FOMC meeting and Christmas will take crypto off pause

December 13, 2021 @ 17:36 +03:00

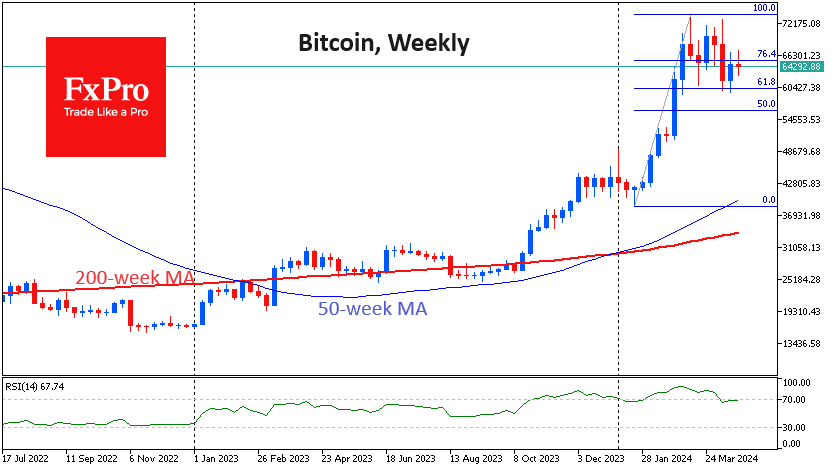

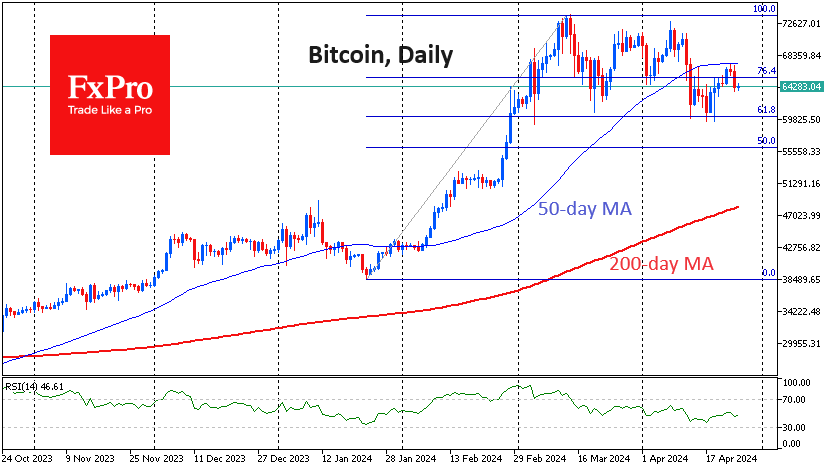

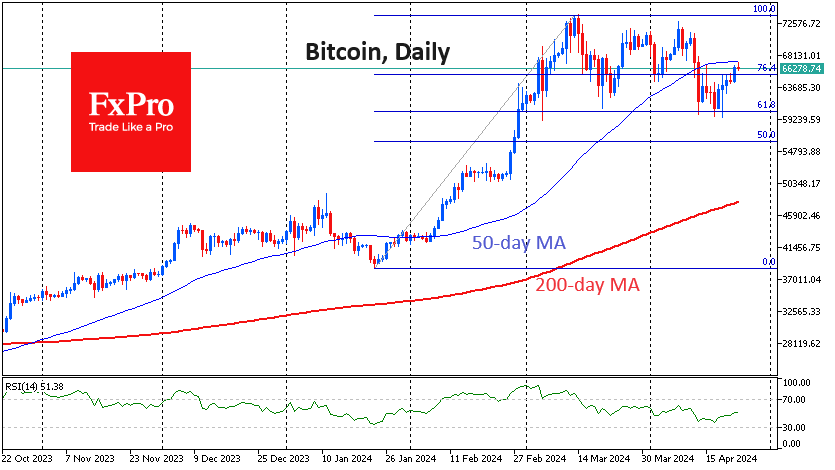

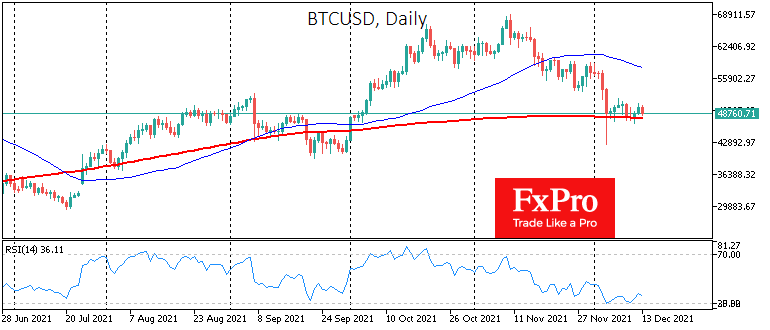

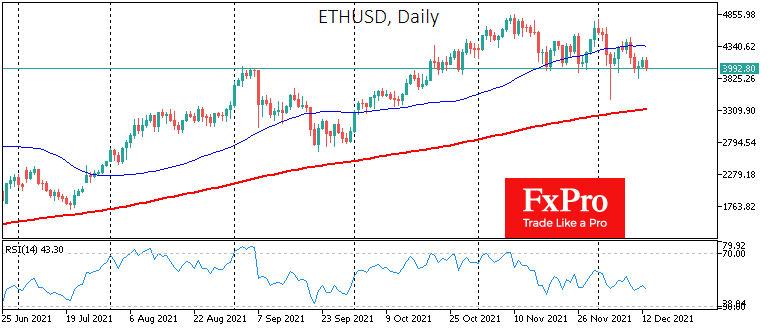

Cryptocurrencies avoided strong moves over the weekend. Bitcoin failed to significantly move away from its 200-day moving average and Ether from the $4000, leaving short-term traders in limbo.

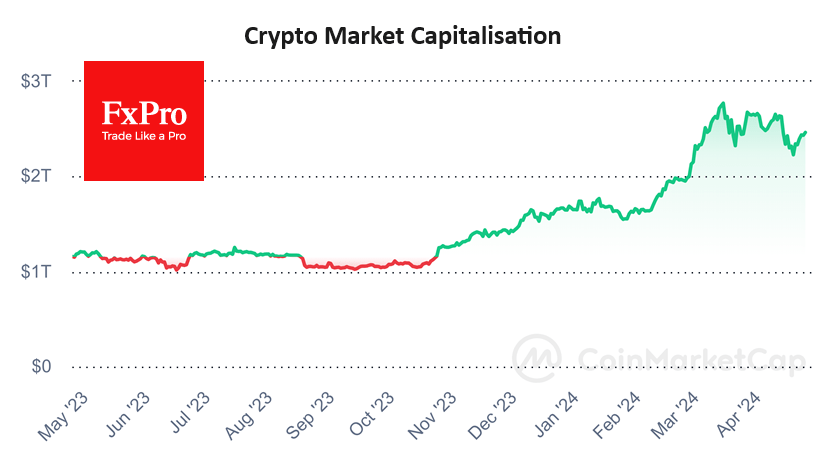

The capitalisation of all cryptocurrencies has barely changed in the past 24 hours, remaining at 2.26 trillion. The cryptocurrency Fear and Greed Index is gradually recovering, rising to 28 (fear) against a low of 16 on Saturday morning. But as we can see, the state of extreme fear has not pushed key coins over the red lines.

Bitcoin saw demand last week on intraday declines below $48K. Buyer’s support prevented it from getting below a critical technical level. But we are alarmed that the bulls managed to push the rate only slightly higher. If the bulls surrender this defensive line, a mighty avalanche of liquidation of marginal long positions is likely. If that happens, we expect volatility to spike to a magnitude like what we saw on the first Saturday in December and earlier in September and May.

ETHUSD is hovering around $4000, and bounces from that level are getting lower in December. So far, Ether has withstood the sellers’ onslaught, defending the round level and the September highs area. However, a fifth consecutive week of declines is lousy publicity for cryptocurrencies. The key demand drivers are still speculative expectations of price growth rather than company performance as in shares.

Investors in the two major cryptocurrency coins have paused to assess the situation. They are waiting for meaningful signals for a continued bullish trend or the start of a bear market. The markets seem to be lacking new drivers for a strong bullish rally in the major cryptos. This week, financial market attention will be focus on the Fed meeting, and cryptocurrencies could come off pause if the Central Bank’s comments elicit an unequivocal market reaction. Investors should also note that Bitcoin often makes strong moves around Christmas.

The FxPro Analyst Team