Rotation from Bitcoin to altcoins?

June 27, 2022 @ 12:00 +03:00

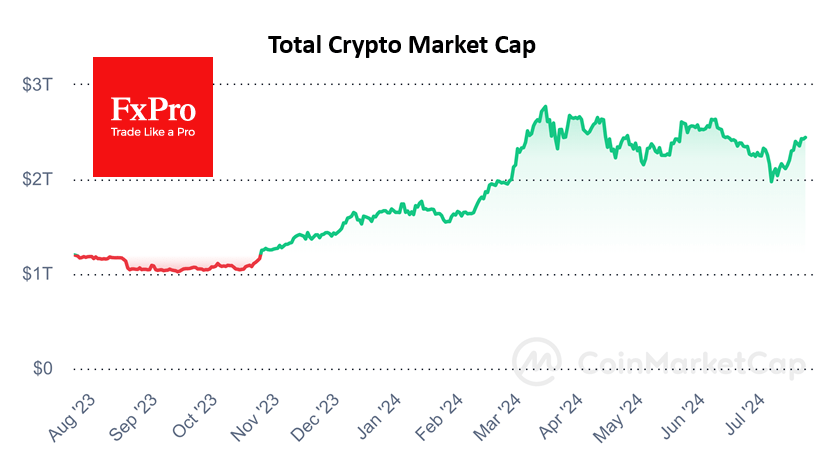

Bitcoin gained 3.8% over the past week, ending around $21.4K, dropping slightly to $21.2K on Monday morning. Ethereum added 9.4%, while other top-ten altcoins gained between 4.6% (Cardano) and 19.3% (Dogecoin). The total capitalisation of the crypto market, according to CoinMarketCap, rose 8% over the week to $952bn. The Bitcoin Dominance Index slipped 0.9 points to 43.4% over the same period due to the outperforming recovery of altcoins.

The cryptocurrency fear and greed index went up to 12 points by Monday, from 9 a week earlier, but remained in the extreme fear zone.

Bitcoin has risen above 20K in the past week, although its recovery has been more subdued than the stock market. This performance of the first cryptocurrency may indicate that investors continue to sell off the first cryptocurrency on the rise, moving into altcoins.

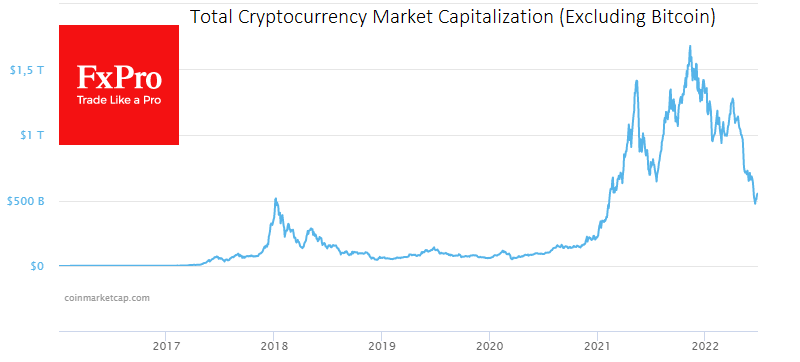

In the coming days or weeks, the important thing will be the performance of the crypto market capitalisation without BTC. Temporarily dipping below 2018 highs near $500B, the Crypto cap ex-BTC is showing a solid rebound, much more active than BTCUSD. However, it remains to be seen how sustainable this bounce will be.

CNBC broadcaster and author of the famous Mad Money programme, Jim Cramer, believes that bitcoin will be able to partially recoup its June losses in the coming months. However, aggressive long-term growth is unlikely. According to him, the rebound before another fall will provide good opportunities to sell previously bought assets.

Gary Gensler, head of the US Securities and Exchange Commission (SEC), is pushing for a single set of rules for cryptocurrencies that would bring together all regulators and strengthen industry regulation.

Cardano co-founder Charles Hoskinson told the US Congress that the SEC and CFTC would not be able to handle oversight of the cryptocurrency industry. In his view, it could self-regulate along the lines of the banking industry.

According to a Paxos survey of regular physical gold buyers, nearly one-third of respondents see bitcoin as a better alternative to that precious metal.

The FxPro Analyst Team