Crypto Review - Page 55

January 2, 2023

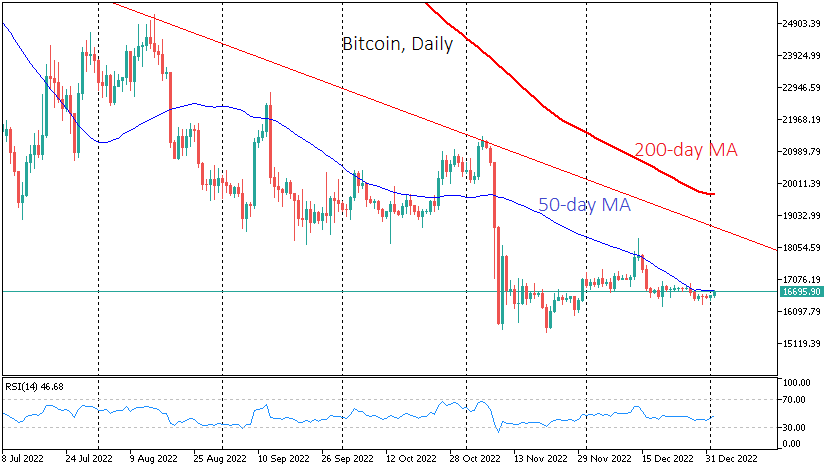

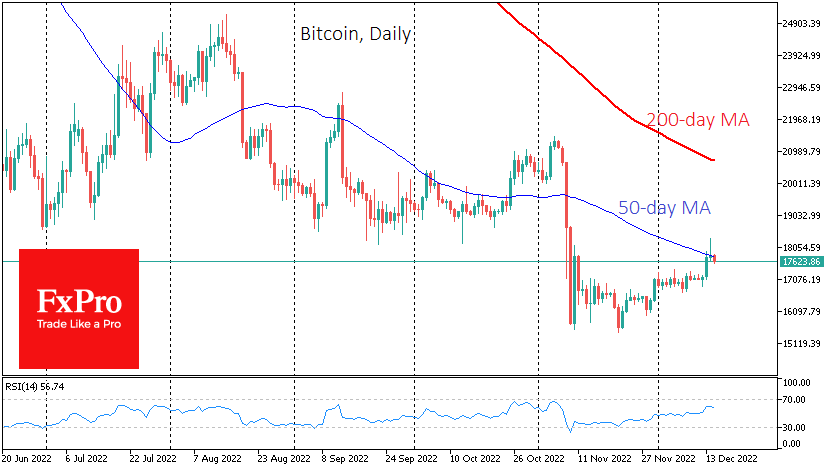

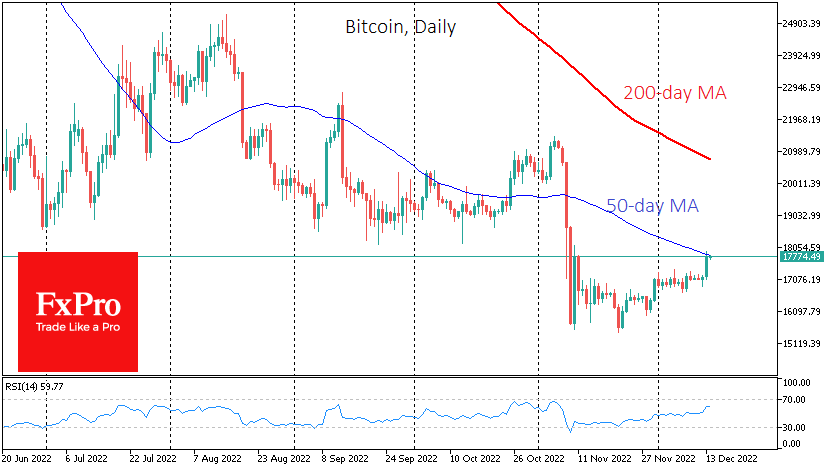

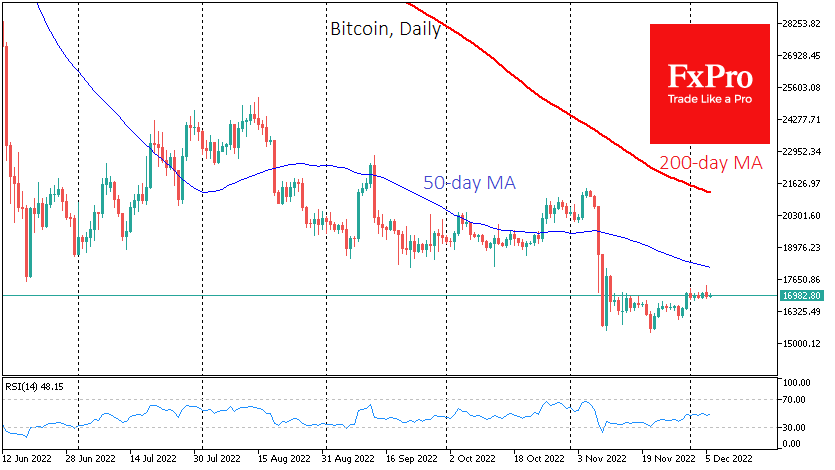

Bitcoin has added 1.4% in the last 24 hours, reaching the 16.7K level. It is a new attempt to test the 50-day moving average on a general lull and an effort by the bulls to paint a more optimistic technical.

December 23, 2022

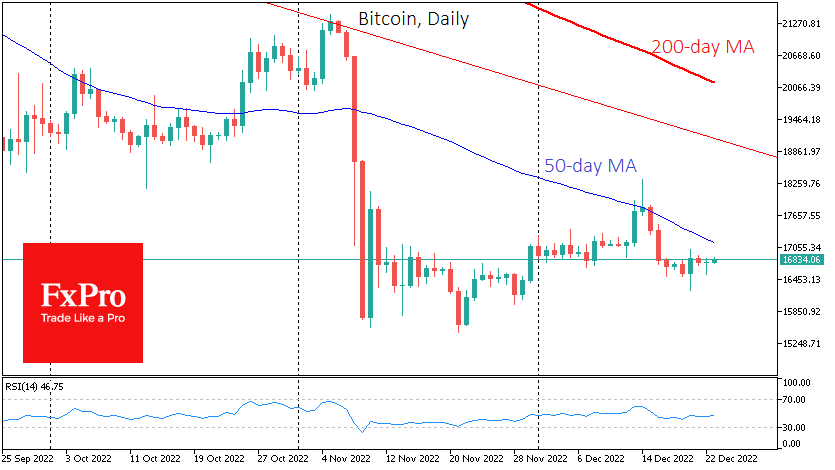

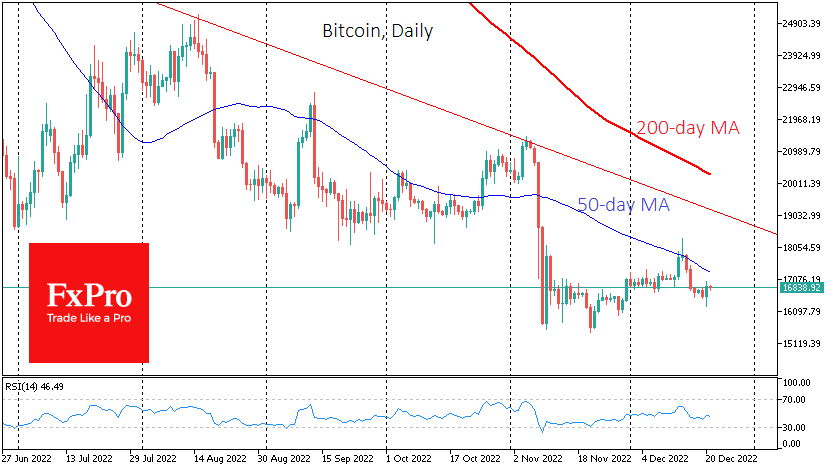

Market picture Bitcoin’s chart remains a horizontal straight line with several pulsations down and up over the past five weeks. The rate remains near $16.8K as the intraday dip of 1.6% to the $16.55K area was quickly redeemed at the.

December 21, 2022

Market picture Bitcoin is trading near $16.8K on Wednesday morning, almost unchanged over 24 hours. The first cryptocurrency reaffirmed on Tuesday that it often acts as an indicator of financial market sentiment for the day. Its ability to halt the.

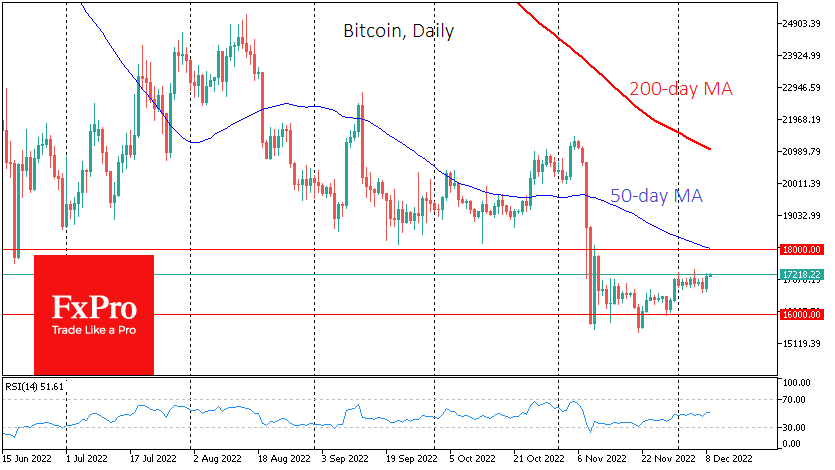

December 19, 2022

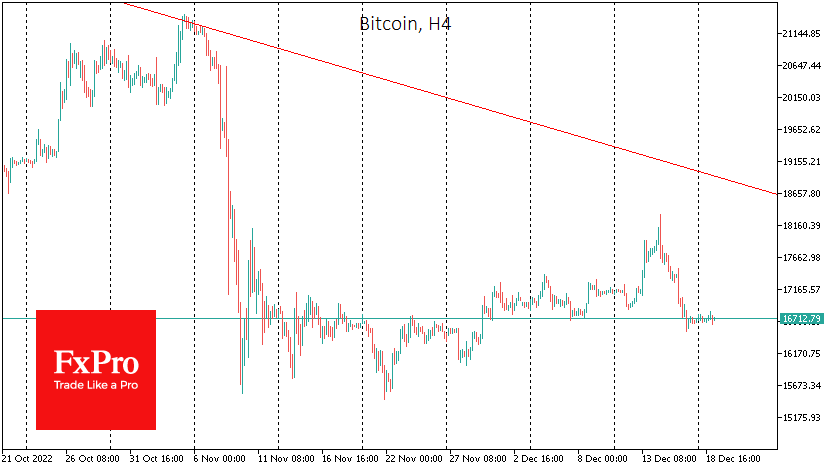

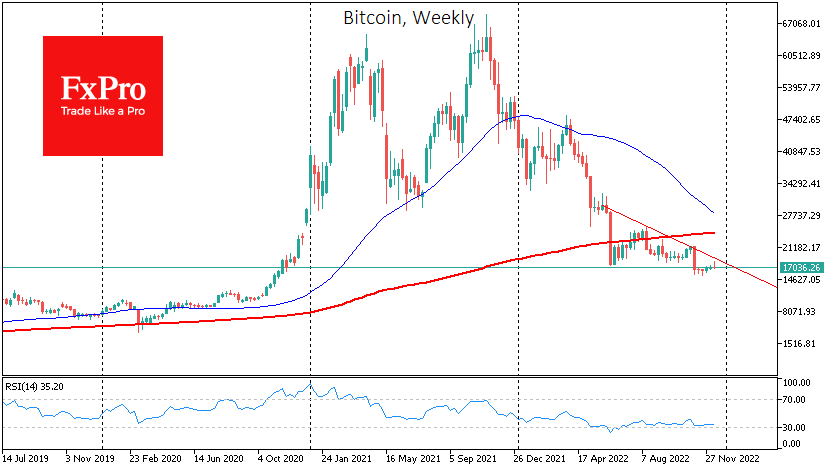

Market picture Bitcoin is down 1.3% over the past seven days, remaining just below $17K since Saturday. Ethereum lost 5.3% to $1180. Other leading altcoins in the top 10 fell 8.8% (XRP) to 17.1% (Dogecoin). The intensified selling at the.

December 16, 2022

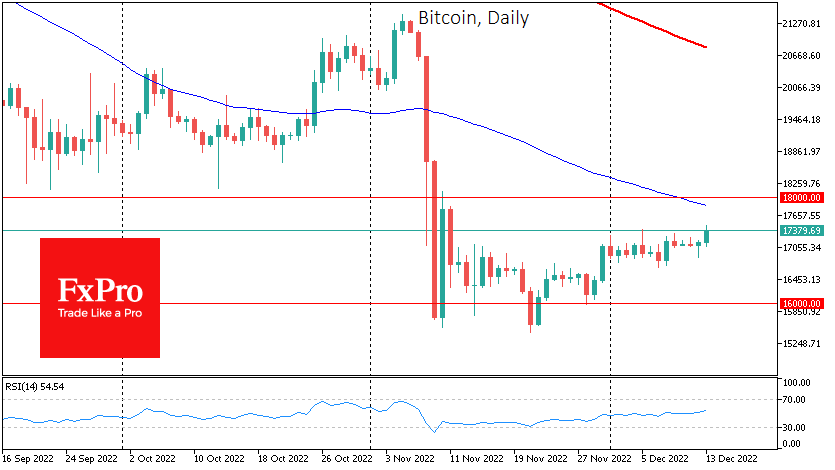

Market picture Bitcoin fell on Thursday by the most in 3.5 weeks amid a sharp decline in stock indices and a stronger US dollar. BTC rolled back to $17.4K, losing 1.3% overnight. Ethereum, which trades at $1270, shows the same.

December 15, 2022

Market picture Bitcoin updated five-week highs above $18,300 on Wednesday but then fell along with stock indices amid the Fed’s intention to raise rates higher and hold them longer than markets had hoped. The market reaction to the Fed brought.

December 14, 2022

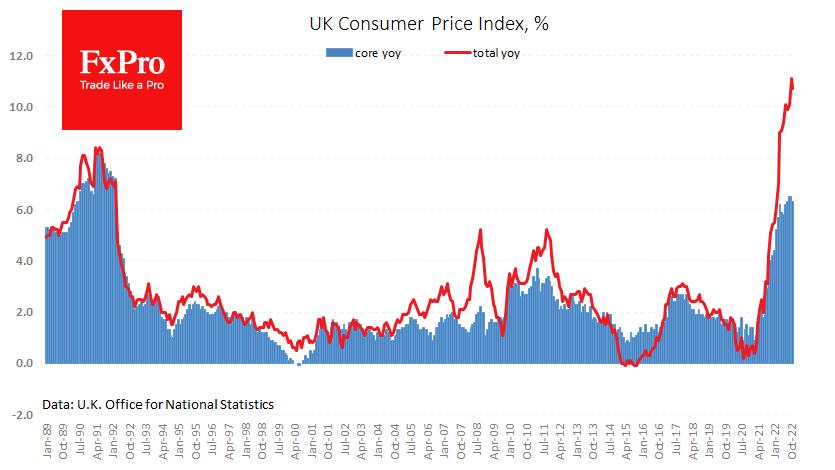

Following the soft US inflation report, the UK published its November data which was also weaker than expected. The consumer price index rose by 0.4% last month against expectations of 0.6%, and the year-on-year increase slowed from 11.1% to 10.7%..

December 14, 2022

Market picture Bitcoin was adding 5% intraday on Tuesday, at one point approaching $18K. The primary growth momentum co-occurred as the stock market after US inflation data boosted risk appetite. The price increased a few hours before the release amid.

December 13, 2022

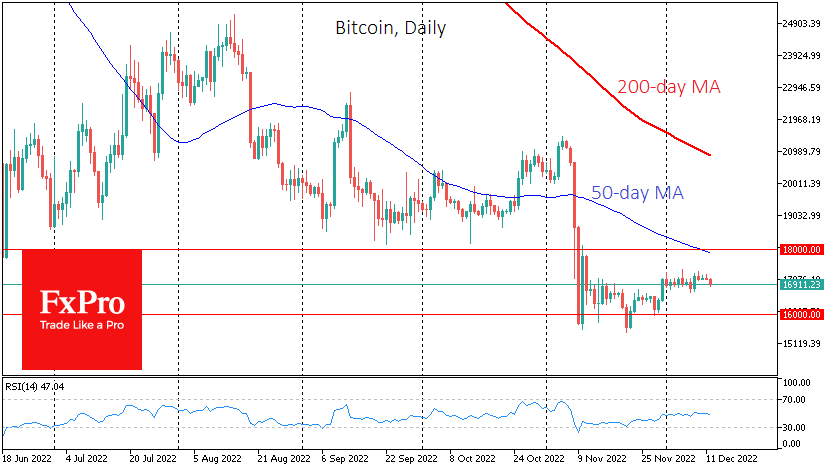

Market picture Bitcoin recouped all its early-day losses in the US session on Monday amid rising stock indices. BTC climbed above the $17,000 level, extending a period of almost no change in price that has become particularly pronounced this month..

December 12, 2022

Market picture Volatility in Bitcoin and the crypto market remains as squeezed as possible. Continuing to hover near $17K, the price of the first cryptocurrency loses 1.5% in 24 hours, 2.5% in 7 days and is up 1.1% in 30.

December 9, 2022

Market picture Crypto market capitalisation rose 2% over the past 24 hours to $858bn. Bitcoin added 2.3% to $17.2K, trading near the top of its range since November 12. The technical picture remains the same for Bitcoin, and it will.