Crypto-winter is coming. Again

November 25, 2019 @ 16:33 +03:00

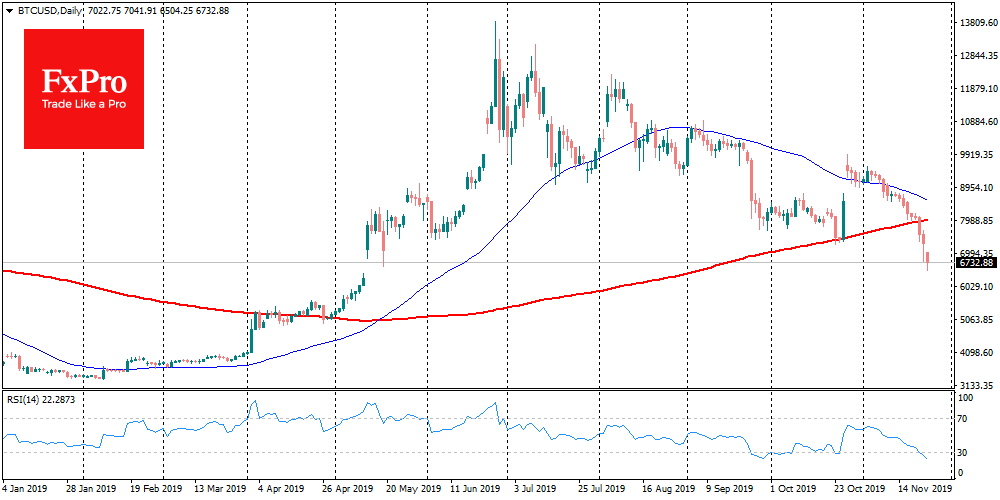

Black Friday turned into a bloody Monday for Bitcoin and the whole market of cryptocurrencies in general. In just four days, Bitcoin lost $1,300 or 16% in price and traded around $6,700 at the time of writing. The total capitalization of the crypto market for the same period dropped by $37 billion. Thus, everything that is happening at the moment strongly recalls the events of last November, when the market was in decline, bottomed around $3K for Bitcoin. The input data were also similar: a series of long sideways trends and almost each of them ended with a decline.

Among the main factors are still Asian sell-off impulse, the maximum of Bakkt platform at the level of $20.3 million on Friday, the bearish signal from miners, fatigue from consecutive, leading nowhere sideways trends and hollowness of the growth impulse itself after the statement of the head of China. If there was no Chinese FOMO, we could have seen the market collapse much earlier, but the scale could have been smaller.

What will happen to Bitcoin if miners start to turn off their ASICs massively? Nothing special will happen, as the network difficulty will begin to adjust. The system is designed to find a balance in such cases. The miners’ capitulation was terrible for the market because the mined coins are beginning to be sold to “stay in business”. This process is somewhat fleeting, and the sooner the market squeezes out the weaker players, the closer the recovery.

A sharp drop below $7K opens the door for testing new lows closer to the lower boundary of $6K. The index of greed and fear turned out to be in the “Extreme Fear” mode at the level of 17, which indicates the panic moods among market participants. At the same time, if the current $6,700 will turn out to be a severe level of support, buyers will start to enter the market. And the same institutional investors who can be partially guilty of the market collapse on Friday now can support the market. However, this will be possible only if Bitcoin can stand by the current levels for some time.

The current market crash was even stronger because of the misguided hopes for halving. Instead of a massive rally, we got an understanding that we can be at the end of the rally within the broad bear market, and the crypto winter wasn’t over, but only interrupted by abnormal warming. Also, the assumption that the current composition of crypto market participants is sensitively listening to the demands of the crypto community and creates precisely the opposite dynamics may be confirmed.

The FxPro Analyst Team