Bitcoin holds near $27K, but downside risks dominate

September 21, 2023 @ 11:57 +03:00

Market picture

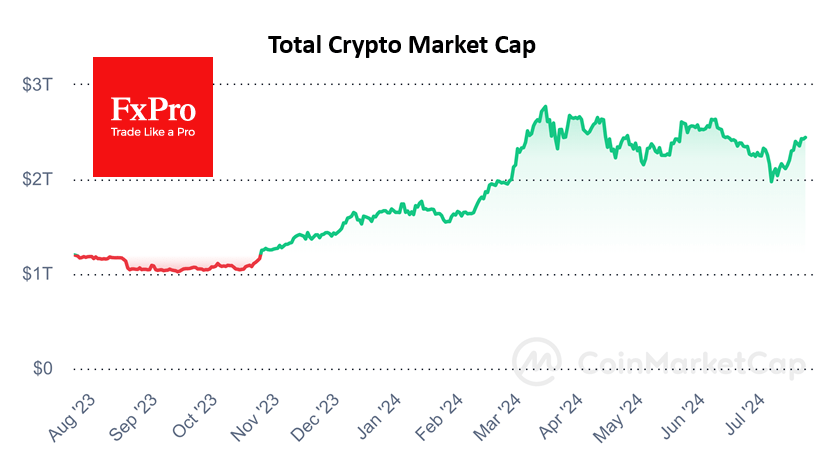

Even the Fed’s decision and comments failed to inspire crypto investors to move from their entrenched levels. The crypto market capitalisation fell a modest 0.25% on the day, significantly less than the Nasdaq’s losses (-1.5%) and more a reflection of the dollar’s 0.3% appreciation over the period.

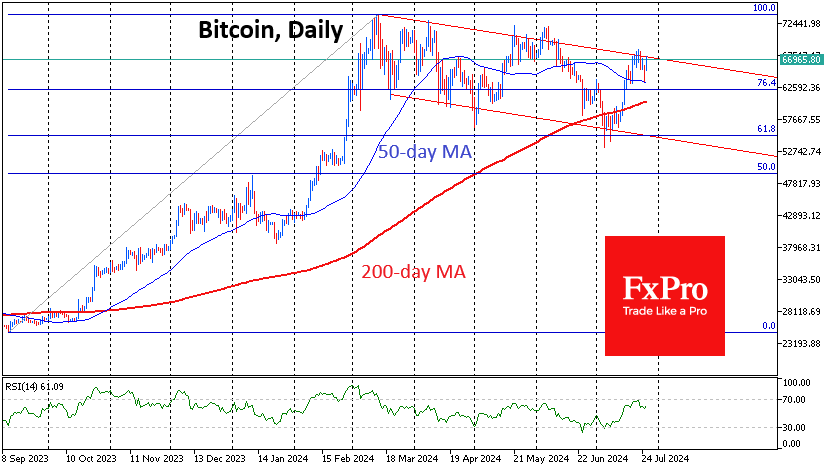

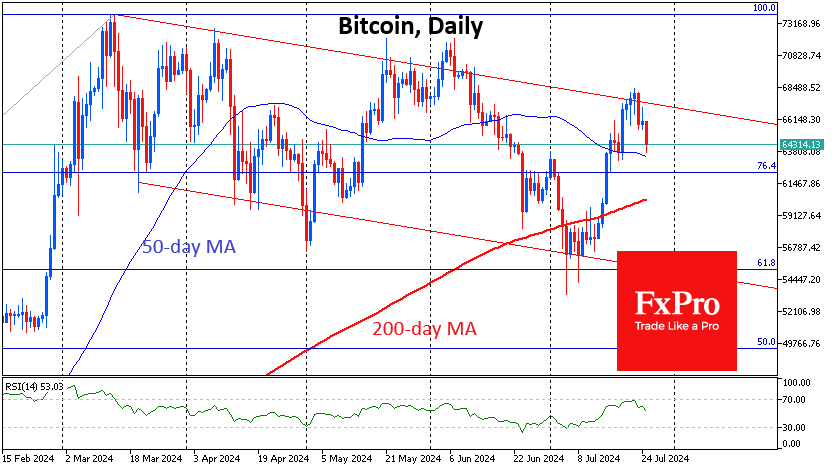

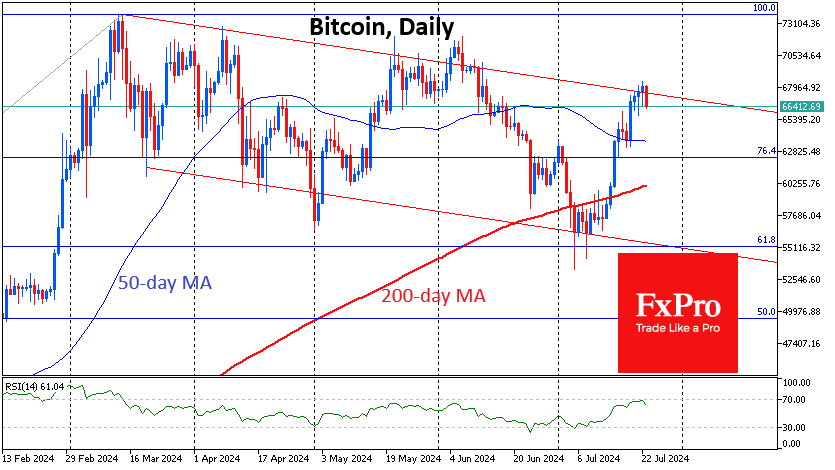

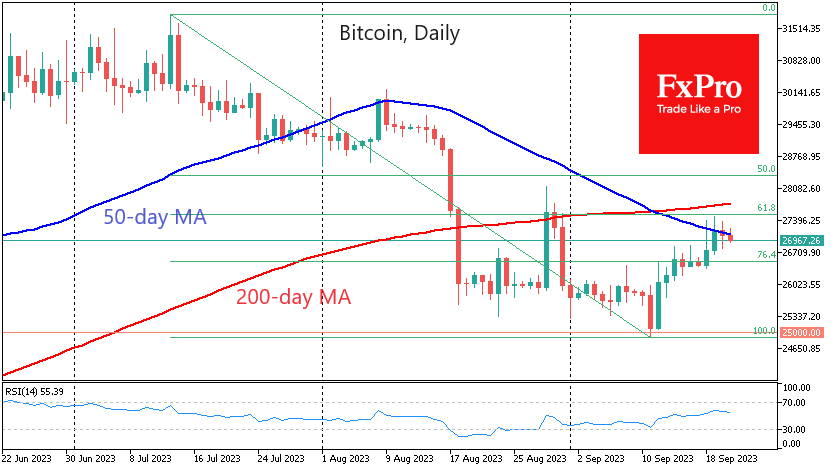

In Bitcoin, the sell-off intensifies around the 50-day moving average, sticking to a downtrend. The curve is near $27.0K but has been pointing down since early August, coinciding with the start of the latest bearish momentum.

On the other hand, with a dip towards $26.8K, Bitcoin is once again being dominated by buying. This tug-of-war won’t last long. Most likely, the market will decide its direction before Friday. We still believe that the chances of further declines are higher for now.

Long-term BTC holders are accumulating the coins they sold to short-term investors in the spring, which promises positive prospects for the future. This is the kind of behaviour hoarders exhibit at the beginning of bull markets, Bitfinex noted.

News background

QCP Capital attributes bitcoin’s recovery above $27K to rumours that the start of the distribution of funds to Mt. Gox customers has been delayed until 2024. Previously, the process was expected to be completed by 31 October 2023. Mt.Gox currently holds 142,000 BTC.

SEC spokesman David Hirsch said the regulator’s interest in crypto is not limited to large exchanges and that there will be increased oversight on intermediaries. These could be brokers, dealers, exchanges, clearing agencies or other cryptocurrency organisations.

The New York State Department of Financial Services (NYDFS) has reduced the number of pre-approved cryptocurrencies that can be hosted for trading and storage on licensed cryptocurrency platforms. XRP, DOGE, LTC, and ETC have been removed from the list.

According to a Coinbase survey, 20% of Americans own cryptocurrency. 87% of Americans said the US financial system needs to change. 72% of 18–34-year-olds believe that “crypto gives direct control over money”.

The FxPro Analyst Team