Constricted Bitcoin Corridor Signals a Volatility Boom

August 29, 2023 @ 11:37 +03:00

Market picture

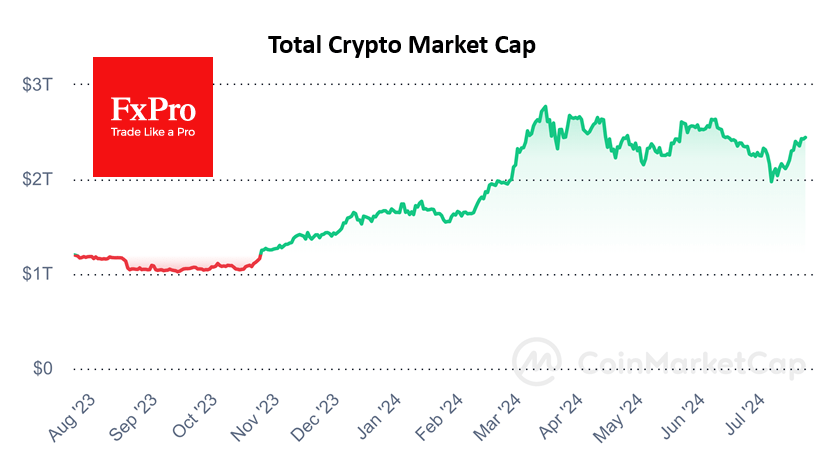

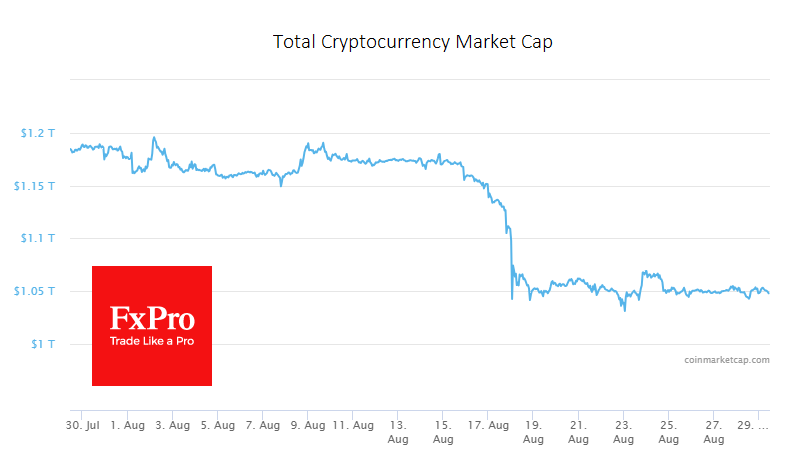

The crypto market continues to trade in a 0.3% range around the $1.05 trillion capitalisation level. Despite some improvement in risk sentiment, sellers got the upper hand on the approach of the 1.06 trillion level.

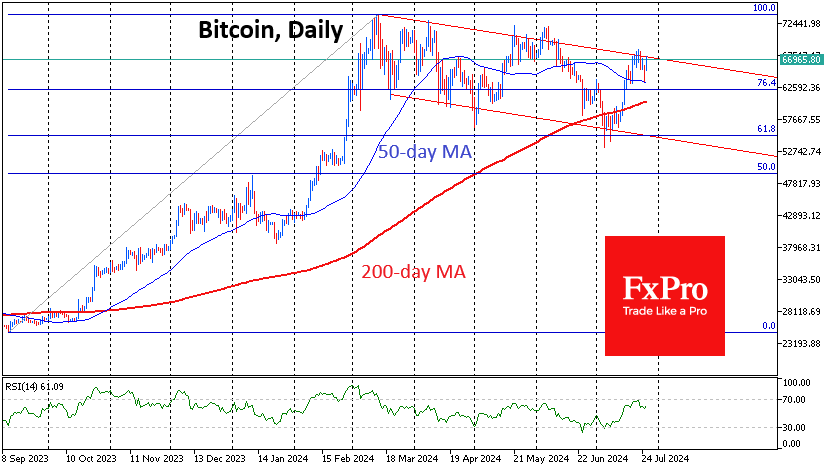

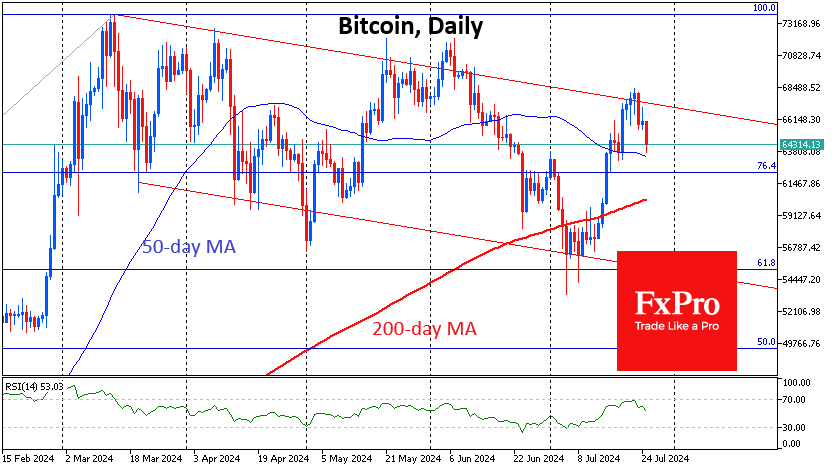

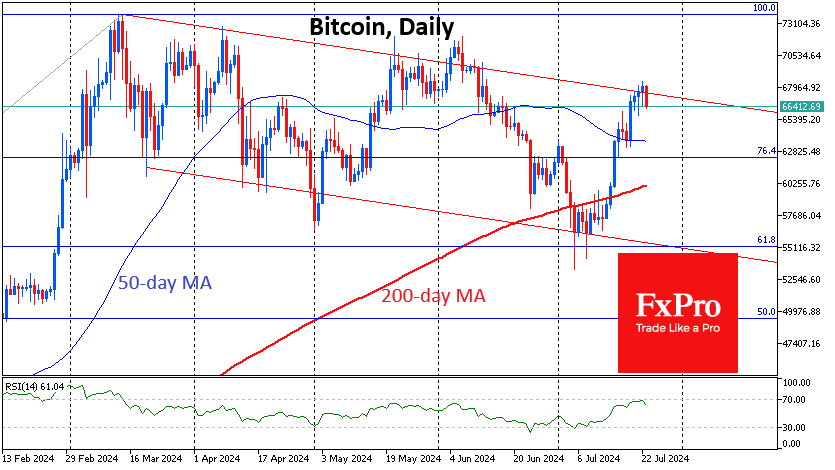

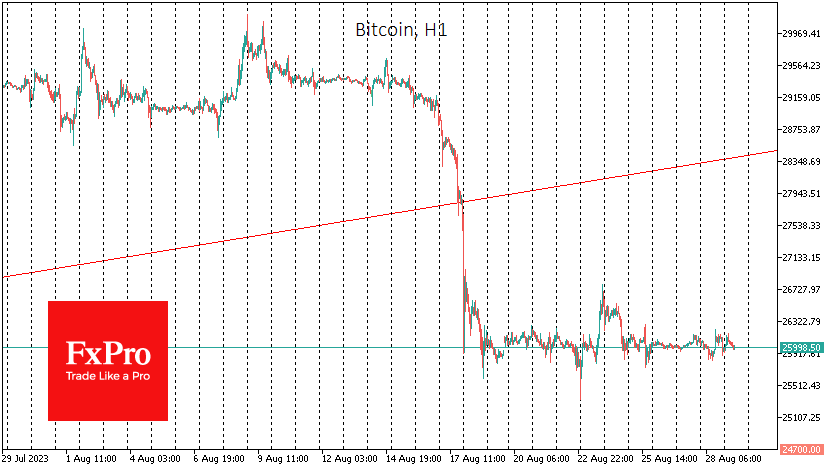

The narrow range has also become a hallmark of Bitcoin, which has been walking on a short leash of around $26K for the past eleven days. Such a lull usually ends with a boom in volatility, which is what we should expect this week.

Bitcoin’s tera hash profit margin has reached historic lows as the price has fallen, and the network’s hash rate has risen as more efficient ASICs went to work. Without a rise in the BTC exchange rate, miners’ operations will soon become unprofitable.

News background

Arkham Intelligence says the Robinhood platform holds over $3 billion worth of BTC, making it the third largest Bitcoin holder after Binance (6.4B) and Bitfinex (4.3B).

Due to extreme heat and drought, Laos has imposed temporary restrictions on cryptocurrency mining. These factors have led to an increase in demand for electricity.

Approximately 16 trillion PEPE meme tokens (~$15 million) were illegally withdrawn and sold on various cryptocurrency exchanges. Pepe’s remaining developer revealed that three former project team members were behind the theft.

Shibarium, the second-tier solution from meme token creators Shiba Inu (SHIB), resumed withdrawals via the Ethereum Bridge after a prolonged malfunction during the launch.

The FxPro Analyst Team