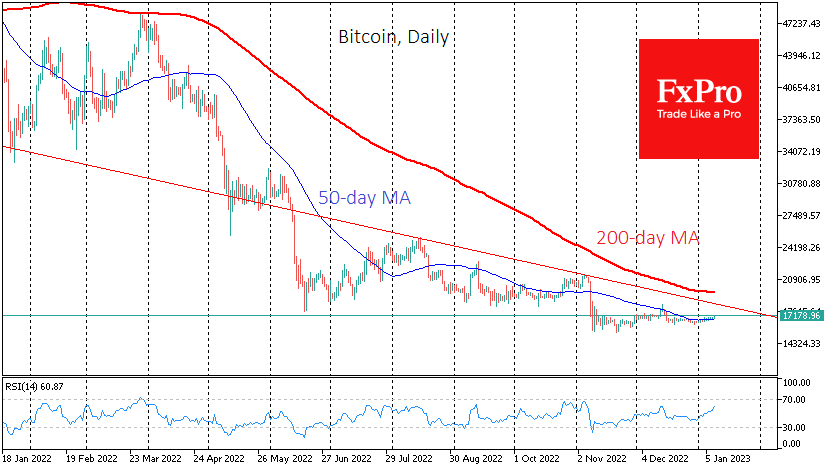

Crypto Review - Page 54

January 23, 2023

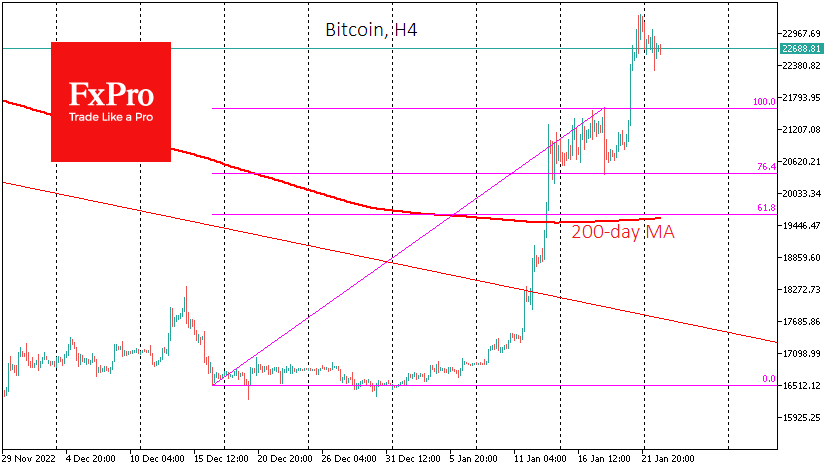

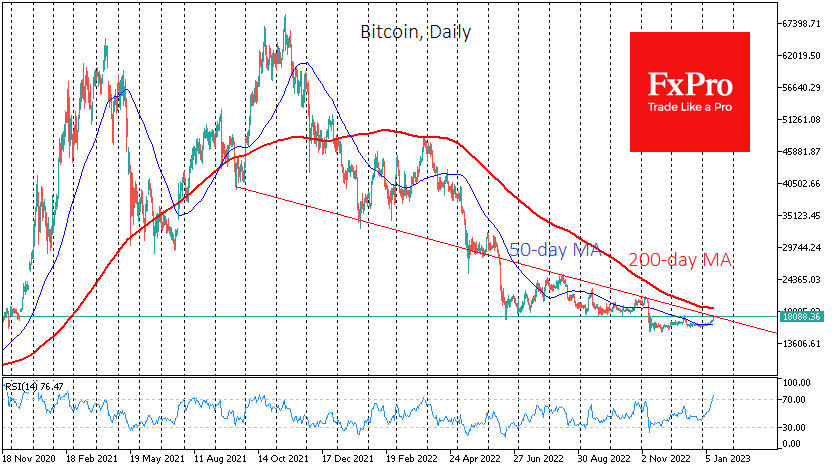

Market picture Bitcoin is up 7.7% over the past week, trading at $22.7K on Monday morning. Ethereum added less – only 4.1% to $1640. Other leading altcoins in the top 10 have gained between 0.4% (BNB) and 12.7% (Shiba Inu)..

January 20, 2023

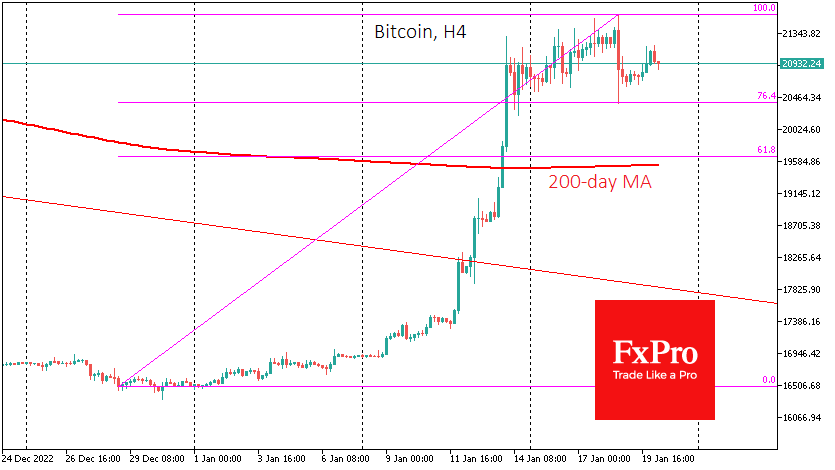

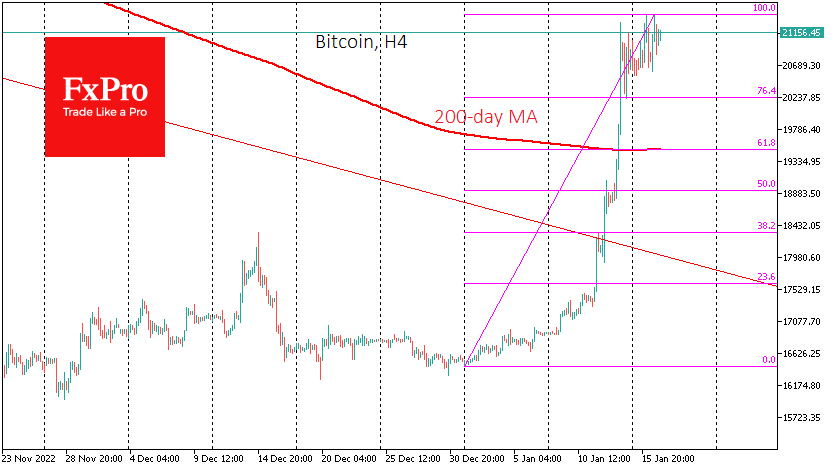

Market picture The cryptocurrency market has added 0.75% in the last 24 hours to 976bn, with Bitcoin rising by the same amount, testing $21K again. The first cryptocurrency has corrected to 76.4% of the rally from December lows to this.

January 19, 2023

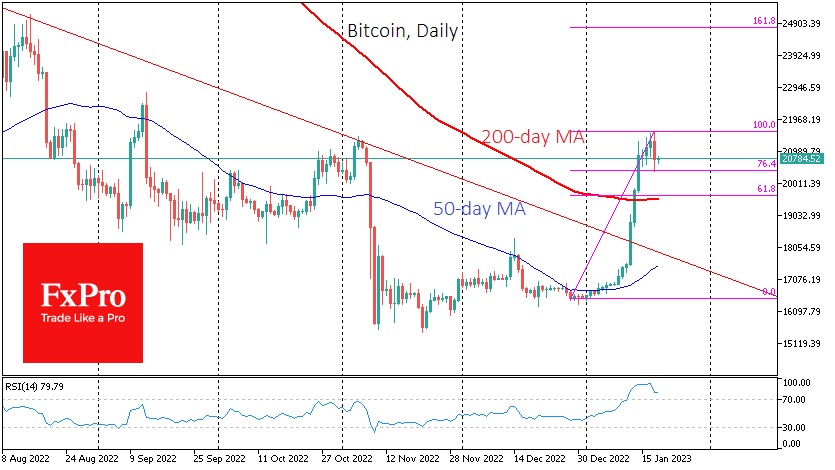

Market picture Bitcoin has lost 2% over the past 24 hours, pulling back to $20.77K, almost $1K below Wednesday’s peak. The first cryptocurrency followed stock indices, which turned sharply lower on Fed officials’ hawkish rhetoric simultaneously with growing signals of.

January 18, 2023

Market picture Bitcoin continues its streak of small wins, recording its 13th consecutive day of gains on Tuesday, adding for 15 days in the last 16 sessions this year. The exchange rate rewrote a two-month high at $21.55K. Local overbought.

January 17, 2023

Market picture Bitcoin hit a high above $21.4K on Monday but pulled back to $21.0K – the area of the high since November – the rate is frozen, waiting for new signals. It was apparent yesterday that the market needs.

January 16, 2023

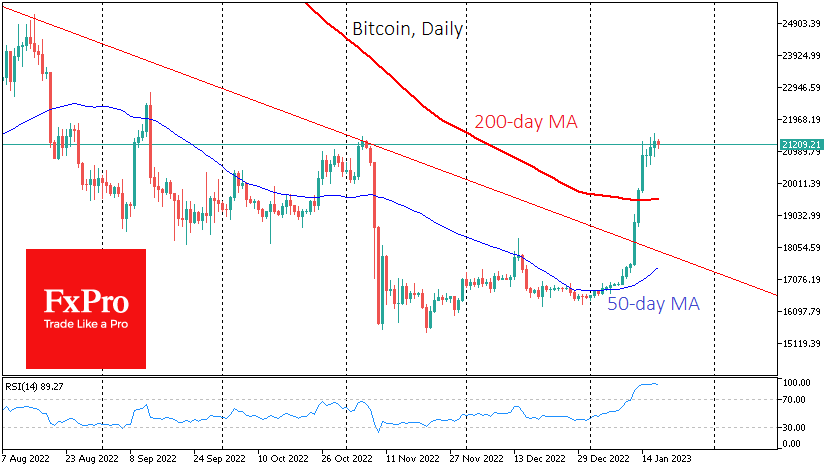

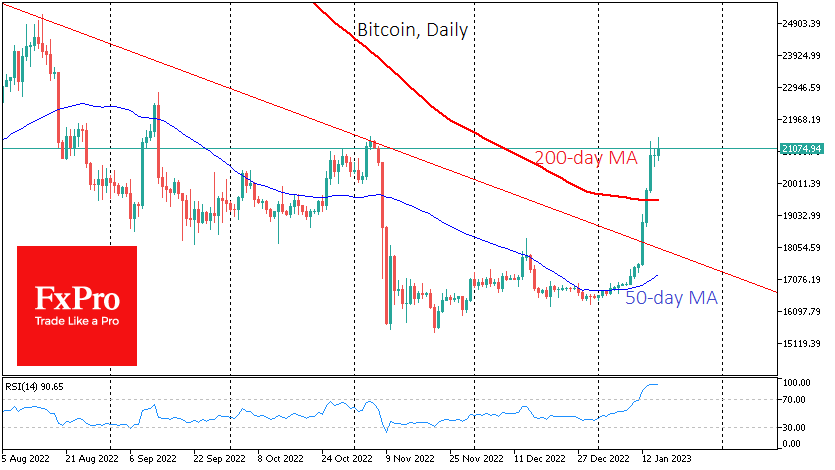

Market picture The bitcoin price has surpassed $21K, adding around 23% over the week. Ethereum jumped 20% to $1570. Other leading altcoins in the top 10 gained between 9% (BNB) and 50% (Solana). Solana has re-entered the top 10, pushing.

January 13, 2023

Market picture Bitcoin jumped 7.2% to $19,000 on Thursday, a high that the first cryptocurrency has yet to trade in the last two months. The intraday growth consisted of two impulses. The first one was due to stop-orders triggering in.

January 12, 2023

Market picture Bitcoin rose on Wednesday on the back of stock gains and strengthened further on Thursday morning. In the low-liquid morning market, stop-loss orders were triggered, pushing the price up 4% within an hour and a half. The price.

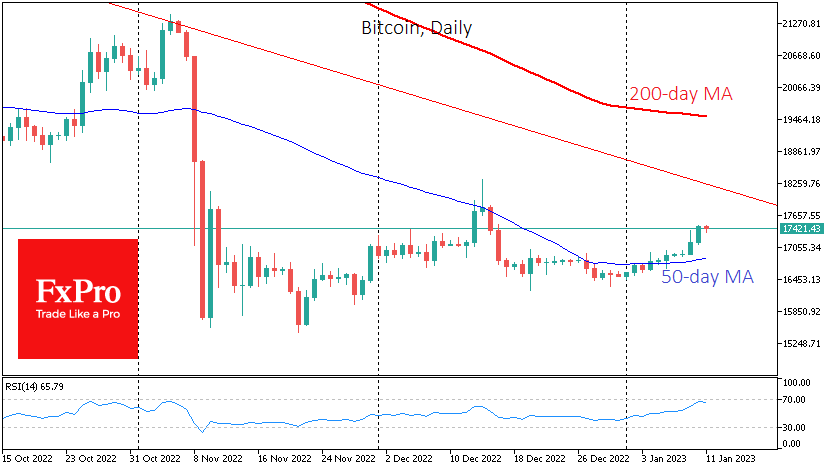

January 11, 2023

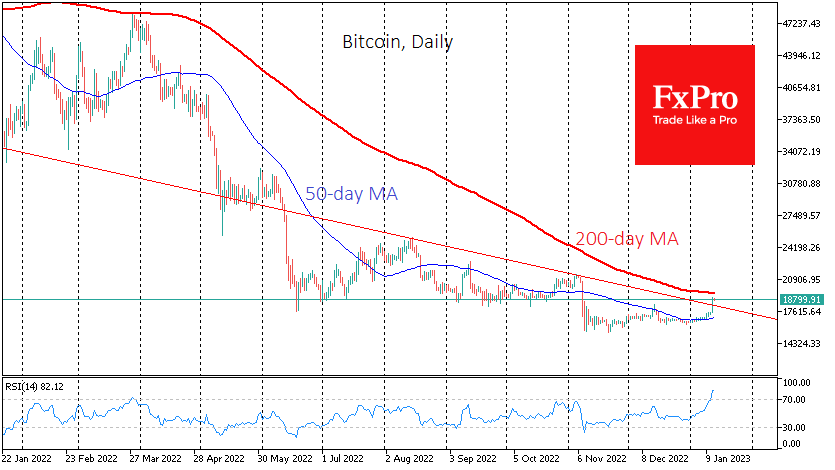

Market picture Bitcoin returned to growth on Tuesday and was approaching $17.5K in early trading on Wednesday, developing its smooth ascent to levels last seen in mid-December. Total crypto market capitalisation has risen 1% in the last 24 hours to.

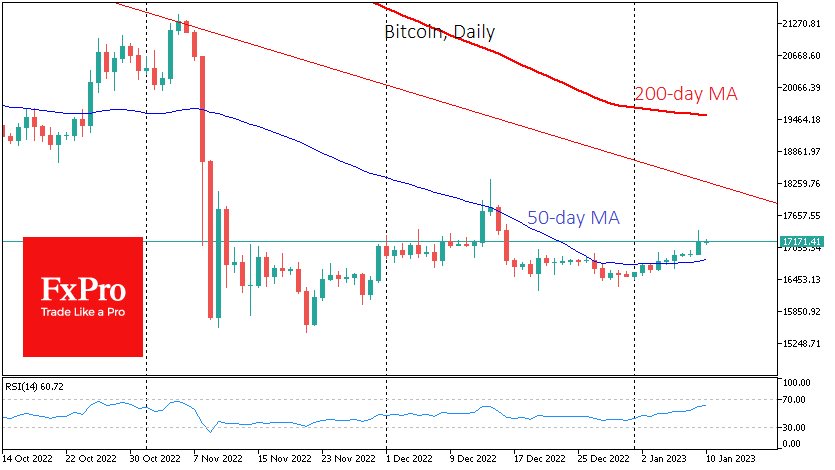

January 10, 2023

Market picture Bitcoin rose to $17350 on Monday but returned to $17200, showing zero momentum over the past 24 hours. The buying was held back by the waning momentum of buying in US equities. Fed officials continue to press the.

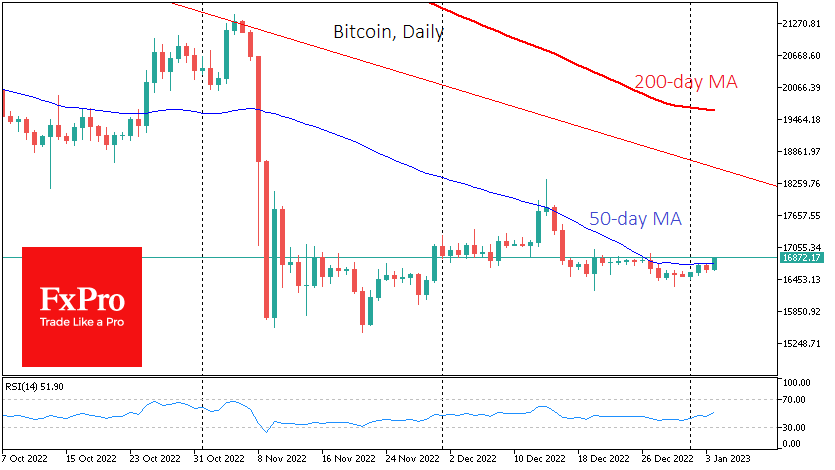

January 9, 2023

Market picture Bitcoin rose 2.2% over the past week, finishing near $17K. On Monday morning, a new upward momentum lifted the price to $17.2K, a new high in almost four weeks. Over the week, Ethereum has added 8% to $1310..