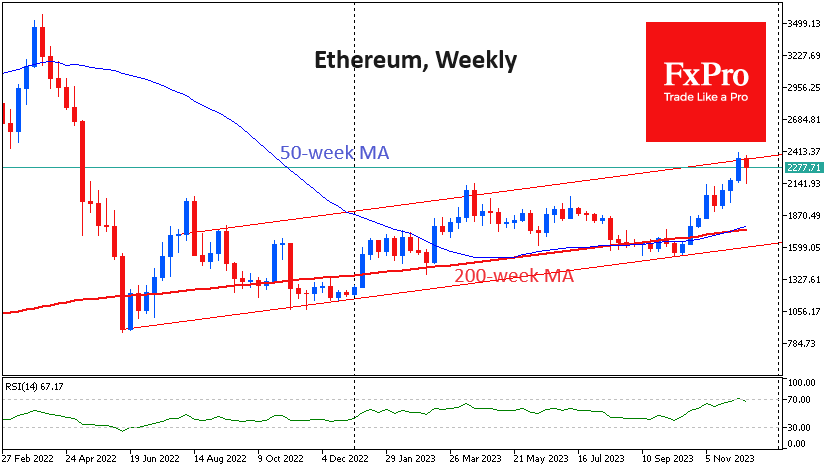

Ethereum has given up 0.2%, retreating deep under $2300. Within a broad ascending channel, the upper boundary of which the second cryptocurrency touched last week. The lower boundary of this range passes through the levels of $1700-1750.

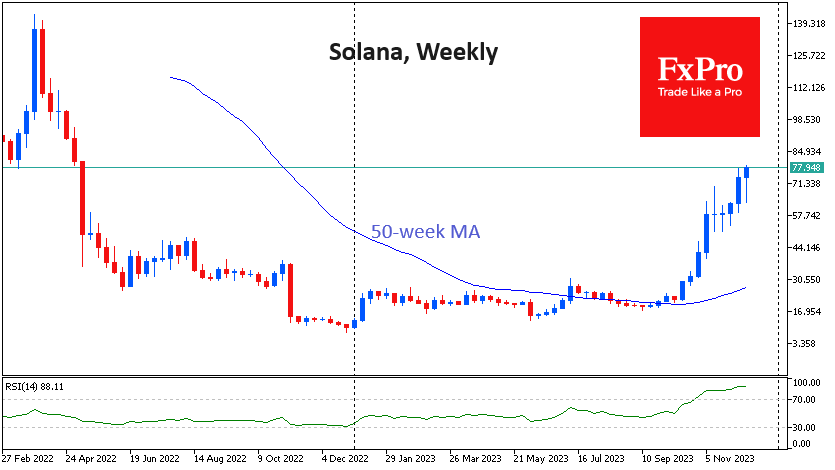

The movement was provided by the top ten altcoins, following Solana (+9%). This is one of the few altcoins that managed to hit the highs since May 2022 in the last hours. At the $78 level, it has a chance to hit resistance. Here, we saw significant support for the declines in the first half of 2022, and its overcoming triggered a solid downward momentum. So even now, we should be ready for a prolonged recharge with a potentially deep correction down to $55. But this is only possible against the backdrop of a widespread sell-off in traditional financial markets – a very risky bet right now.

News Background

Bitcoin will set a new all-time high of $80,000 in 2024 thanks to the approval of spot bitcoin-ETFs and halving, Bitwise predicts.

Next year, Ethereum will reassert itself and regain crypto market share. The primary catalyst will be the EIP-4844 update, which is expected to take place in the first half of 2024, according to JPMorgan. This update should be a big step towards improving the scalability, performance, and activity of the ETH network.

‘Regulation of cryptocurrencies should be a priority on the global agenda’, commented Kristalina Georgieva, head of the International Monetary Fund. She called for coordinated efforts by international regulators to control crypto assets.

Cryptocurrency exchange Binance has challenged the legality of the US Securities and Exchange Commission’s (SEC) lawsuit. Binance has filed two documents in the case against the SEC, claiming the agency’s actions were improper.

Hardware wallet developer Ledger reported the compromise of a software library used by decentralised applications. A hacker was able to inject malicious code into their interfaces. The damage from the attack is estimated at $600K. Tether froze the Ledger code cracker’s funds.

The FxPro Analyst Team