Has Bitcoin hit bottom?

February 23, 2022 @ 10:23 +03:00

The rebound of bitcoin began along with the growth of European stock indices at the beginning of the day. They corrected up after three days of decline on the crisis around Ukraine. Futures for the S&P 500 and Nasdaq, with which BTC has been highly correlated lately, also showed gains on Tuesday.

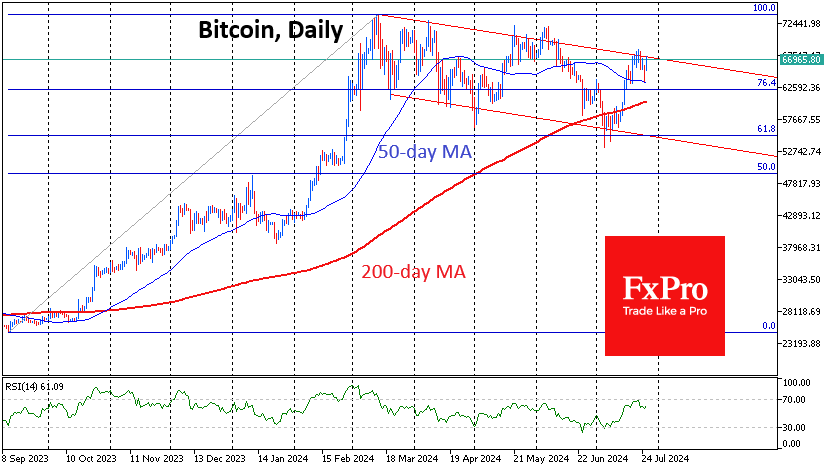

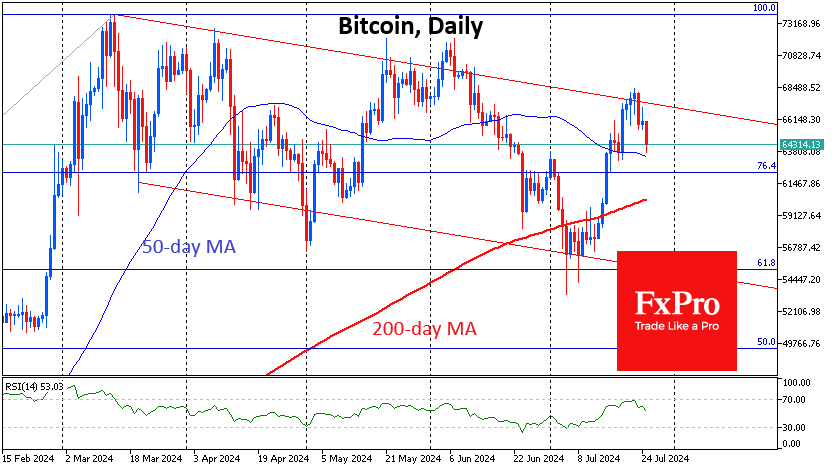

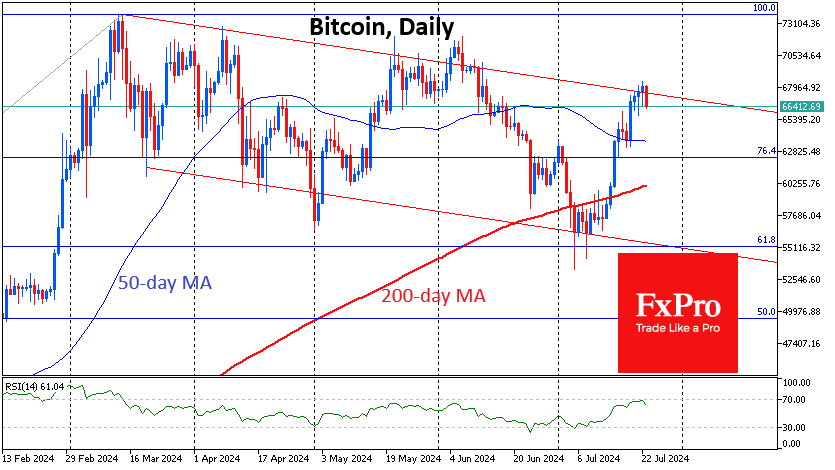

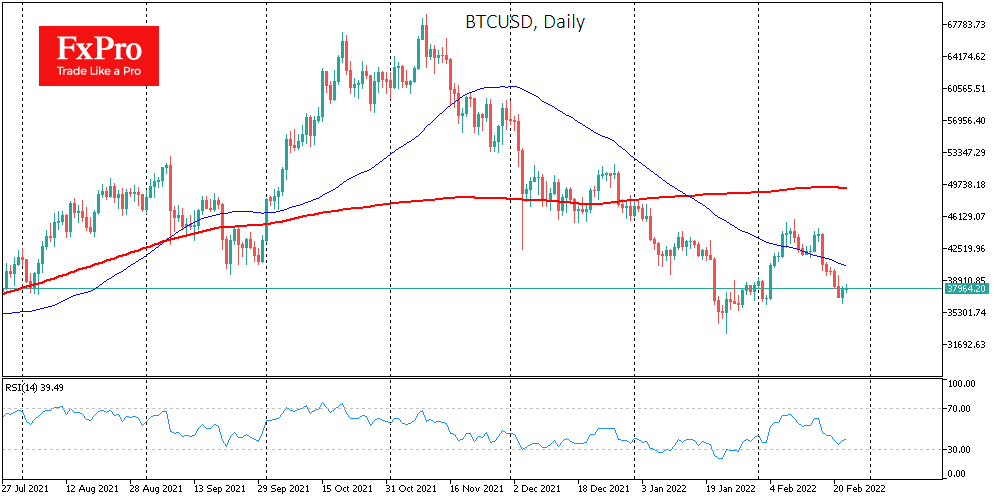

So far, the rebound of risky assets, which includes cryptocurrencies, can be considered as a movement within a downtrend. Bitcoin has been trying to correct from levels close to the lows of February, but this is probably not the bottom yet.

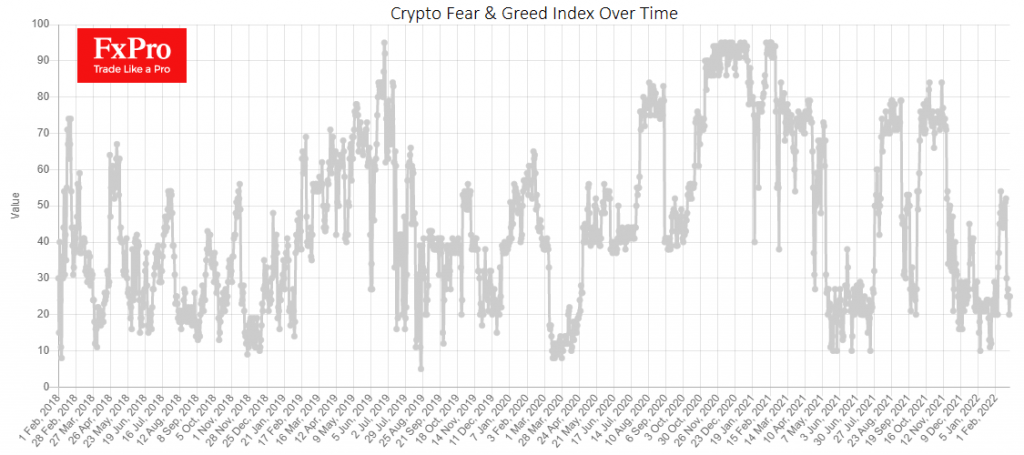

Expectations of a rate hike by the US Federal Reserve and rising geopolitical tensions are putting pressure on all risky assets. Despite the rather low levels of the Cryptocurrency Fear Index, the history of the indicator suggests that the best moments to enter were periods of falling into the 10 area.

Meanwhile, Ricardo Salinas Pliego, one of the richest Mexican billionaires, called for not selling bitcoin during the fall. In his opinion, BTC will rise in the long term.

Overall, Bitcoin is up 3.6% over the past day to $38,100, closing Tuesday higher after five days of decline. Ethereum gained 6.1% over the same time period, while other leading altcoins from the top ten showed mixed dynamics: from 4% growth in XRP to 13% in Terra.

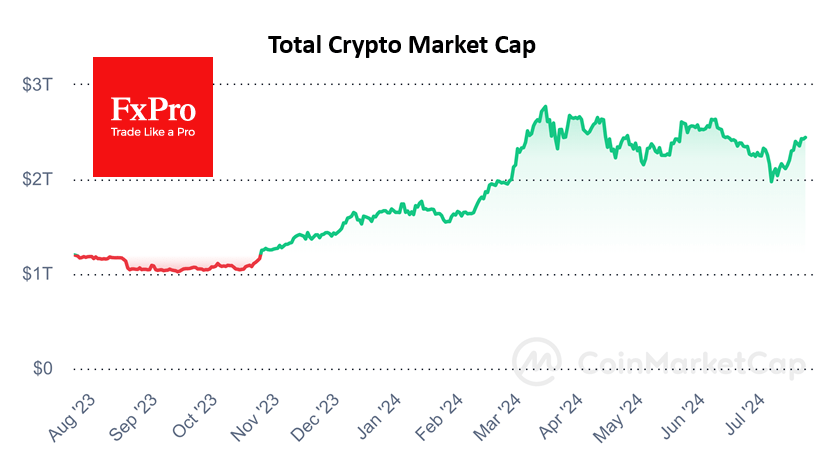

The total capitalization of the crypto market, according to CoinGecko, decreased by 1.5% over the day to $1.79 trillion. Altcoins grew worse than the first cryptocurrency, which led to an increase in the Bitcoin dominance index by 0.4%, to 40.3%.

The index of fear and greed turned back again, losing 5 points to 25 and remaining in a state of “extreme fear”.

The FxPro Analyst Team