Bitcoin is selling off but not getting cheaper

September 06, 2022 @ 09:06 +03:00

Market picture

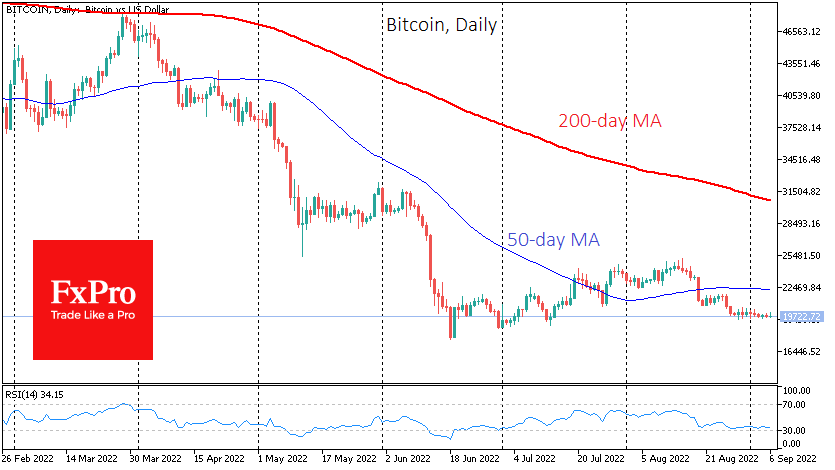

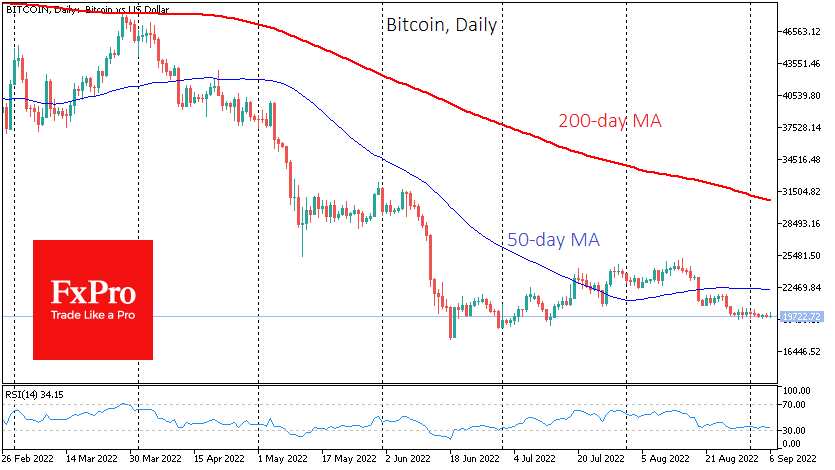

Bitcoin was down 0.7% on Monday, ending at around $19,750. BTC had a quiet day, trading just below the round level $20K amid a US holiday that reduced trading activity.

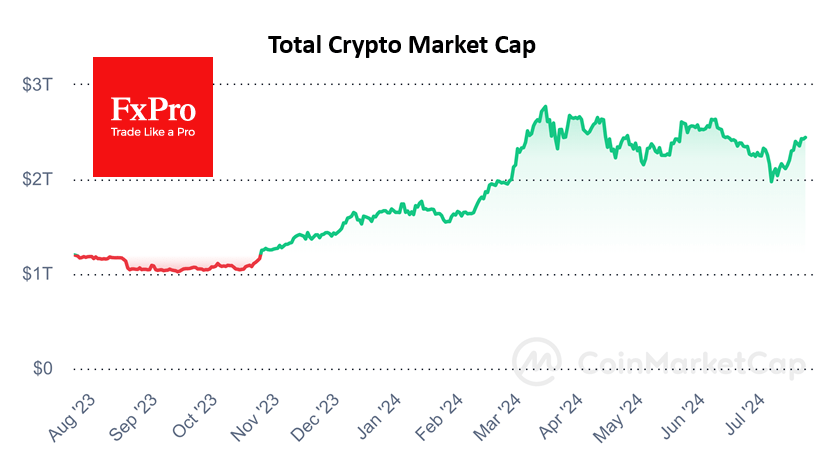

Ethereum continued to gain weight, adding 4.4% in the last 24 hours to $1640. Top altcoins are mainly in green, with a price range of -0.8% (Shiba Inu) to +2.2% (Solana). Total crypto market capitalisation rose 1% to $993bn and is again hovering around the psychologically important round mark.

With highs in almost two weeks, Ethereum is again testing its 50-day moving average. This successful countering of oppressive sentiment in traditional finance encourages cryptocurrency enthusiasts. However, the second cryptocurrency will need at least a solid consolidation above $1700 to assert growth.

News background

News background

According to CoinShares, net outflows from bitcoin funds were $11 million last week. Investments in funds that allow shorts on bitcoin rose by a record $18 million. That is, only downside bets provided the inflows. This may be good news as it did not cause a price drawdown, but sooner or later, these shorts will need to be closed, pushing the price up.

Miners are selling off bitcoin again. According to CtyptoQuant, miners were among the most active sellers, selling around 4,600 BTC in the last three days.

According to the analytics resource BitInfoCharts, the crypto whale sold 5,000 BTC in 2013. Since then, the value of bitcoins in his wallet has increased almost 30-fold.

Another 5,000 BTC linked to the bankrupt crypto exchange Mt.Gox has arrived, a Telegram channel reported. The funds arrived at the Kraken exchange.

Interestingly, such large transactions occur amid abnormally subdued price fluctuations, leaving us to speculate whether we see the professionalism of sellers and market makers who have fed such volumes without immediate consequence or manifest underlying buyer interest.

The FxPro Analyst Team