Bitcoin whale activity has fallen to the lowest

March 18, 2022 @ 14:02 +03:00

Bitcoin is down 0.4% over the past 24 hours to $40.7K. Ethereum has added 1.5% over the same time, other leading altcoins from the top ten are changing from -2.0% (Terra) to 5% (Avalanche).

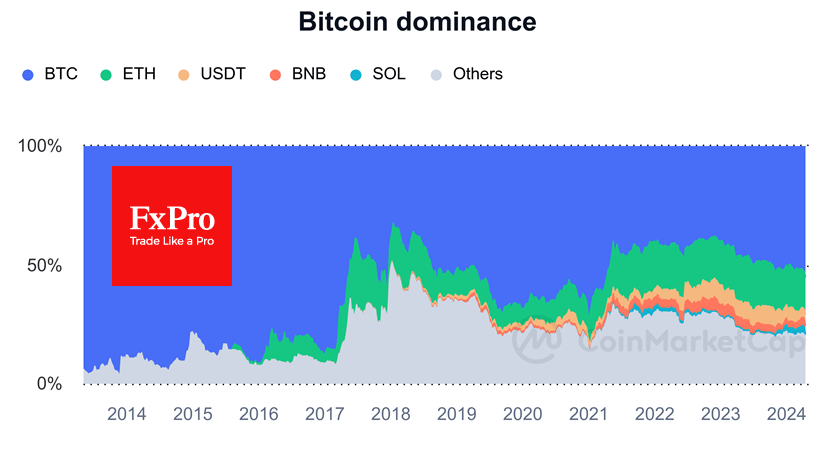

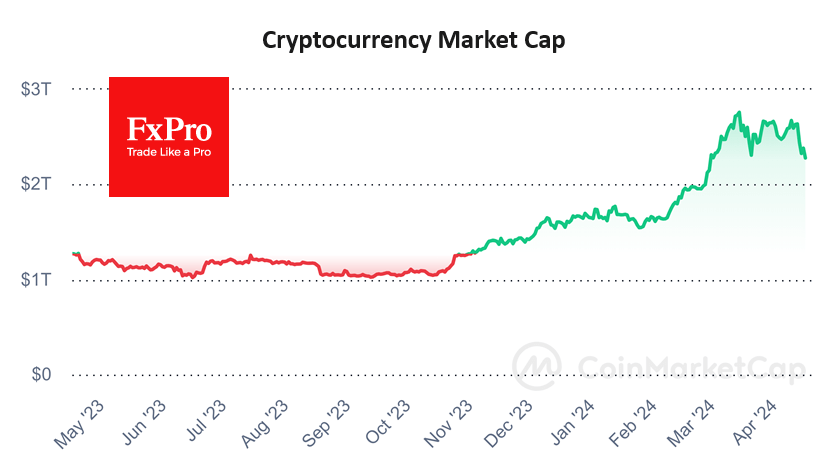

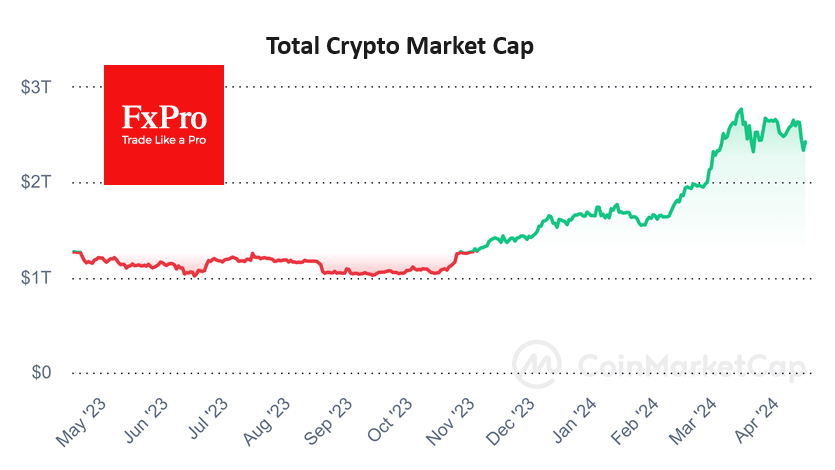

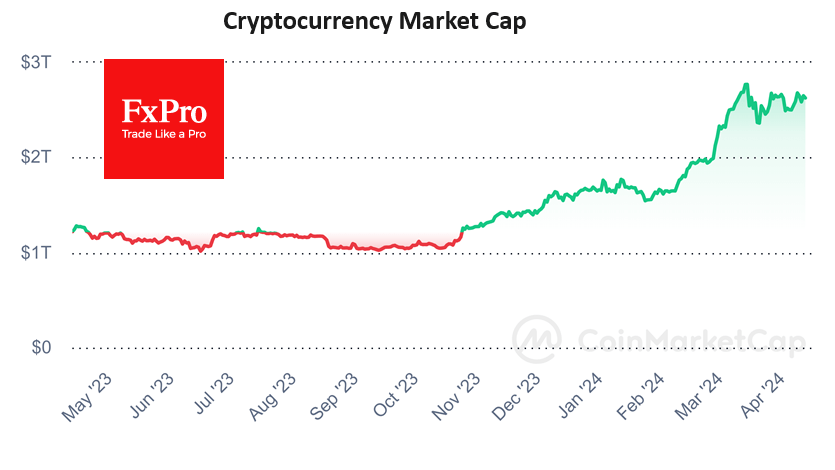

The total capitalization of the crypto market, according to CoinMarketCap, grew by 0.3% over the day, to $1.83 trillion. The Bitcoin dominance index decreased by 0.4% to 42.4% due to the better dynamics of altcoins.

The crypto-currency index of fear and greed lost 2 points to 25 in a day and again found itself in a state of “extreme fear”.

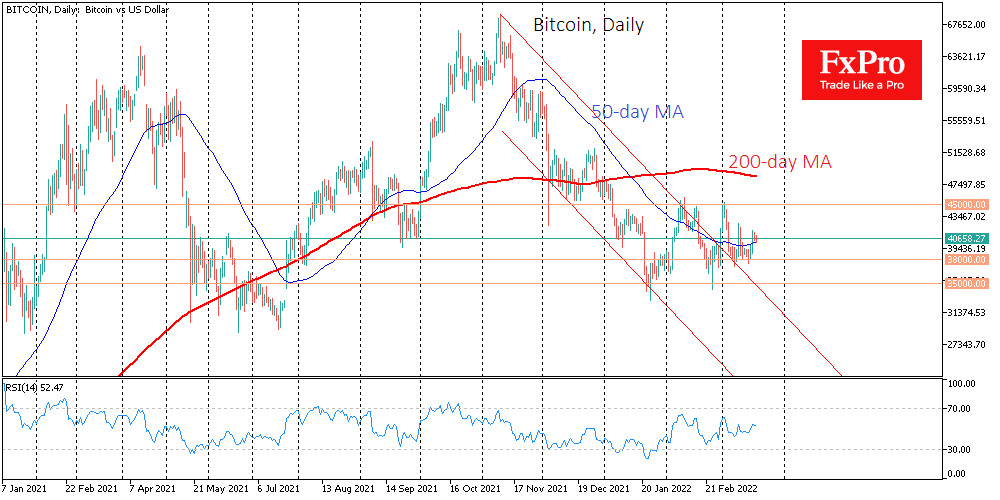

Despite the outstripping dynamics of altcoins, a sequence of lower and lower local highs continues to form in Bitcoin. In early February, the upside lost momentum as it moved above $45.5K. In the first days of March, the bears already dominated on the way to $45K, on the 8th already near $42.5K, and in the last two days, they are trying to form a downward reversal at $41.5K. At the same time, the bulls manage to form strong support near $38K.

In terms of technical analysis, BTCUSD remains close to its 50-day moving average, clearly indicating the absence of any trend now. However, consolidation in a descending triangle is usually a respite before the next decline. We will see the implementation of this scenario if BTCUSD fixes under $38K. An alternative scenario and a new upside momentum should be expected if the bulls manage to push the price above the previous highs of $42.5K, or close the day/week above $42K.

Galaxy Digital CEO Mike Novogratz, known for his bullish predictions, has unveiled a new one that sees BTC hit $500,000 in 2025.

According to the Santiment team, Bitcoin whale activity has fallen to its lowest level in a year in recent days. Therefore, one should not expect sharp movements in the market soon.

The FxPro Analyst Team