Challenging March for Bitcoin

March 01, 2023 @ 11:34 +03:00

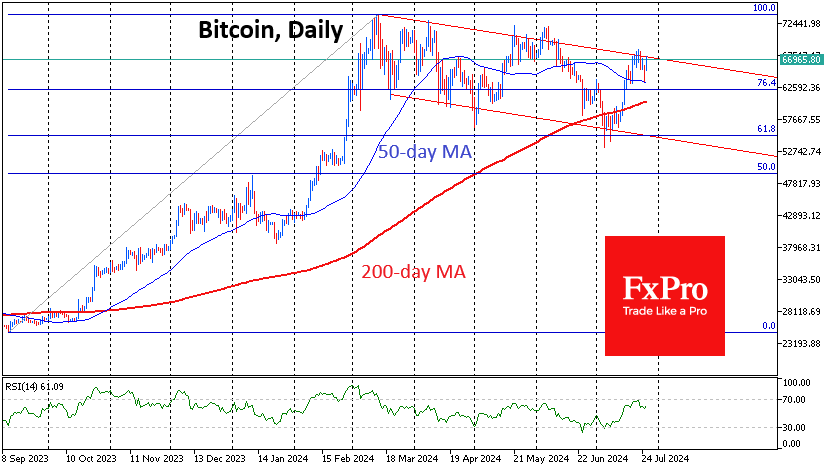

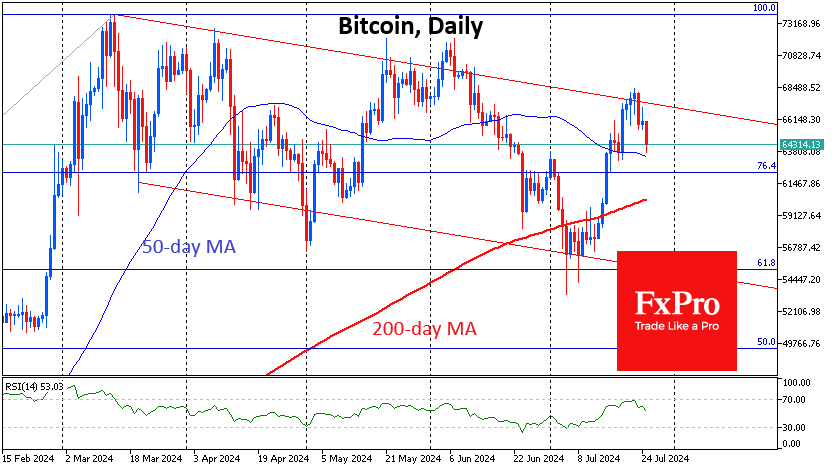

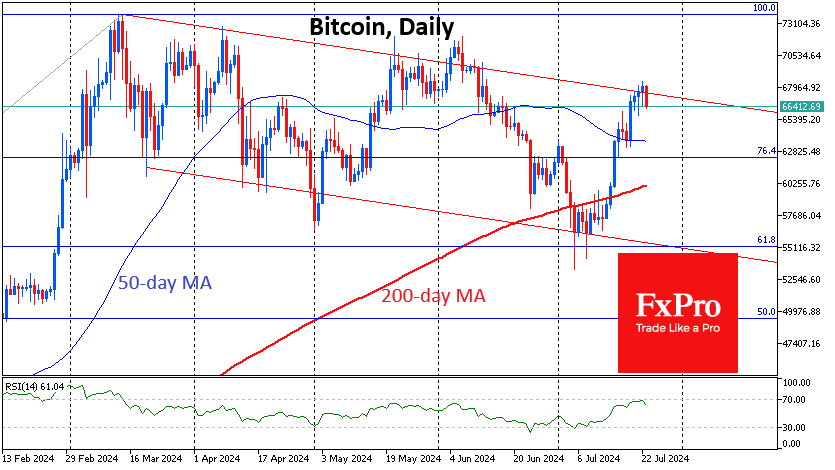

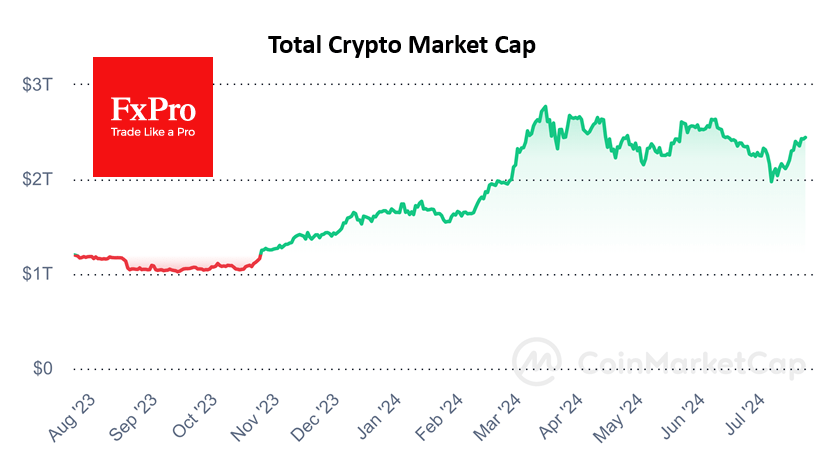

Market picture

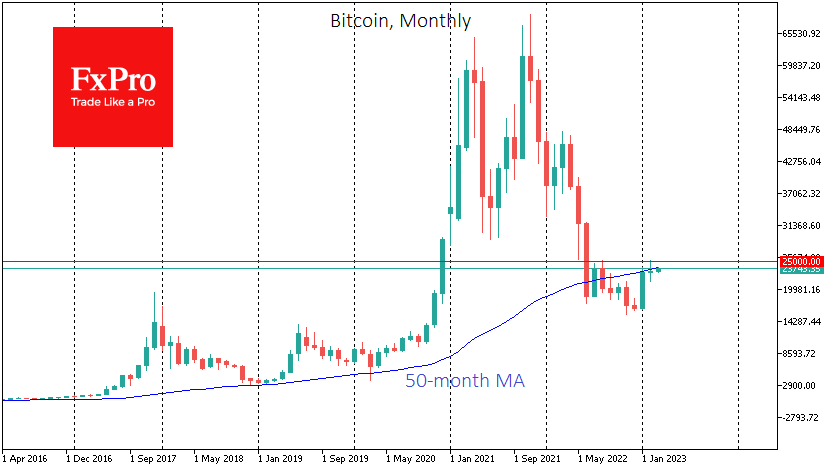

Bitcoin ended February slightly higher (+0.9%, to $23,200). March is off to a buying start, pushing the price up to $23.7K at the time of writing.

March is considered an unpromising month of the year for the top cryptocurrency, having fallen in eight of the last 12 years with an average decline of about 15%, an average gain of 16%.

The strong growth momentum in January and the renewal of local highs in February suggest that the bulls prevail. At the same time, the technical picture on the weekly timeframe suggests that only a consolidation above $25K will strengthen the bullish view of the market.

Bernstein noted that cryptocurrencies’ correlation with the US stock market and macroeconomic events is weakening amid BTC’s current flat move, which is a bullish signal.

News background

Ethereum developers have completed the Shanghai-Capella (Shapella) hard fork on the Sepolia test network. An update to the second cryptocurrency’s main network should occur as early as March. The main change after the update will be the ability to withdraw ETH from stakes.

Reuters reported that payment giants Visa and MasterCard had put plans for cryptocurrency integration on hold after a series of bankruptcies rocked the industry in 2022. The payment companies want to wait for market conditions and the regulatory environment to improve.

Coinbase, the largest US cryptocurrency exchange by trading volume, issued a notice of impending delisting of the Binance USD stablecoin. Investors began withdrawing funds from BUSD in early February after Paxos announced it would stop issuing the stablecoin under pressure from US authorities.

The Tel Aviv Stock Exchange is set to launch cryptocurrency trading. One of the largest local banks, Leumi Bank, has also agreed to start trading digital assets.

The FxPro Analyst Team