A bullish pause of the Crypto

March 14, 2023 @ 11:53 +03:00

Market picture

Bitcoin is swimming in the troubles of the US banking industry, gaining 9% in the last 24 hours and over 25% from Friday’s lows. Remember that bitcoin was created in 2008 to respond to distrust in the global financial system. This function of bitcoin as capital preservation was recalled over the weekend and worked out on Monday.

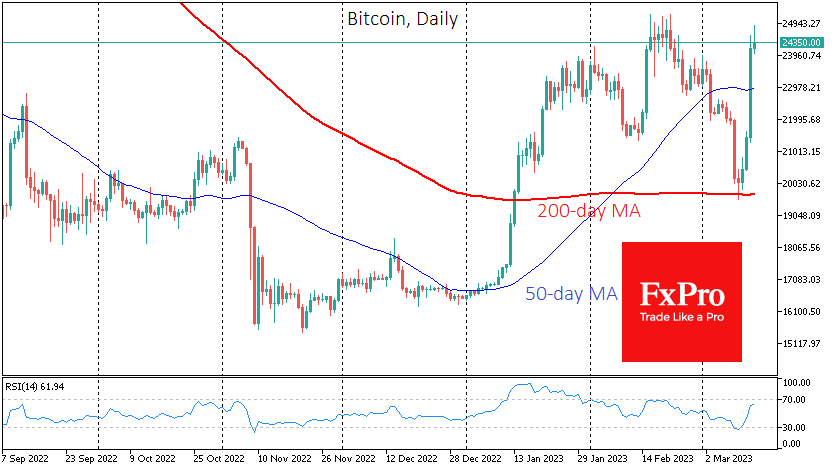

BTCUSD returned strongly above its 50-day moving average, indicating that long and medium-term sentiment remains bullish.

At the same time, the short-term sentiment is more wait-and-see. Since last night, bitcoin has been bouncing around the 24.5 level. About a month ago, selling pressure prevented the price from going higher. The latest stop is an attempt to breathe before a new surge.

On the weekly timeframe, bitcoin has passed the 50-week mark and is testing the 200-week mark. After the pullback of the past three weeks, the chances of a breakout have increased significantly.

Fundamentally, cryptocurrencies are being helped by a change in monetary policy expectations. In less than a week, the markets have gone full circle on expectations, from a 25-point hike to a 50-point hike and back. In addition, expectations for further hikes later this year fell on Monday and Friday, which is positive for cryptocurrencies, the Nasdaq index and gold.

Another recalculation resulted in a 1.16% increase in the bitcoin mining difficulty. The index hit an all-time high of 43.55T.

News background

According to CoinShares, investment in crypto funds fell by a record $255 million last week, the fifth consecutive week of outflows. Bitcoin fell by $244 million and Ethereum by $11 million.

According to Santiment, cryptocurrency “whales” and “sharks” have started to accumulate extremely fast. Major BTC holders added $821 million to their accounts in just one week.

Another bank has been closed in the US. The Fed shut down Signature Bank, one of the largest lenders in the cryptocurrency industry. The regulator stressed that all of Signature’s deposits would be returned to its owners and the Silicon Valley bank’s customers. Against this backdrop, the USDC and DAI stablecoin exchange rates have almost returned to $1.

Changpeng Zhao, chief executive of the Binance exchange, said banks had become a risk to stablecoins backed by fiat currencies. And fiat currencies themselves, he said, could pose risks to cryptocurrencies, stablecoins and financial stability in general.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks