Bitcoin: it’s not the end of the rally

March 30, 2022 @ 09:38 +03:00

BTC was down 1.1% on Tuesday, ending the day near $47,400, and has been remaining close to that level on Wednesday morning. Ethereum lost 0.5%, while other leading altcoins from the top ten fell in price, from -0.8% (Binance Coin) to -4.1% (XRP). The only exception was Terra (+7%), which reached its all-time high.

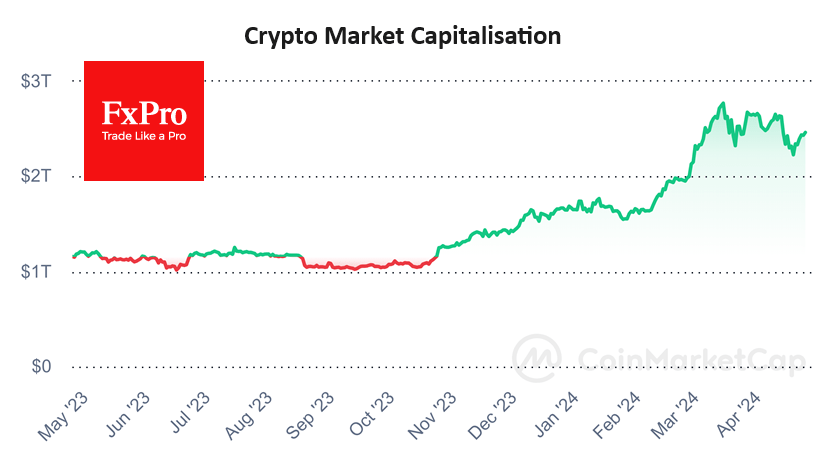

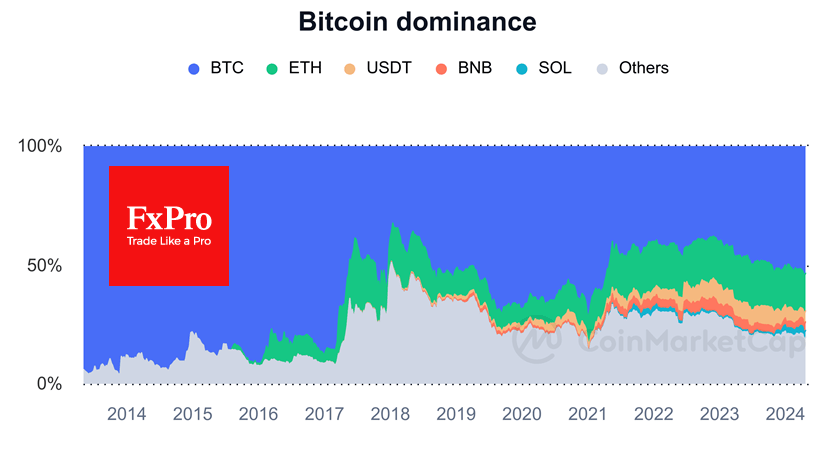

According to CoinMarketCap, the total capitalization of the crypto market decreased by 0.7% over the day to $2.13 trillion. The Bitcoin dominance index remained at 42.1%.

The Cryptocurrency Index of Fear and Greed for Wednesday is down 1 point to 55, but still is in greed territory.

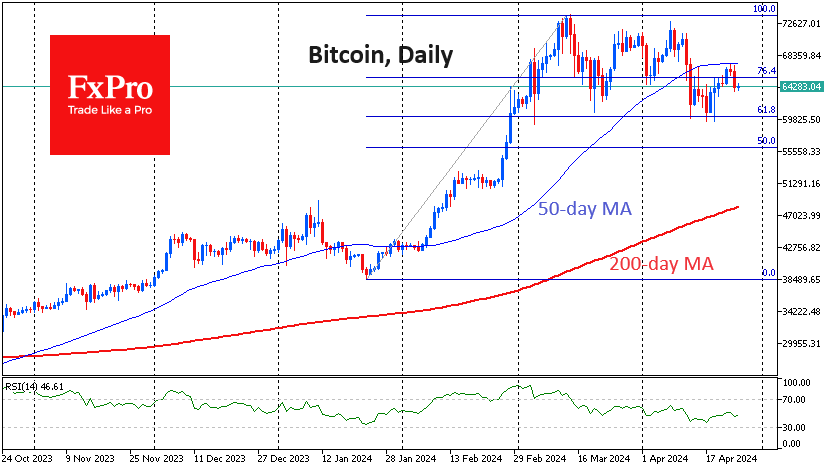

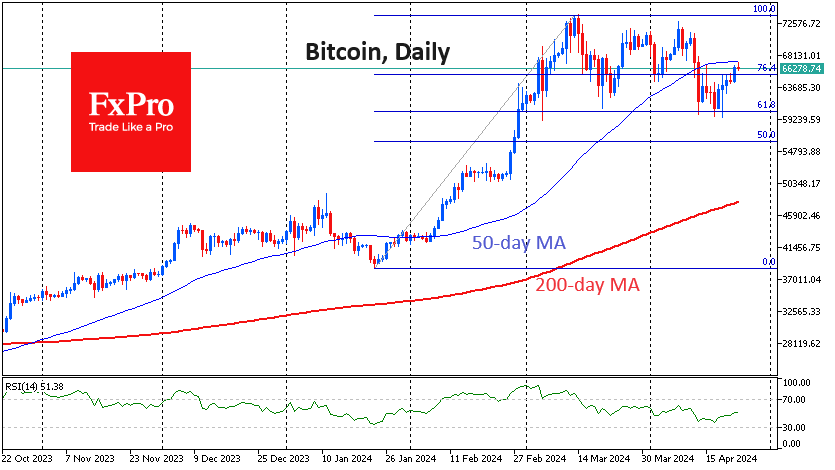

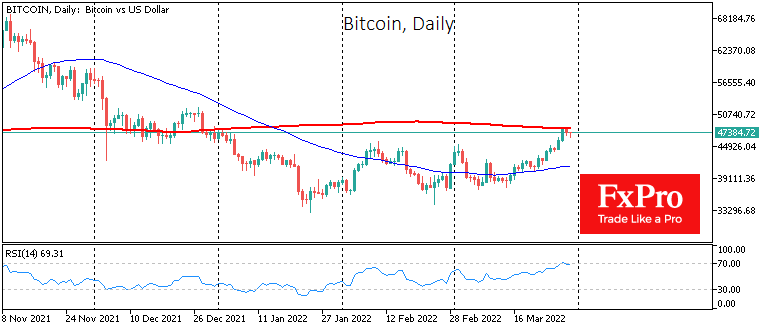

Bitcoin slowed down ahead of strong resistance at $48,000, near which the 200-day moving average also lies. The bulls are taking a tactical breather after the 28% rally from the lows seen on March 14th. At the same time, the positive mood on the global stock markets sets up that we will already see a test of this important level today.

The FxPro Analyst Team mentioned that now we will see the return of the bullish trend only after a couple of days of confident growth above the 200-day Moving Average. But even then, many participants may still have doubts about the rally since, in December, under similar conditions, it was not possible to develop an offensive.

According to CryptoQuant, Crypto whales have started sending bitcoin to exchanges again, which is a wake-up call. Typically, investors send cryptocurrencies back to the exchanges for their subsequent sale. CryptoQuant does not exclude that BTC will move to an active decline in the near future. However, the sale of bitcoins can also take place to buy altcoins, which are growing stronger than the first cryptocurrency in the bull market.

DataDash CEO Nicholas Merten believes that short-term investors and traders with leverage influence the volatility of bitcoin, and “whales” influence the growth. In his opinion, crypto whales have been buying up BTC over the past six months.

CEO of Tesla, Elon Musk, plans to create his own open-source social network with support for the DOGE cryptocurrency. Meanwhile, the Biden administration has proposed tightening tax reporting rules for cryptocurrency holders.

The FxPro Analyst Team