Revival of optimism in the crypto market

September 02, 2021 @ 17:10 +03:00

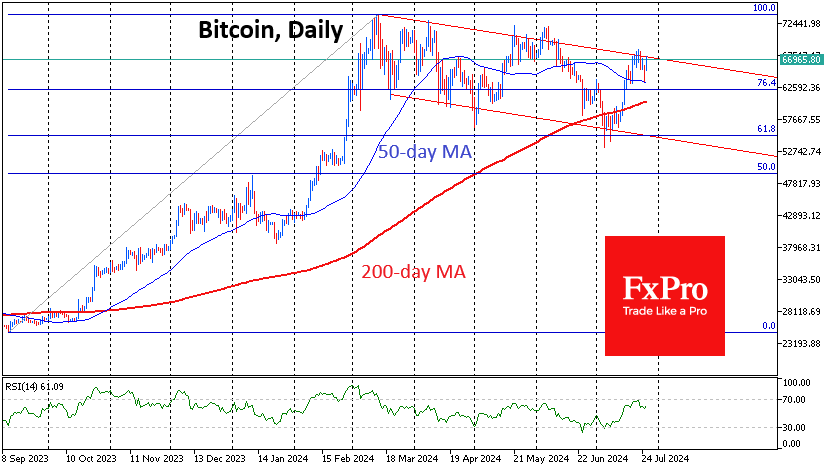

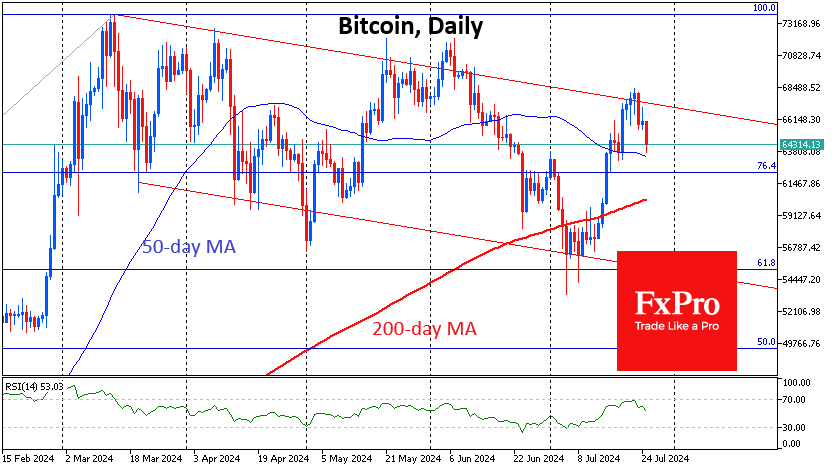

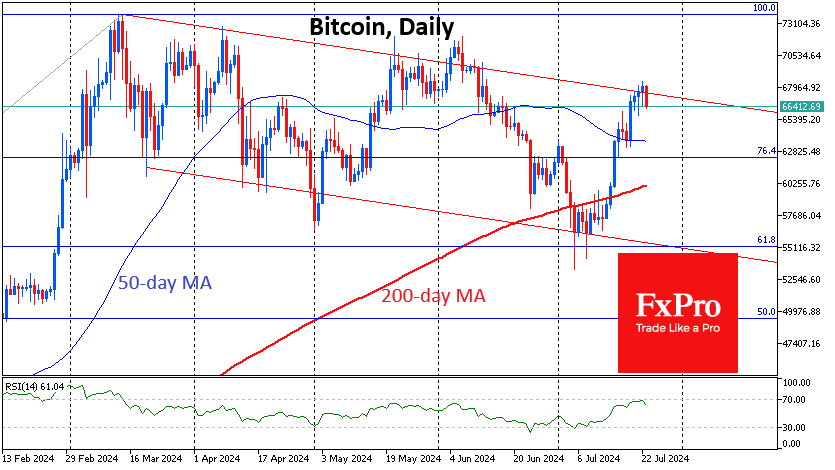

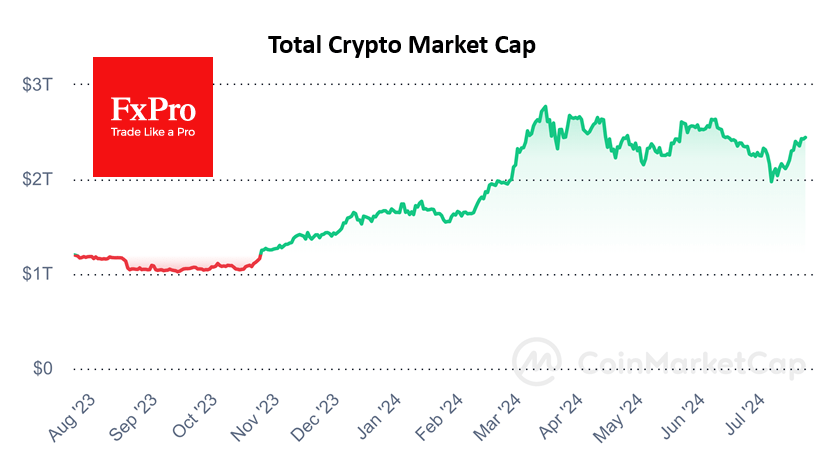

The crypto market starts the fall season quite positively. While far from a dizzying rally, indicators and price dynamics are generally optimistic. The total capitalization of the crypto market is gradually increasing above $2 trillion, which is not far from the historical highs. An even more positive sign is the decline in Bitcoin’s dominance index, which has already fallen to 41.9%. This points directly to the existence of widespread demand for altcoins. The capitalization of the first cryptocurrency reached $934 billion, approaching the most important psychological threshold of $1 trillion.

Ethereum (ETH), which has surpassed $3,700 and is not stopping its upward movement, is particularly noteworthy. There are several important reasons behind this growth, including the decline in ETH coin inventories on cryptocurrency exchanges. According to analytics company CryptoQuant, the volume of coins on cryptocurrency wallets has dropped by 700,000 ETH in less than half a month.

As in the traditional economy, the drop in supply spurs price growth and sometimes even increases demand for a limited commodity. In addition, the coin is strongly supported by what is happening around NFT. The CryptoPunks project is reaching the level of Hollywood, and that can’t help but stimulate demand for these tokens. It is worth noting that NFTs run on the Ethereum blockchain, and every transaction within the ecosystem is subject to a fee. The blocking of coins within the DeFi protocols also affects the decline in coin supply.

The news that the European Commission is trying to introduce cryptocurrency regulations in the EU, related to the rules of circulation in the bloc’s member states, among other things, can be viewed with a certain amount of anxiety. The initiative is met with rather fierce opposition from citizens of various countries, who prefer regulation at the level of individual countries.

Beijing wants to create an international network for mobile payments using the digital yuan. China’s economic machine requires the currency to go international. The country now has the power to make a truly competitive digital currency, but protectionism and direct opposition to the digital yuan from Western countries may hinder these plans.

In the future, the global digital economy will likely revolve around several major centres of gravity, one of which will be China, absorbing all of Asia, while the second centre will be in Washington, which will dictate the rules for the West. There will be no predetermined winner, but we can guess who will be among the losers – the first cryptocurrencies, which can wait for the fate of Yahoo and other once-great but lost power projects.

The FxPro Analyst Team