Bitcoin is the lame duck of the crypto market

April 13, 2022 @ 09:10 +03:00

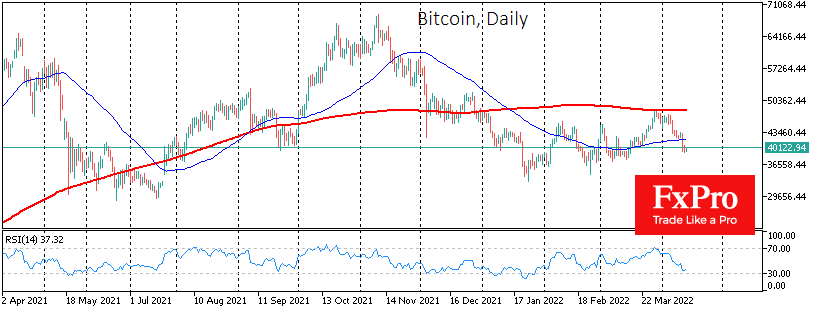

Bitcoin was down 0.8% on Tuesday, ending the day near $39,500. On Wednesday morning, the price stabilized around the $40K level, showing a slight increase of 0.4% over the past 24 hours. Ethereum added 1.8% during the same time. Other leading altcoins from the top ten are showing growth in the range from 0.9% (Avalanche) to 3.7% (Binance Coin). The Shiba Inu Token (SHIB) has also jumped by 15%, becoming the growth leader in the TOP-100.

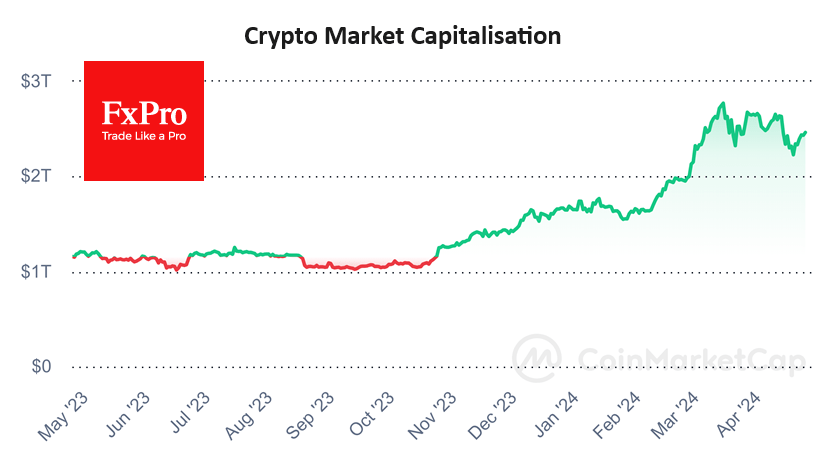

The total capitalization of the crypto market, according to CoinMarketCap, increased by 1.5% per day to $1.87 trillion. The Bitcoin Dominance Index fell 0.4% to 40.7% on a sharper rebound in altcoins.

Сrypto market attempts to stabilize after the downturn caused the Fear and greed index to strengthen. It added 5 points up to 25 by Wednesday morning and remained in a state of “extreme fear”.

Bitcoin remains the lame duck of the crypto market due to the prevailing price decline in traditional financial sectors. BTC tried to correct upwards on Tuesday after a strong drawdown the day before.

According to CoinShares, institutional investors withdrew $134 million from crypto funds last week, the most in 13 weeks.

In addition, it is still difficult to find confirmation of the hypothesis that cryptocurrencies are a hedge against inflation. The latest US consumer inflation data showed an 8.5% rise in prices in the US. During the same time, the capitalization of the crypto market in dollars decreased by 13%, reducing the purchasing power of the initial capital by more than 20%.

Speaking of Germany, for example, with its 7.6% price increase per year, an 8% depreciation of the euro against the dollar should also be added to the equation, which will further increase the losses. Investments in gold, on the other hand, give real (inflation-adjusted) growth of 8%, and in euros – more than twice as much.

This relationship is critical for retail investors, most of whom make decisions based on rather impulsive estimates and proceed from the foreseeable horizon.

At the same time, the institutional approach still points to the attractiveness of cryptocurrencies. Bank of America believes that Bitcoin and other cryptocurrencies could outperform bonds and stocks in the face of a potential global economic recession.

Investment agency Morningstar believes that cryptocurrencies have no equal in terms of income among assets, although they have too high volatility.

This is similar to the issue of new assets that the US stock market went through about a hundred years ago. By the beginning of the new century: it was the sector of high-tech companies, and now is the turn of cryptocurrencies.

The FxPro Analyst Team