Bitcoin resists equity market pressure

September 05, 2022 @ 09:49 +03:00

Market picture

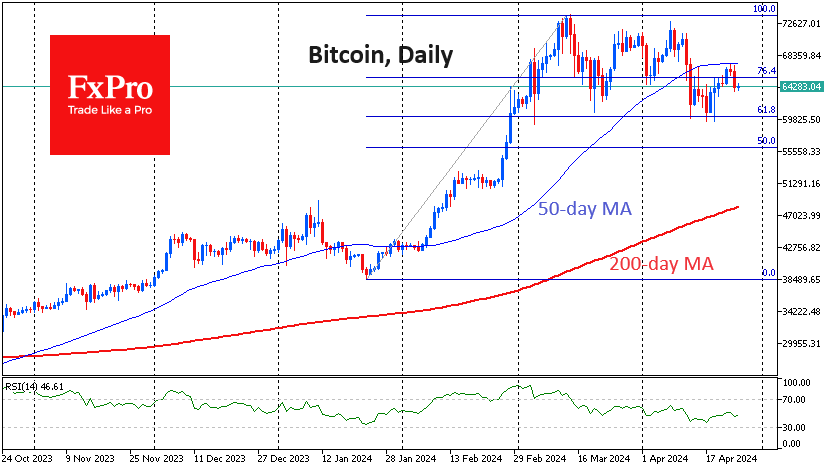

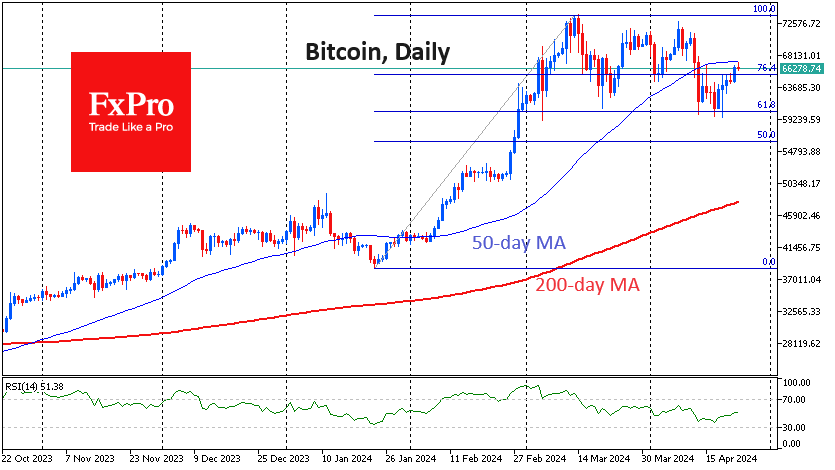

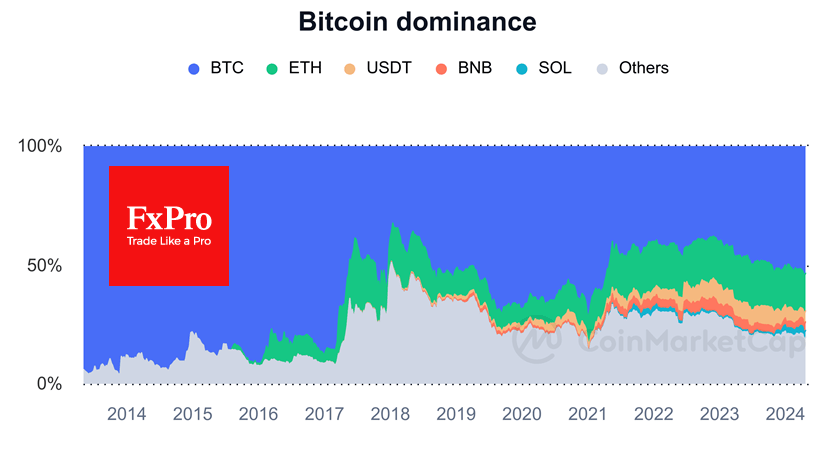

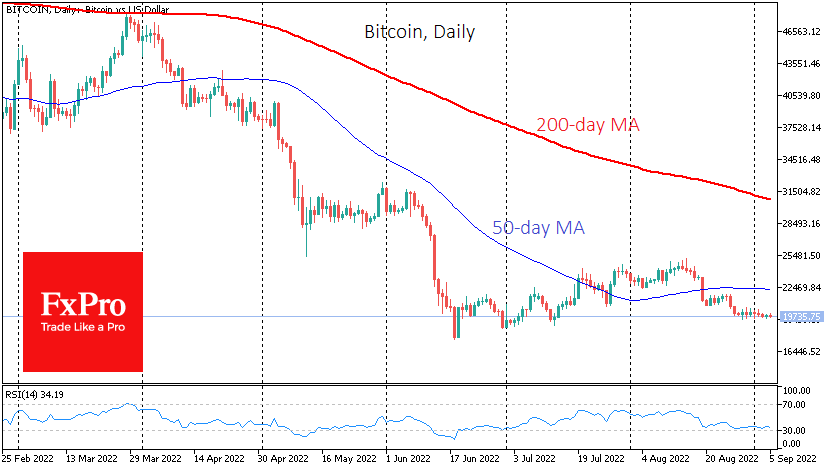

Bitcoin declined 0.4% over the past week, ending at around $19,900 without experiencing any significant movement during that time. For now, we can only say that the crypto market is wagering on the strengthening of the dollar, and to a markedly lesser extent than other markets. Ethereum added 5.9% to $1570, while other leading altcoins from the top ten showed mixed dynamics: from a decline of 1.3% (BNB) to a growth of 13% (Cardano).

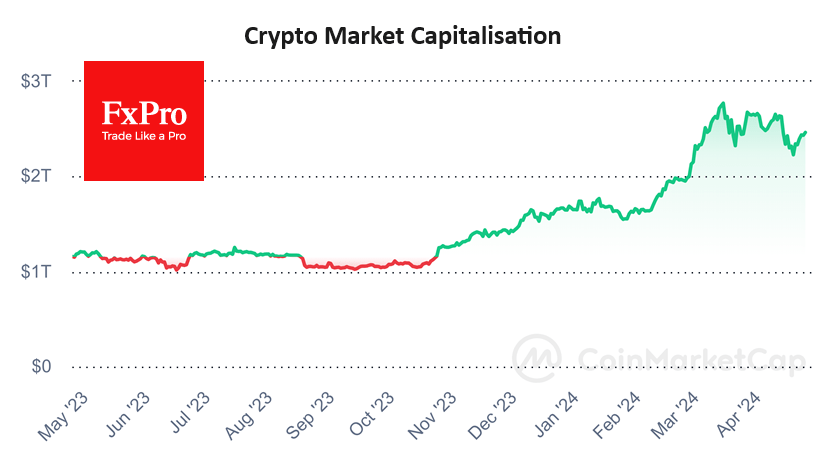

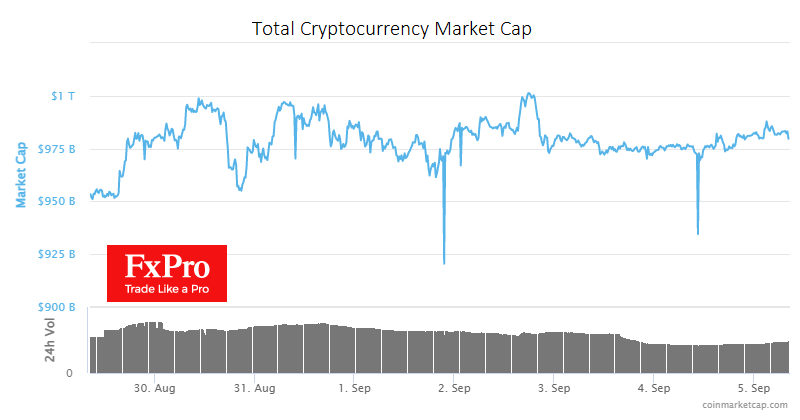

Total crypto market capitalisation, according to CoinMarketCap, rose 2.5% over the week to $976bn. The cryptocurrency Fear & Greed Index lost 8 points over the week to 20, returning to “extreme fear” status.

Bitcoin stood aloof from key market movements last week, moving on a short leash around $20K. Meanwhile, tectonic shifts were taking place in the markets as the dollar continued to renew multi-year highs and stock markets returned to a sell-off.

Cardano rose sharply at the end of the week on the back of the news. IOHK, the company behind the Cardano project, has set a date for Vasil’s update – the largest and most important hardfork in the project’s history will take place on September 22.

News background

According to analytics service TipRanks, HODLers are refusing to sell the cryptocurrency. 62% of wallets hold bitcoins for more than one year. 32% of addresses control BTC for 1 to 12 months, and only 6% of investors hold cryptocurrency for less than 30 days. At the same time, both profitable and unprofitable addresses have a 48% share.

Bitcoin miners’ revenues in August amounted to $657 million and increased for the first time since March. The growth in revenues was helped by the growth of the first cryptocurrency’s network hash rate.

Despite the crisis, investor confidence in cryptocurrencies increased slightly over the quarter. 65% of retail investors and 70% of institutional investors trust digital assets, according to a survey by cryptocurrency exchange Bitstamp.

Cryptocurrencies are helped by the aura that, in the long term, they are more promising than stocks and other risky assets, as they are at an early stage of adoption and still undervalued by the market.

Ethereum co-founder Vitalik Buterin called the current bear cycle expected. In his view, Terra’s collapse and market decline are a boon for the crypto industry, as they help identify problems and unsustainable business models well.

With the rising capitalisation of the crypto market, the DeFi sector could pose long-term risks to financial stability, according to the US Federal Reserve.

The FxPro Analyst Team