Broad growth of the crypto market

July 20, 2023 @ 16:48 +03:00

Market picture

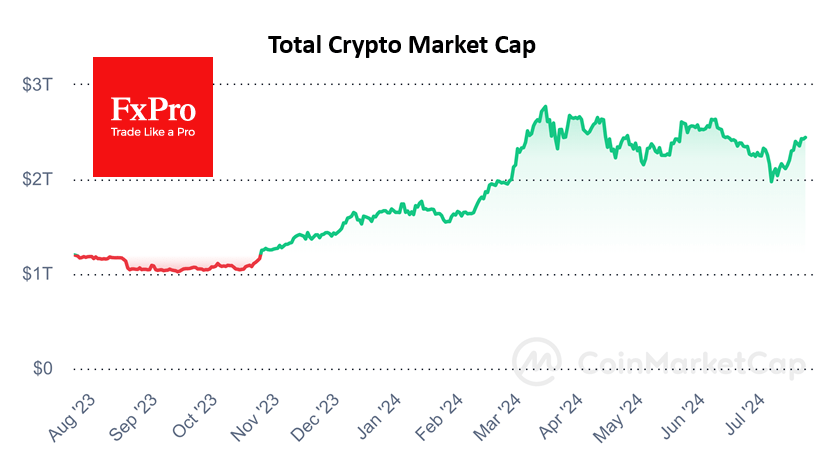

Crypto market capitalisation reached 1.218 trillion, up 1.1% in the last 24 hours. Altcoins are growing across the board. Although the momentum is far from euphoric, it is more like interest in the market. And this is particularly attractive as equity indices have lost ground over the past 24 hours.

The big question in the short term is whether we’re seeing a reallocation of interest towards the riskier part (crypto vs stocks) or a delayed reaction (Nasdaq hit highs since January 2022 on Wednesday).

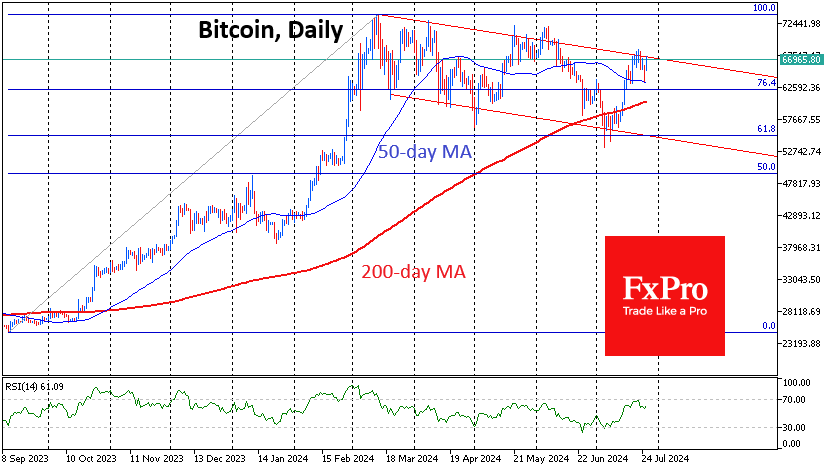

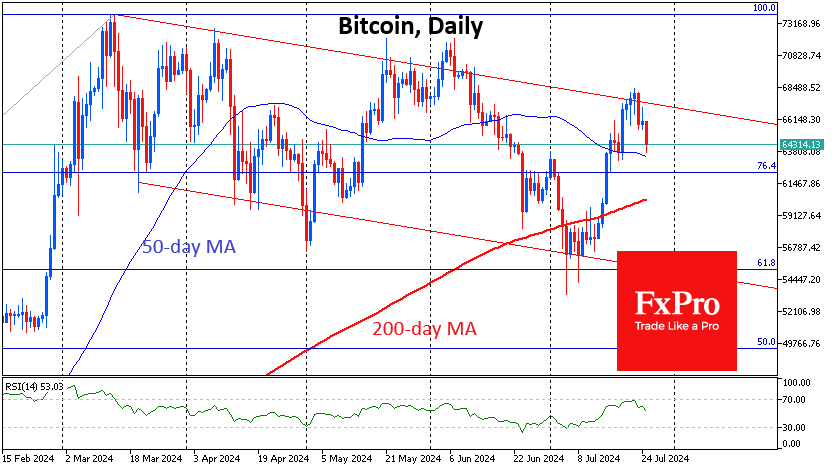

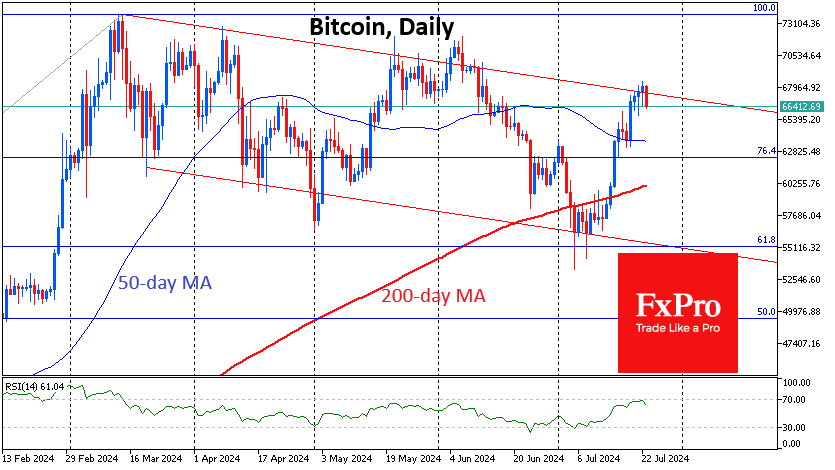

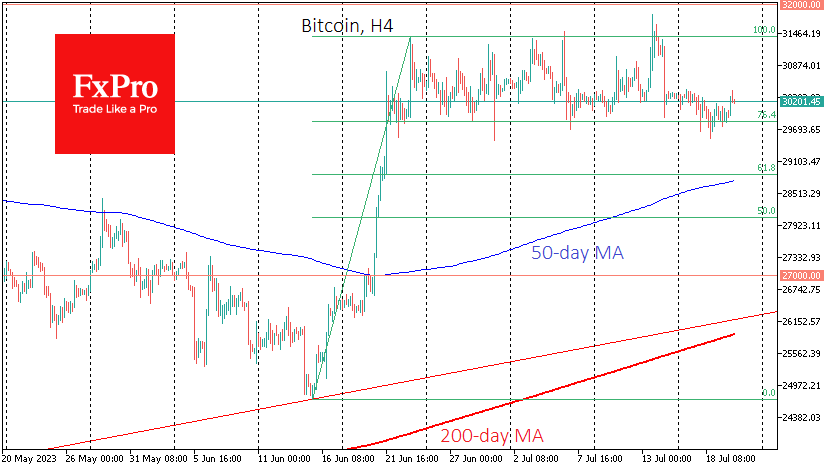

Bitcoin continued to find support on Wednesday on dips below $30K, returning to the range of the last four weeks. A move to the upper boundary at $31.3K is most likely in this environment. At the same time, medium-term traders should pay more attention to the price dynamics at the boundaries of the range between $29.8 and $31.3 an ounce. A break above these boundaries will greatly increase the chances of a continuation in the breakout direction.

News background

The main sellers of BTC in recent days have been short-term investors, Glassnode notes. They have been preparing to take profits for several weeks. Long-term investors who have held the cryptocurrency for more than 12 months are in no hurry to join the sellers.

At the end of June, miners sent a record $128 million worth of bitcoins to trading platforms – 315% of their daily production.

The US stock exchange Nasdaq has abandoned plans to launch a crypto asset storage service due to “regulatory risks” in the US. The launch had been announced for the end of the year’s first half.

Ethereum blockchain co-founder Vitalik Buterin discussed implementing account abstraction in the ETH network. He said, this feature can attract a billion users to the Ethereum network, but its implementation has some problems.

The FxPro Analyst Team