Crypto Review - Page 10

August 7, 2025

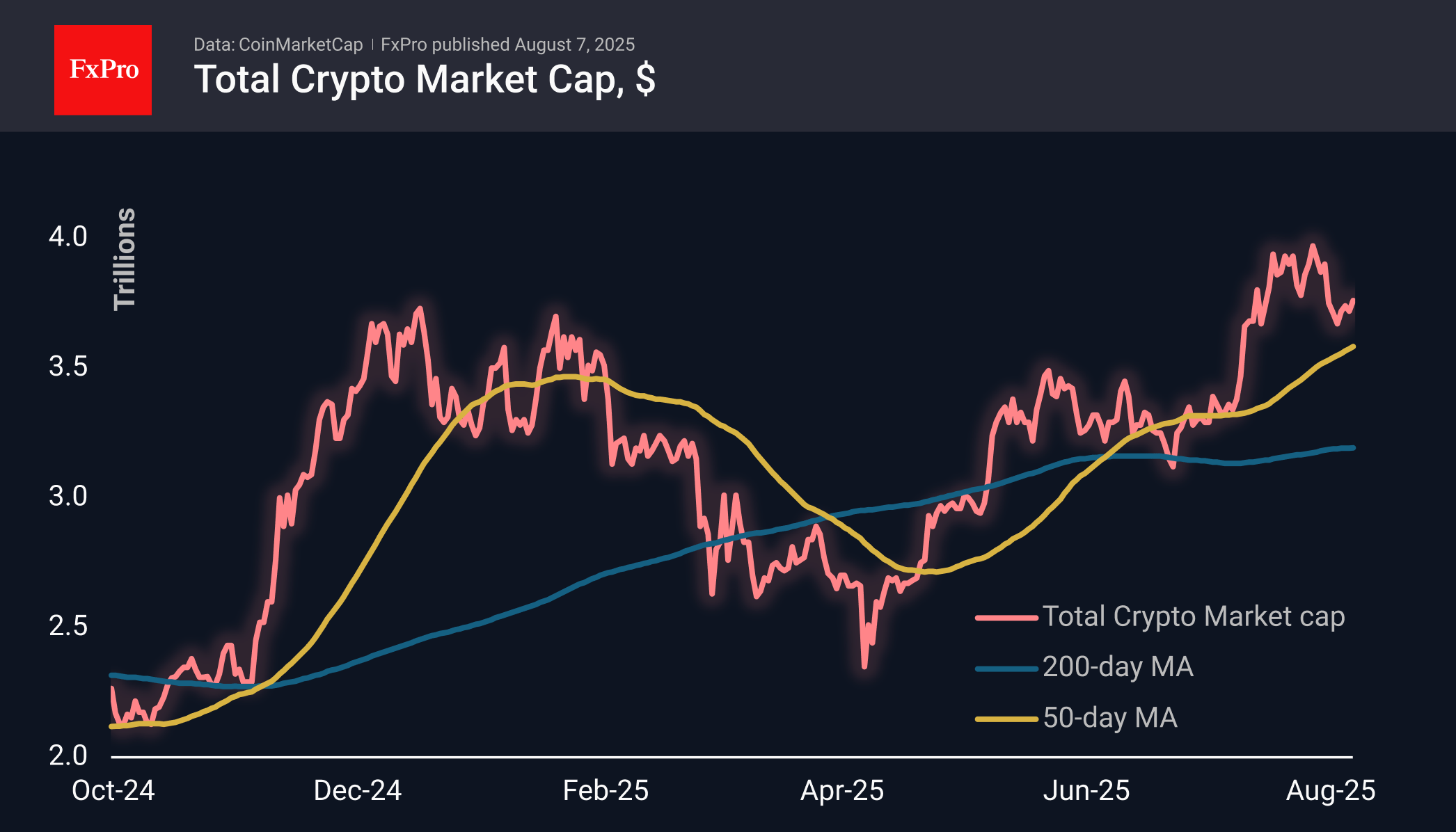

Altcoins outperform BTC due to stock market boost. Crypto market cap up; leading altcoins rise. Bitcoin nears $115K but faces uncertainty.

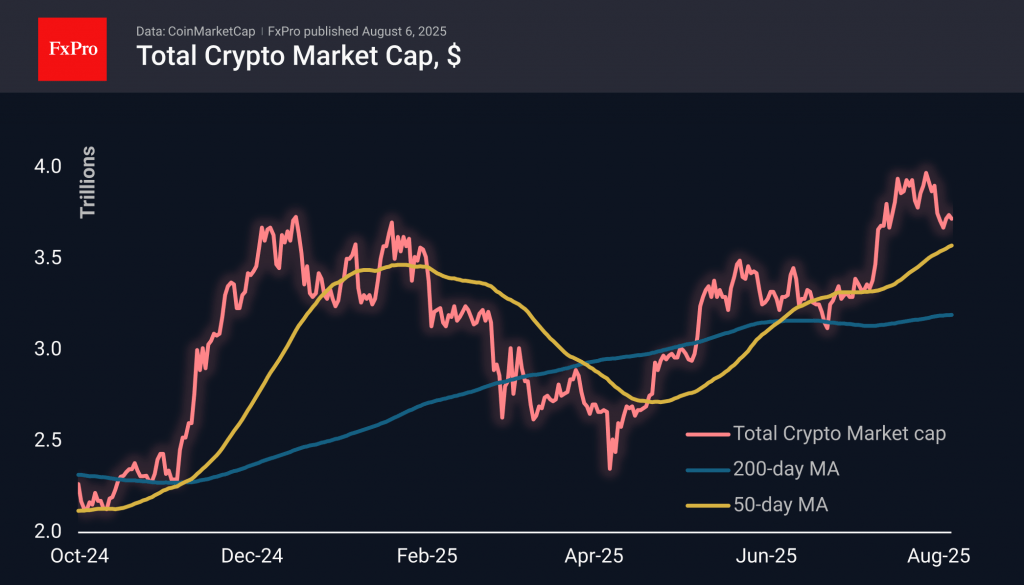

August 6, 2025

The crypto market showed a summer slowdown in early August, with Bitcoin nearing its 50-day moving average. Institutional investors are buying Ethereum, while large companies continue to accumulate Bitcoin reserves.

August 5, 2025

In this episode of Pro News Flash, we break down Bitcoin’s sharp sell-off, its rapid recovery, and what could come next for the crypto market. 🪙After U.S. Congress passed new stablecoin regulations and U.S. stock indices retreated from record highs,.

August 5, 2025

Bitcoin experienced a decline due to regulations on stablecoins but rebounded as US stocks saw an increase.

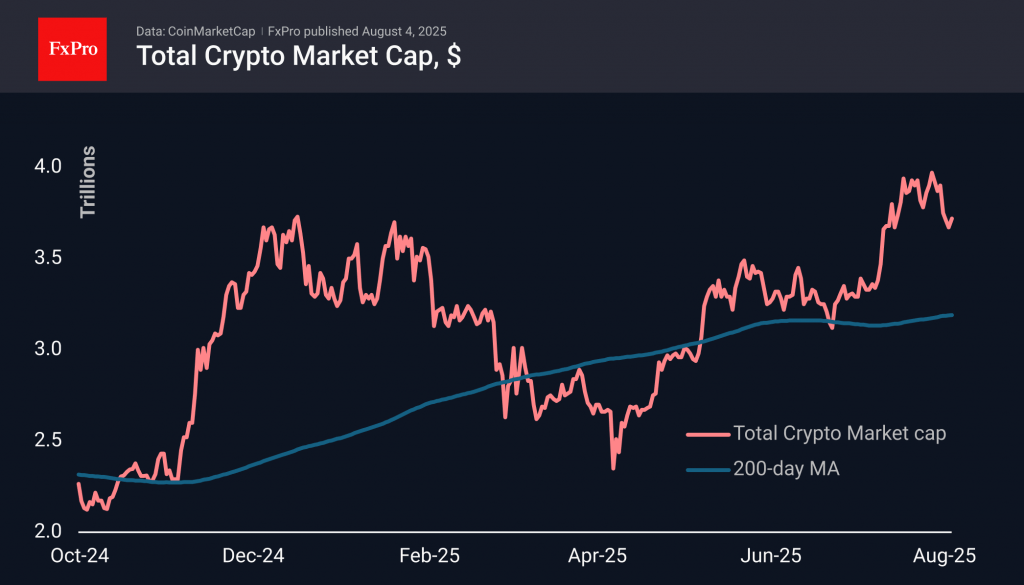

August 4, 2025

The cryptocurrency market saw a decline but rebounded, with Bitcoin finding support near the 50-day moving average. Bitcoin whales bought 30,000 BTC as the US SEC aims to establish clear rules for cryptocurrencies.

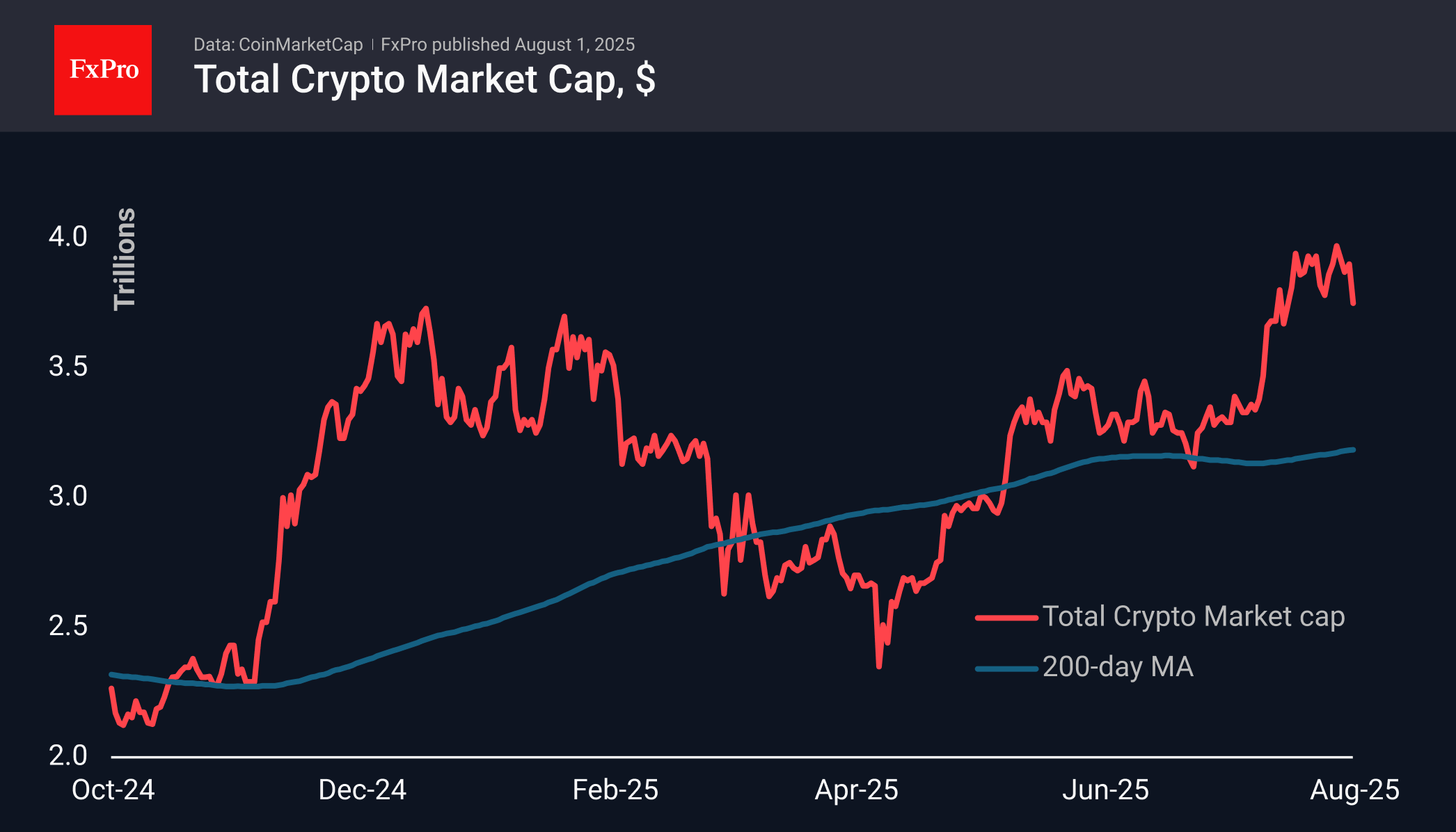

August 1, 2025

Despite July's gains, the crypto market faces renewed volatility and bearish sentiment as August, historically one of the most challenging months for Bitcoin, begins with further declines and cautious outlooks.

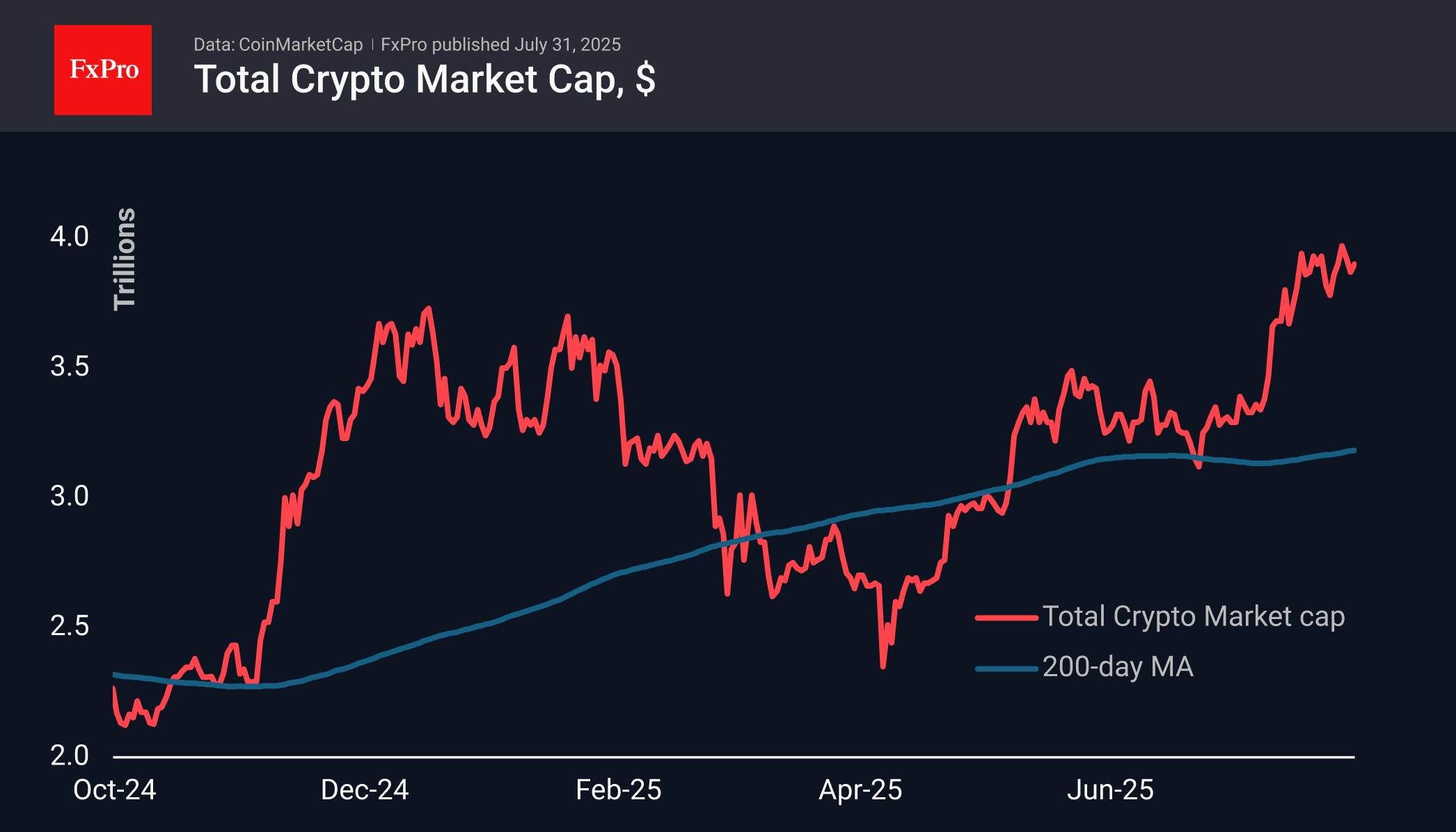

July 31, 2025

The influence of macroeconomic factors on cryptocurrencies continues to grow, even in the absence of major industry developments — a trend that can also be seen as part of the market’s maturation

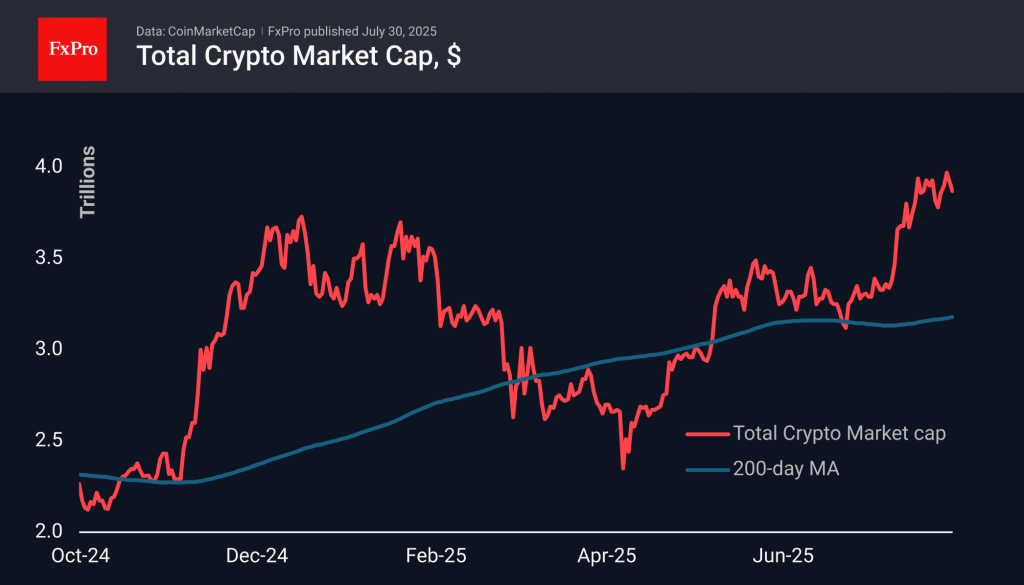

July 30, 2025

The crypto market cap has retreated another 0.7%, maintaining a cautious stance ahead of an extremely busy second half of the week

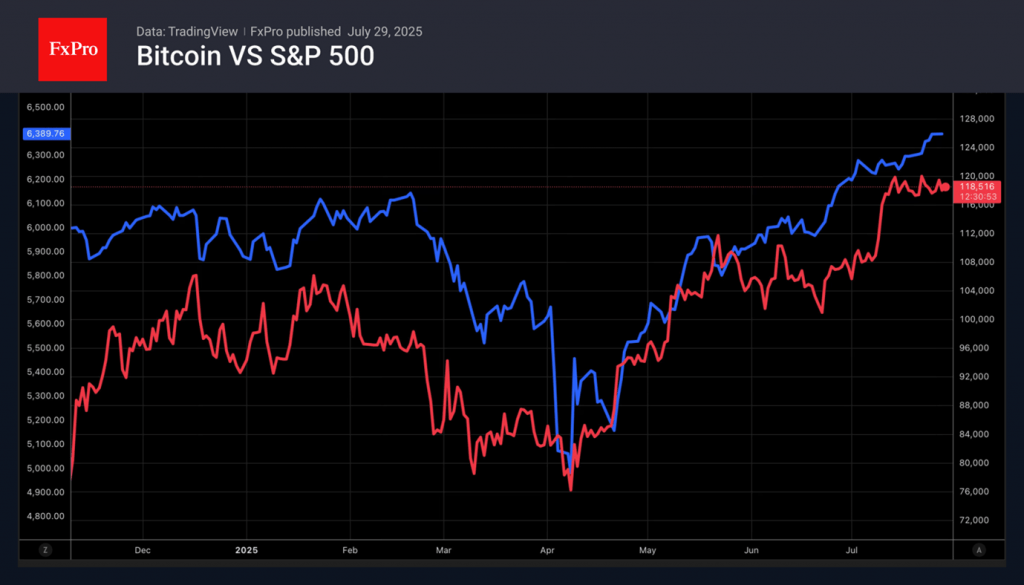

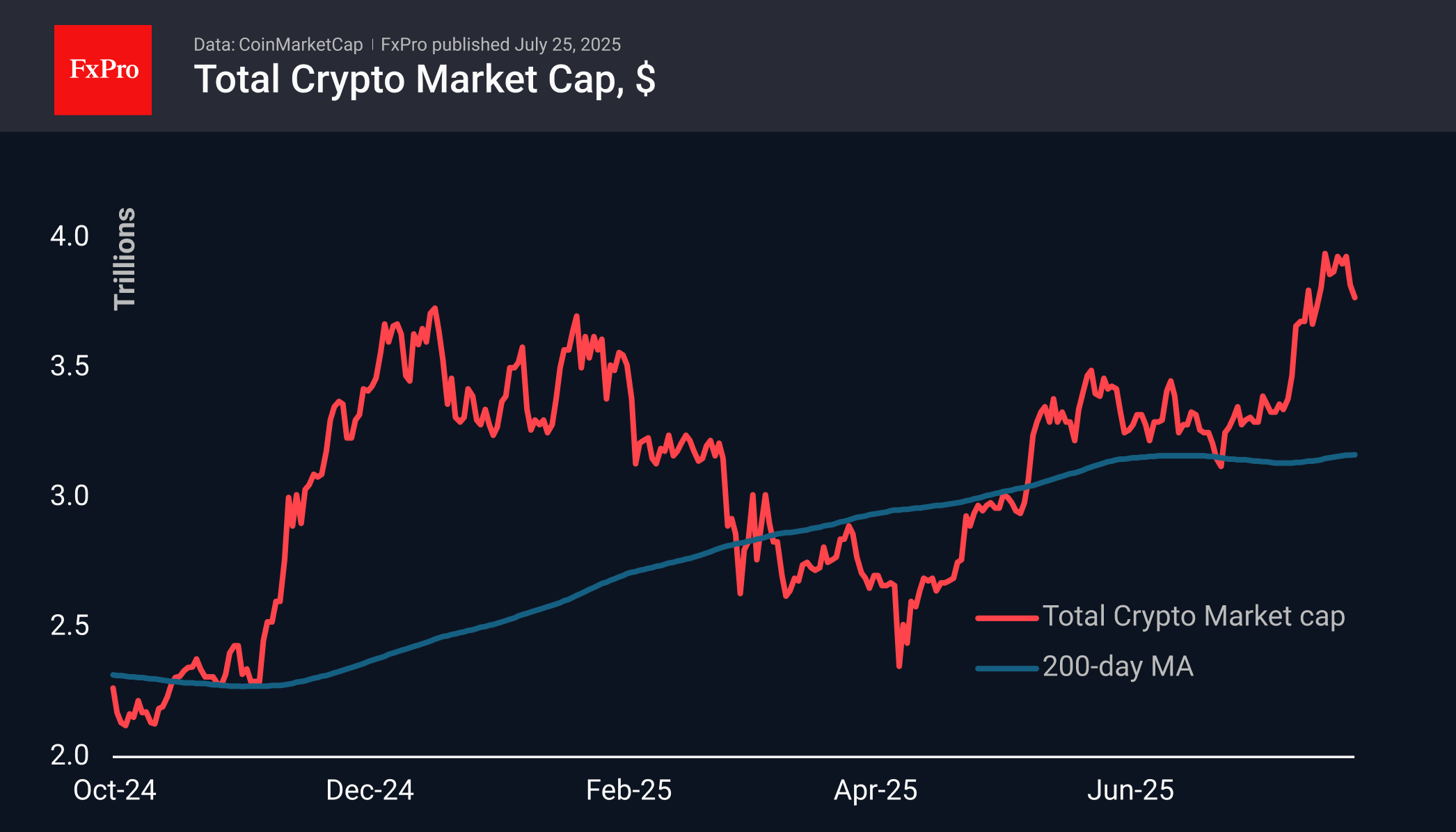

July 29, 2025

After a turbulent rally in the first half of July, Bitcoin entered a period of consolidation. Neither the sixth consecutive record high of the S&P 500 nor the associated improvement in global risk appetite are helping it. At the same.

July 29, 2025

Ethereum aims to surpass $4,000 amidst a market pullback, with Bitcoin trading near $118.7K. Global investment inflows into crypto funds see significant growth, especially in Ethereum and Solana.

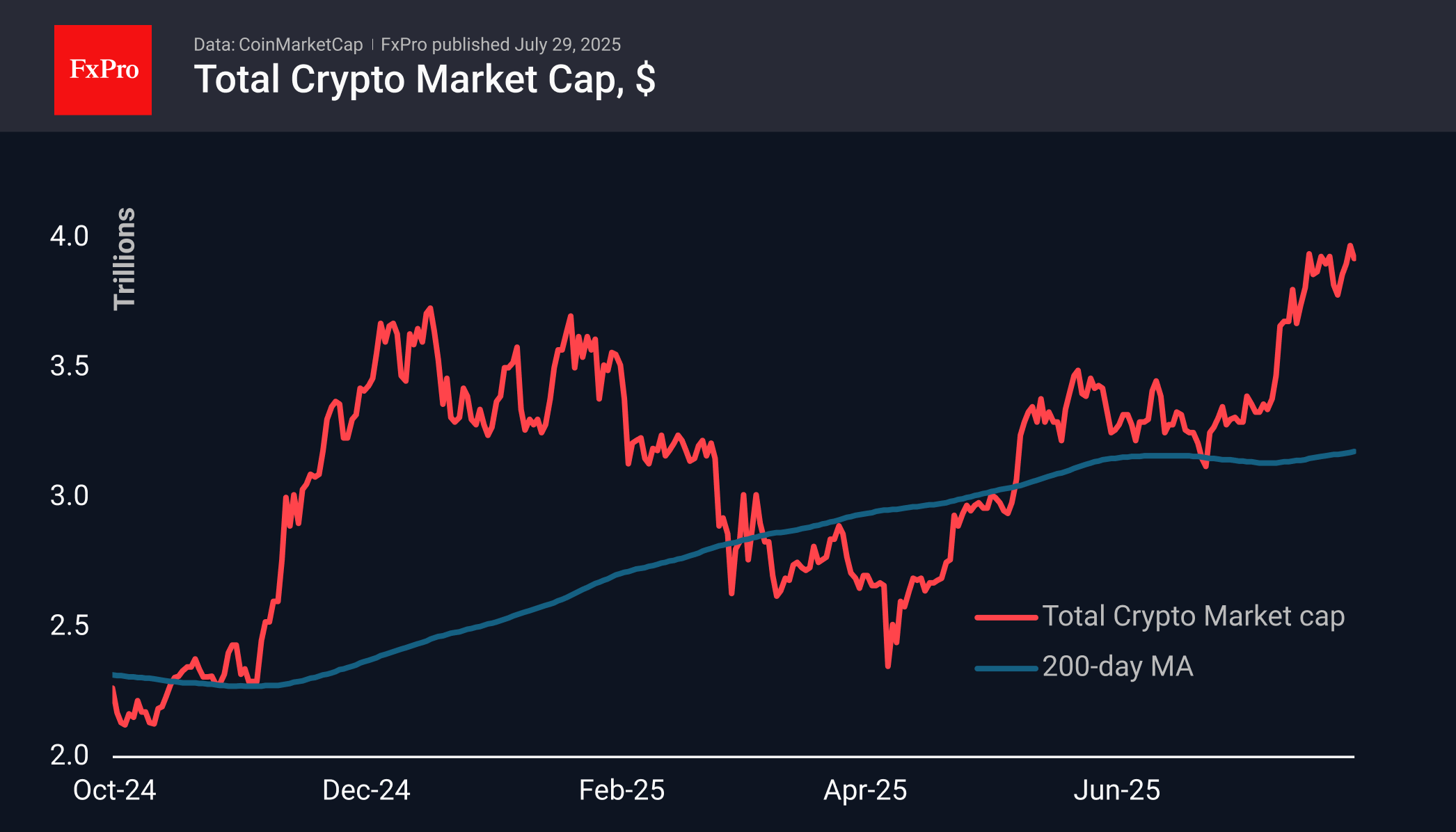

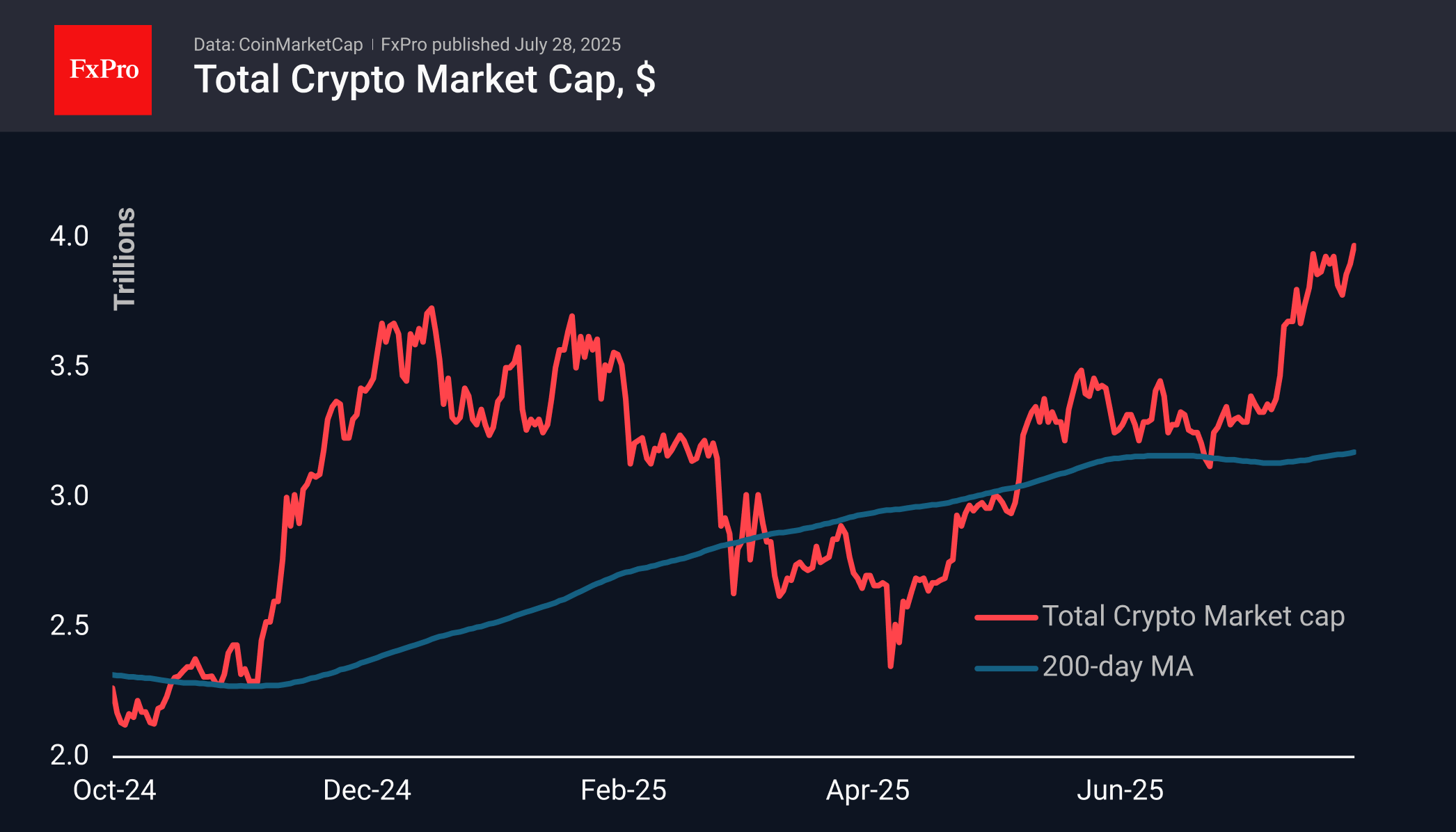

July 28, 2025

The cryptocurrency market reached a $4 trillion market capitalisation, with altcoins bouncing back demand. Bitcoin stayed within a range, while Ethereum aimed to break $4000 and reach $5000.