Bitcoin testing the major support again

June 08, 2021 @ 15:52 +03:00

Bitcoin is down 10% in the last 24 hours and is trading around $33,000. The entire crypto market as a whole has turned red, following the first cryptocurrency. The total capitalisation of cryptocurrencies fell by $170bn overnight.

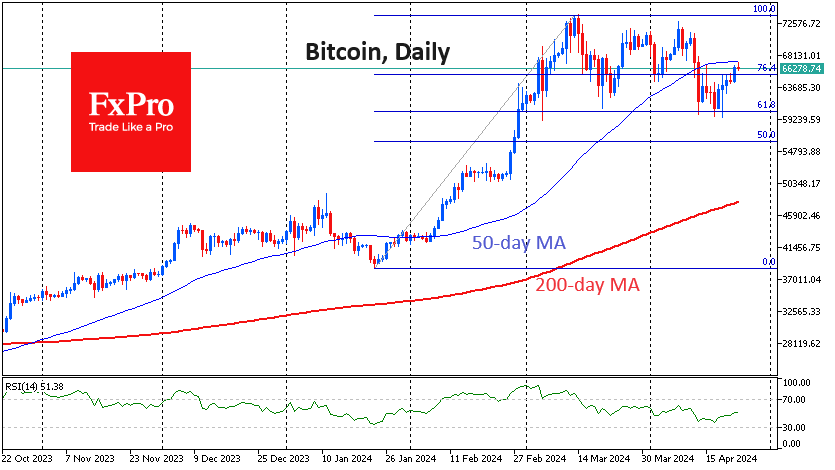

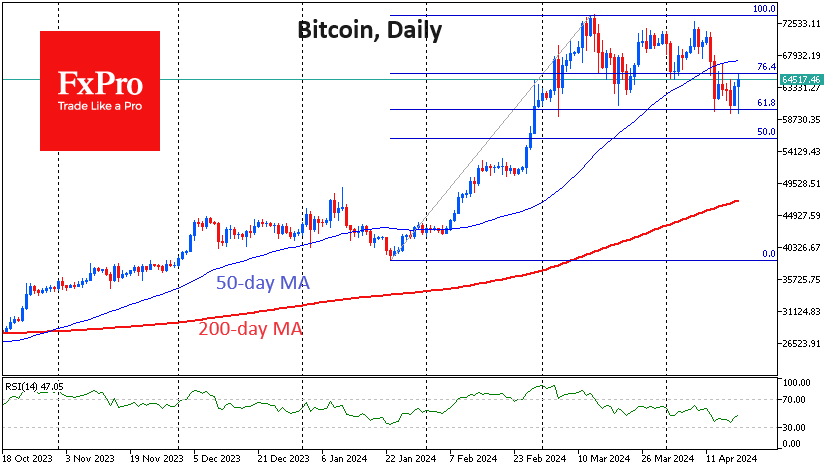

Bitcoin is once again testing support in the form of the 200-day moving average over the past month. Failure under this line could be a real surrender of the bulls.

If Bitcoin does not start attracting active buyer demand soon, the battle will go beyond $30K with a possible bearish attempt to push the coin even lower with potential targets at $23K.

The Fear & Greed Index for Bitcoin and the largest cryptocurrencies is at 13, which corresponds to the “extreme fear” mode. The RSI index for the BTCUSD pair on the daily chart is at 30, close to oversold levels. Both indicators show that there is significant room for growth. However, buyers still prefer to stay on the sidelines, which can also be seen in the reduced trading volumes.

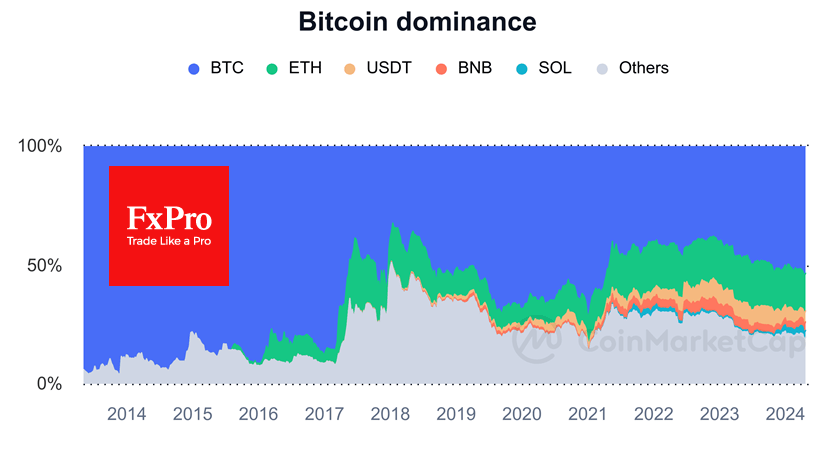

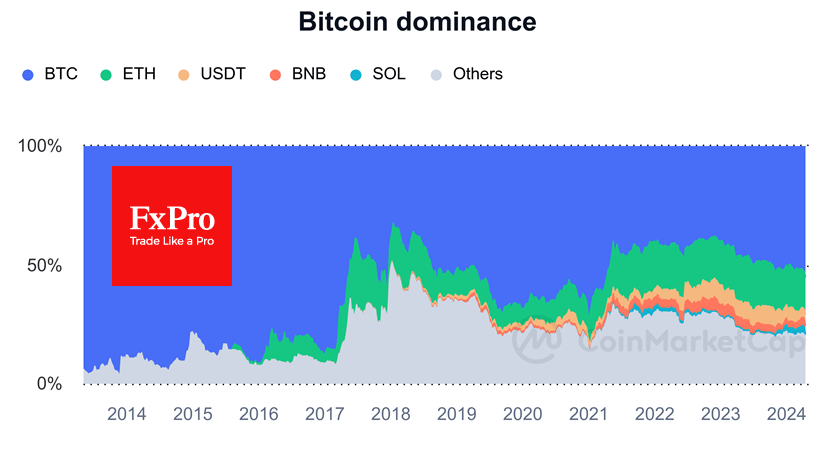

An increasingly clear split between bulls and bears is palpable in the crypto community. Bitcoin’s long inability to develop growth momentum above $40K every day is pushing more and more investors toward a wait-and-see position or even profit-taking. New buyers are in no hurry to enter the market, realizing that the risks of investing at the current stage are high, observing the uncertainty with regulation and the fall of cryptocurrencies last month.

The price dynamics in the near future may determine the medium-term trend, so market participants are especially wary now. This can be seen both in Bitcoin’s price dynamics and in the declining number of transactions and rather low daily trading volumes. The weekend showed that the retail sector is not ready to make decisions, but perhaps the institutions will help them during future business days.

The FxPro Analyst Team