Crypto feels power

October 02, 2023 @ 12:04 +03:00

Market picture

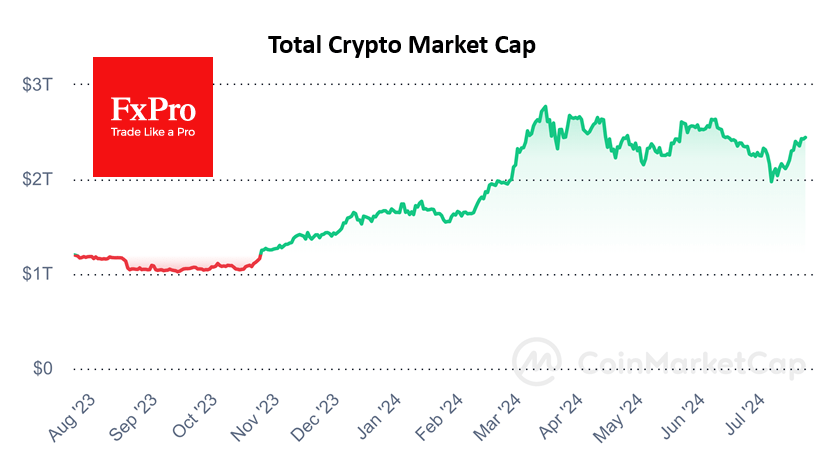

The crypto market capitalisation has risen over 2.7% in the last 24 hours to over $1.11 trillion, a level not seen since mid-August.

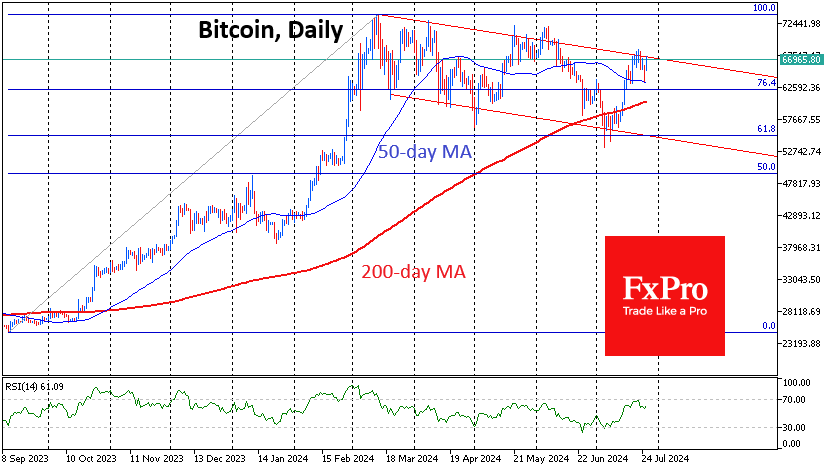

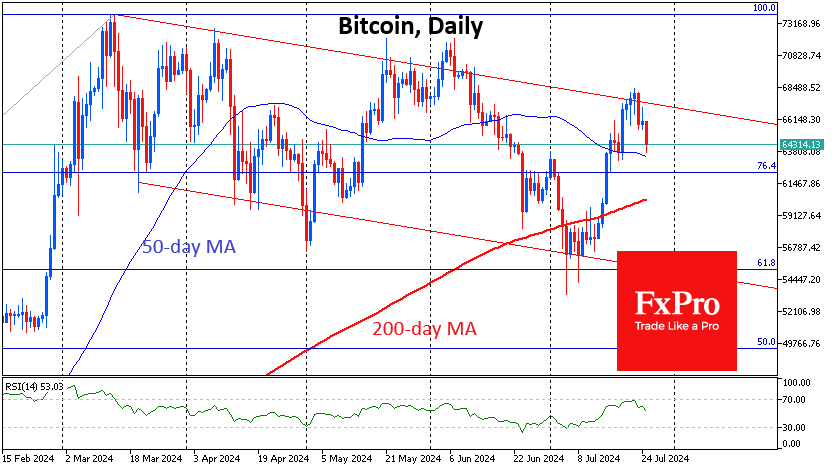

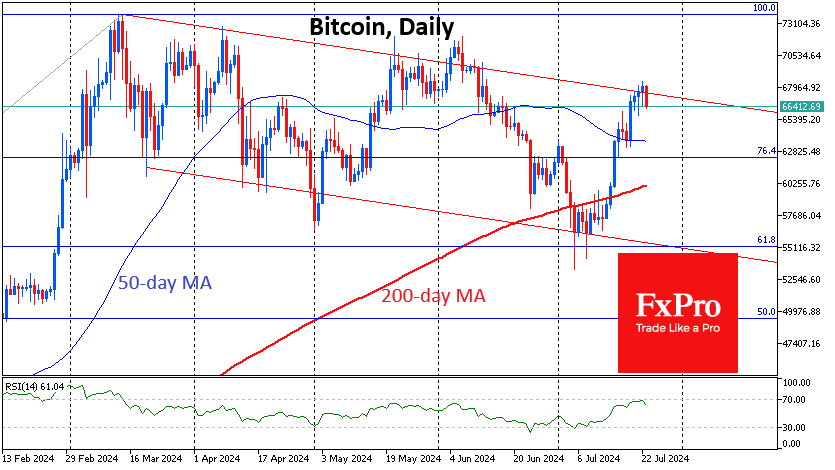

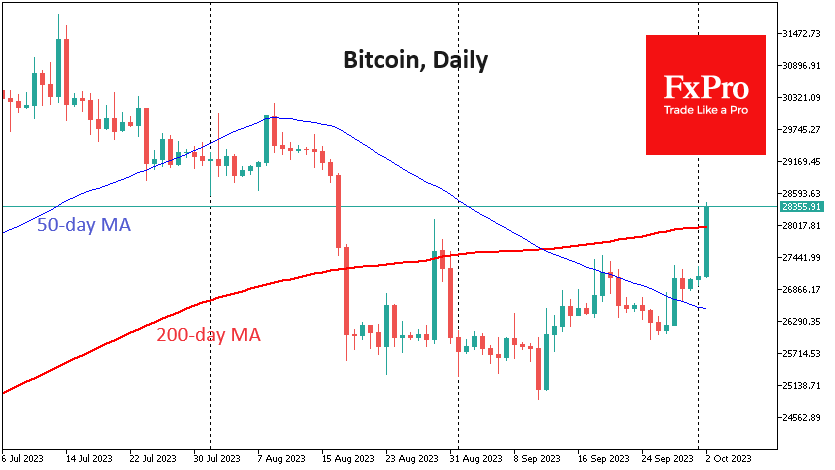

Bitcoin managed to hold above its 50-day moving average over the weekend, which it surpassed in a strong move on the 28th of September. BTCUSD surged over $1000 with a 4% gain, hitting a 7-week high of $28.3K. Contrary to the upward momentum at the end of last week, the intraday rally may be too stretched for now. After a long march, the price touched the technically and emotionally important 200-day moving average (currently $28K). There is a risk that we could see a repeat of the August 29 reversal to the downside. But that’s a risk, not the main scenario.

Bitcoin ended September up 4.1% at $27.1K, bucking the seasonal trend of the worst month of the year, which was hard to expect in an environment of a rising dollar and a falling S&P 500. Over the past 12 years, bitcoin has ended October higher on eight occasions. The average gain was 29.6%, and the average loss was 15.2%.

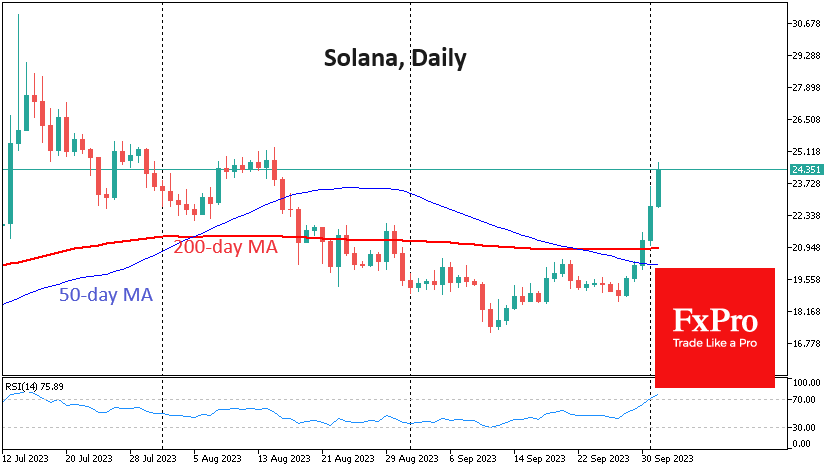

Solana rose 30%, rallying for the fifth day in a row and reaching its highest level since August 15th. On Sunday, it broke through the 50 and 200-day averages and continued to rise on Sunday and Monday. If Bitcoin has once again become an indicator of risk sentiment for global markets, has Solana become a leading indicator for Bitcoin?

News Background

Asset management company VanEck announced the launch of the Ethereum Strategy ETF. The actively managed ETF will be based on CFTC-regulated Ethereum-based settlement futures. The new instrument is similar to the firm’s other product, the Bitcoin Strategy ETF (XBTF), which will launch in November 2021.

The team behind the newly launched crypto exchange, CommEX, includes former Binance employees who helped develop the platform, the company said in an open letter. CommEX did not name the beneficiaries, saying they “prefer to remain undisclosed persons”.

The FxPro Analyst Team