Bitcoin is unlikely to gain support before falling to $20K

June 13, 2022 @ 09:22 +03:00

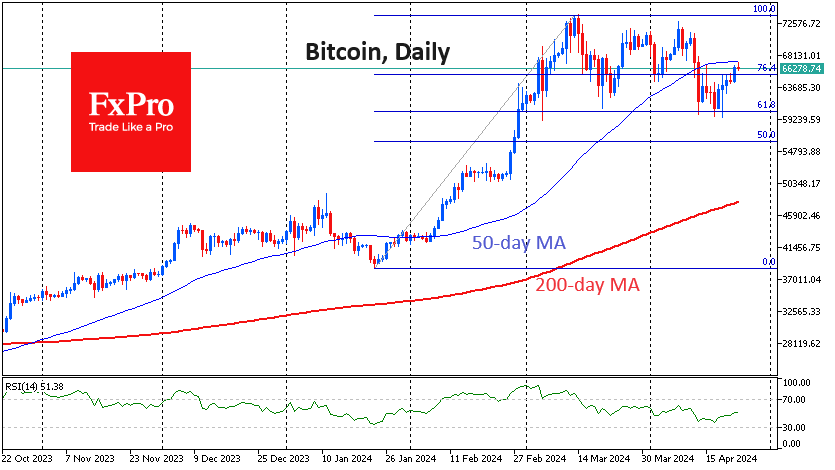

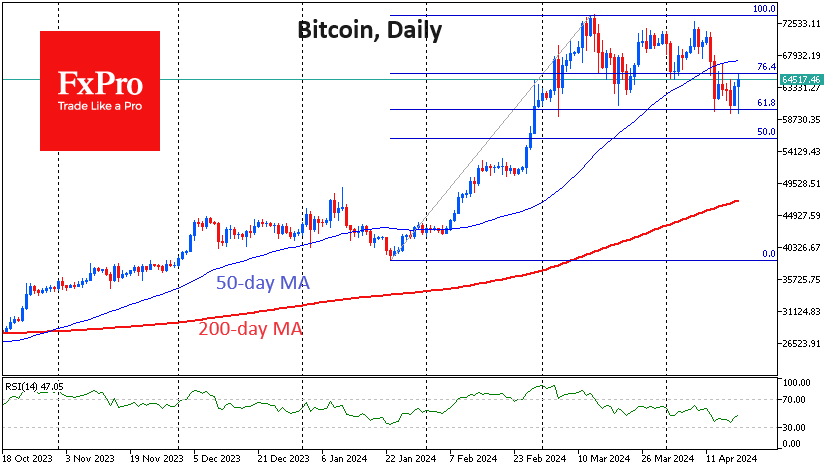

Bitcoin is losing for the seventh consecutive day, at one point on Monday morning, falling below $25K. The loss in seven days of selling is approaching 18%, bringing the rate to its lowest since December 2020. Ethereum has lost 28% in seven days. Altcoins in the top 10 fell in price from 14.5% (Tron) to 32% (Solana).

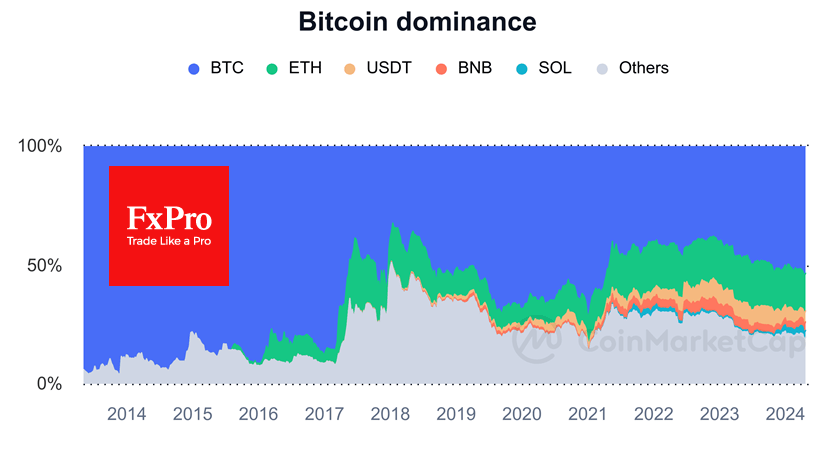

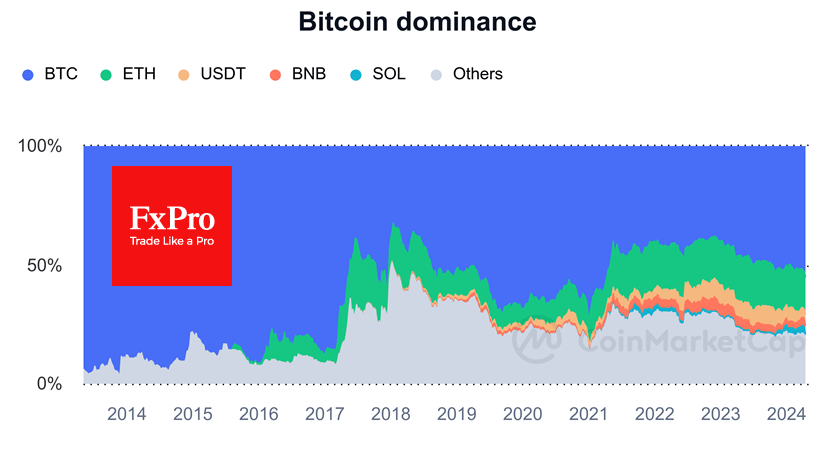

The total capitalisation of the crypto market, according to CoinMarketCap, sank 20% for the week, approaching the 1 trillion mark and crossing it at some point in the morning. As the price falls, so does trading volume, meaning we see investors fleeing the crypto market. However, the traditional market is suffering from the same symptoms.

The cryptocurrency Fear and Greed Index dipped to 11 points by Monday. Two similarly prolonged swings of this index in the 10-20 range were in December 2018 and March 2020. In the first, it was the end of the crypto-winter; in the second, it was the final chord of the sell-off.

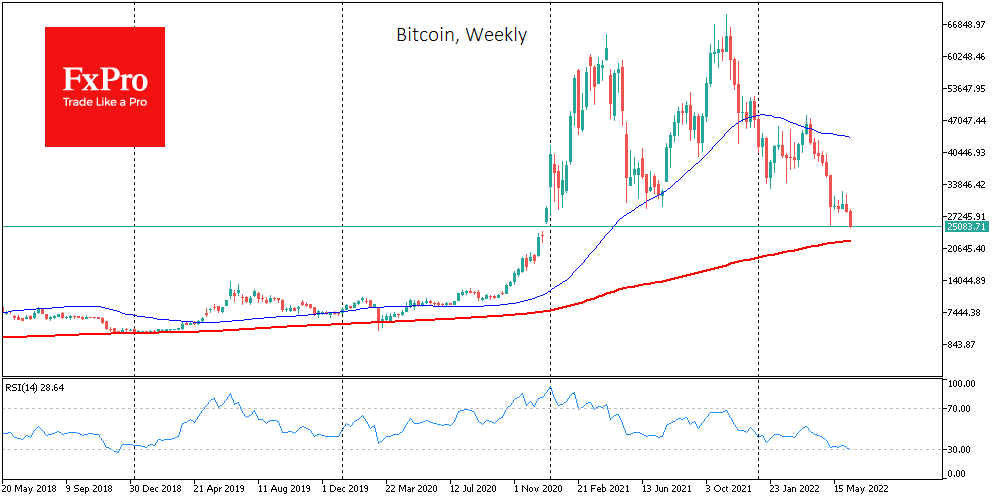

However, it may be too early to rush to redeem the drawdown. Bitcoin does not seem to have closed the gestalt yet, having not tested the 200-week moving average as it did in the previous two cases. It is now passing through 22K. A more ambitious target for the bears would be an attempt to push Bitcoin back to the 2017 highs region, above $19K.

US Treasury Secretary Janet Yellen called cryptocurrencies a ‘very risky’ option for retirement savings.

Galaxy Digital CEO Mike Novogratz warned investors of a prolonged phase of market consolidation amid tightening monetary policy by the US Federal Reserve.

Cardano blockchain founder Charles Hoskinson believes there are positives to be found even in the current market situation, as a bearish trend opens new opportunities for the crypto sphere.

The Central Bank of Canada reported that the share of its citizens owning BTC almost tripled to 13% in 2021. The Swedish Central Bank has called for a ban on bitcoin and other Proof-of-Work cryptocurrencies because of the environmental impact.

The FxPro Analyst Team