Market picture

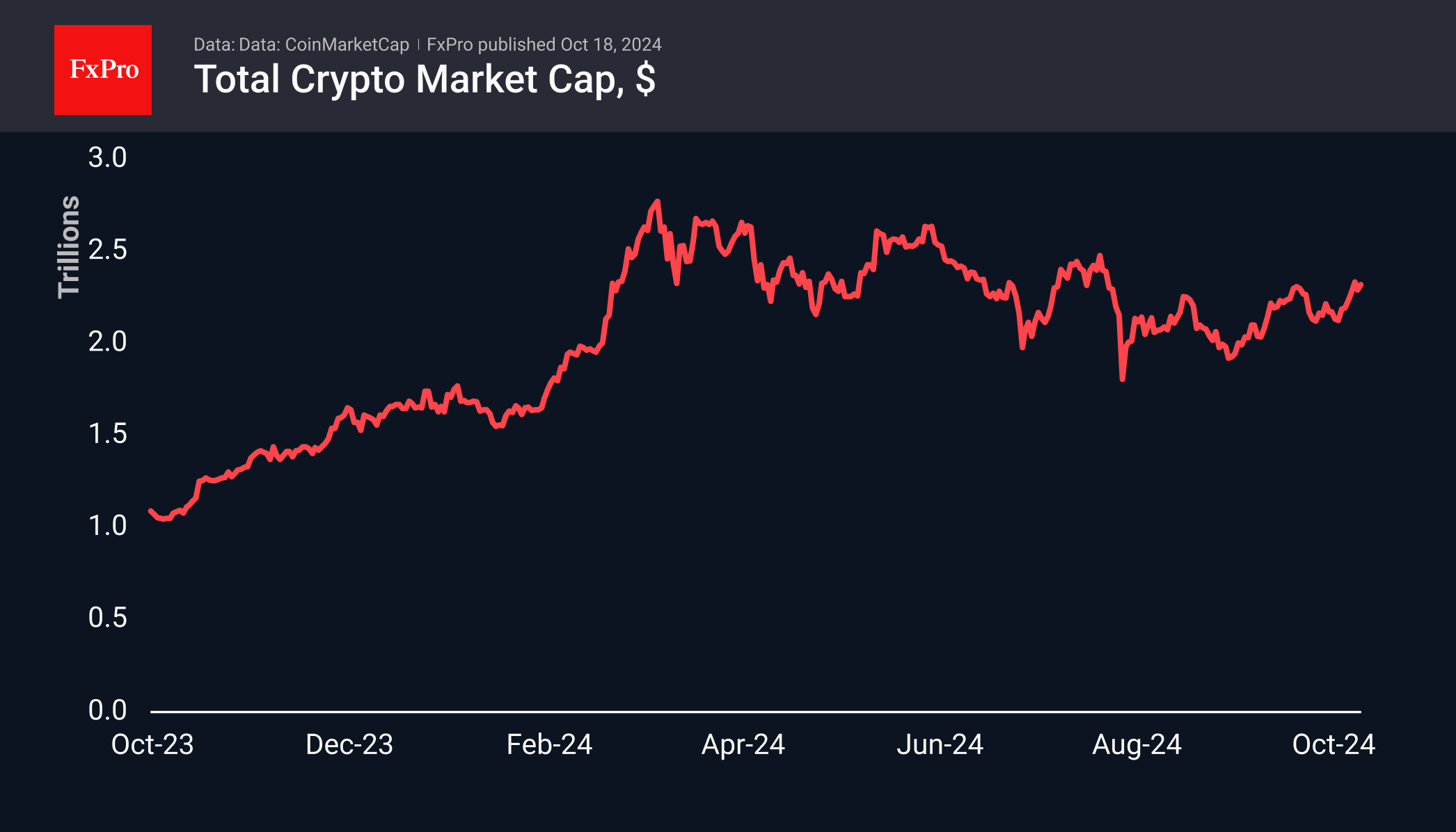

The crypto market has gained around 8% over the past seven days, stabilising near $2.30 trillion over this week and reaching a capitalisation of $2.32 trillion at the time of writing on Friday. The sentiment index is firmly in greed territory at 73. This is the highest level of optimism since late July and contrasts sharply with fear (32) a week earlier.

Bitcoin has gained over 12% in the last week, making two attempts to break through the $68 thousand level. In our view, the bulls in bitcoin already showed their strength on Monday, as they took the price above the 200-day MA in one fell swoop, breaking through the previous highs and the upper boundary of the multi-month descending channel. The next growth target looks to be the $71-73K area, where strong resistance and historical highs from March are concentrated.

News Background

CryptoQuant notes that bitcoin inventories on centralised crypto exchanges have fallen to multi-year lows. More than 51,000 BTC were withdrawn from major trading platforms last month.

QCP Capital recorded purchases of March call options on Bitcoin with an exercise price of $120K. The purchases were accompanied by a rise in quotes above $68K, which analysts saw as a sign of the return of bullish long-term buyers.

According to a16z crypto estimates, there are about 617 million cryptocurrency owners and 30-60 million monthly active users, excluding bots and temporary addresses. However, only 5-10% of users can be considered active, highlighting the huge opportunity to attract passive cryptocurrency holders.

The Block estimates that the total revenue of users staking Ethereum has fallen by around 30% from its peak in March due to a drop in the network activity.

Ethereum co-founder Vitalik Buterin sees the network’s most pressing problem as the lack of a unified ecosystem. According to him, the space built around the protocol is now more like 34 different blockchains.

The FxPro Analyst Team