Bitcoin’s continued collapse and furnace of fire for the crypto periphery

June 15, 2022 @ 10:27 +03:00

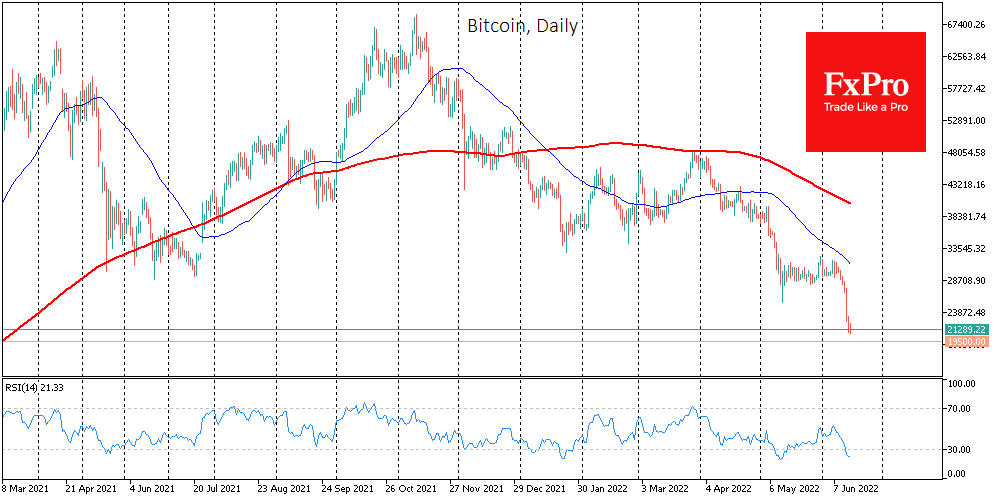

Bitcoin was down 5.7% on Tuesday, ending the day at around $22K. The decline picked up on Wednesday morning, taking another 3.3% off the price to $21K, declining for the eighth consecutive day and losing 30% in seven days.

Ethereum lost 8.1% in 24 hours and 38% in a week. Leading altcoins in the top ten are losing between 2% (Polkadot) and 9.6% (Dogecoin).

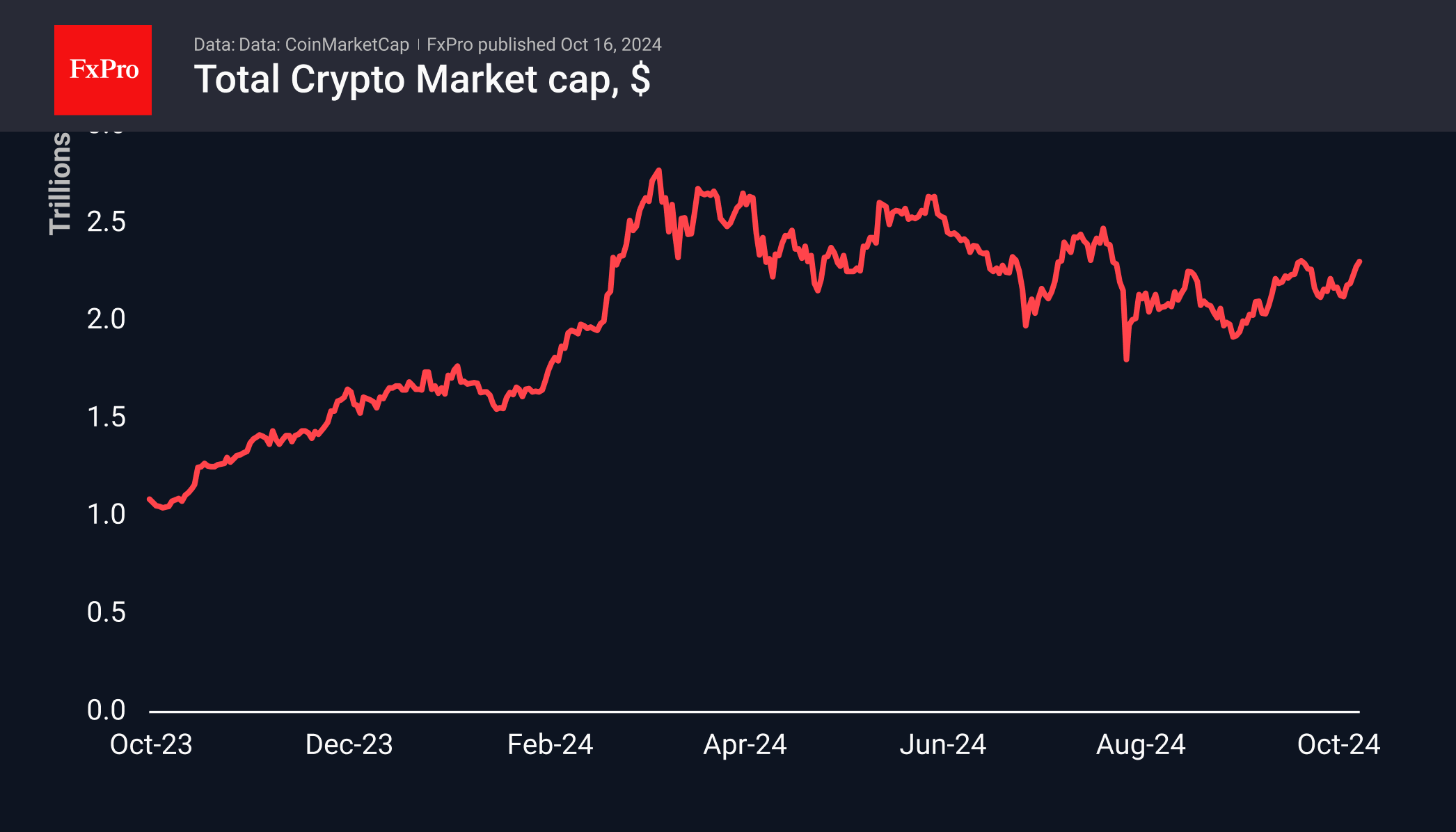

Total cryptocurrency market capitalisation, according to CoinMarketCap, sank 6.4% overnight to $898bn. The Cryptocurrency Fear and Greed Index was down 1 point by Wednesday, to 7, which last was in March 2020.

Concerns around a sharp tightening of monetary policy are weighing on financial markets and are trickling down into cryptocurrencies through their influence on large institutional investors. It is not surprising that Bitcoin and Ether are dragging the entire cryptocurrency market down in such an environment.

According to CoinShares, institutional investors withdrew $102 million from cryptocurrencies last week amid expectations of a tightening of monetary policy by the US Federal Reserve. The US regulator’s two-day meeting results will be announced today.

BitMEX founder Arthur Hayes fears that the market has not yet hit rock bottom, and we could see a massive sell-off in cryptocurrencies if bitcoin falls below $20,000. Galaxy Digital head Mike Novogratz is convinced that bitcoin is close to the “bottom” and will hold above $20,000.

We believe Bitcoin may be close to its bottom, but it could take months until the next rally. During those months, the entire crypto industry will probably go through a furnace of fire, as we saw with Terra (Luna), and is now happening with Celsius. Stablecoins continue to be tested, and USDD being below parity with USD for the third day tells us that history with USDT (stable tied to Luna) could repeat itself several times.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks