FxPro: Tightening grips: Bitcoin’s waves of growth are narrowing

September 25, 2018 @ 17:46 +03:00

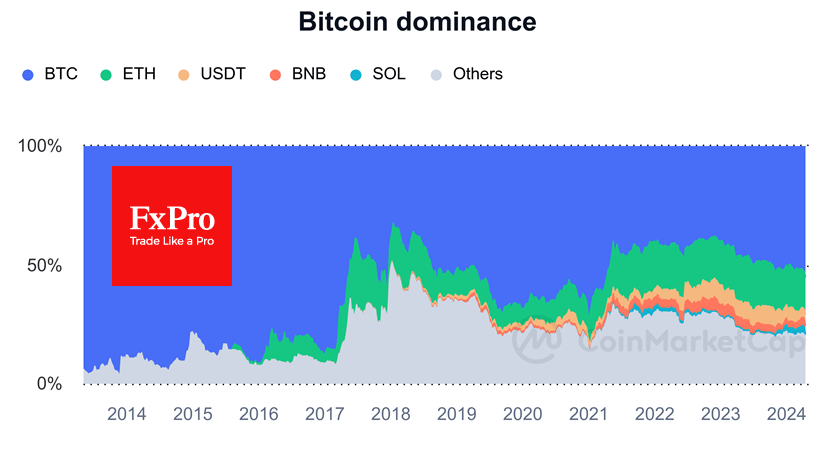

At the end of last week new wave of crypto optimism was exhausted. Even though the total market capitalization drawdown lower than $190-200 bln. should attract buyer’s demand, it is hard for market to break above this level. If anything, looks like the digital currencies “touched” a certain balance.

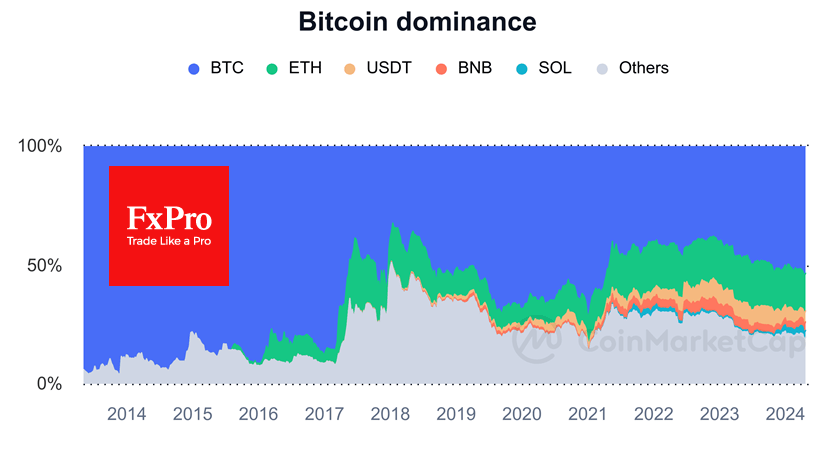

Meanwhile, a two-fold XRP growth during the last week significantly “shook up” the market. Some investors could remember the good times when similar positive price dynamics appeared quite often which was very attracting for a huge number of new investors. It’s worth noting that the faith in “crypto-project” and hype around it have significantly weakened, that’s why in the beginning of the new week XRP is experiencing the biggest pullback among the TOP-10 coins.

As of Tuesday morning, XRP loses 20% but the current token price at $0.44 still 37.5% higher than before the rally. In case of actual launch of the product based on XRP token we can expect the new wave of buying as early as in October.

Bitcoin (BTC) loses less than 4% in the last 24 hours and is trading at around $6,400. BTC locked in the range $6,300 – $7,300 from early August. The leading altcoins among Top-10 are also experiencing the significant drawdown: Ethereum (ETH) loses almost 11% and trading at $210, Bitcoin Cash (BCH) loses around 7% trading at $440, EOS, Stellar (XLM) and Cardano (ADA) are losing around 12%.

Blockchain.com’s data showed the growth of daily volume of confirmed transactions in the Bitcoin network: from 200k (spring) to 270k at the end of last week. However, it is significantly lower that historical maximum at 400k recorded in December 2017.

The stabilization of the cryptocurrency rates is the reverse side of the current market stagnation. This should have positive affect on cryptocurrencies in context of using them as a payment method, though the process can be relatively slow. However, it is already clear that the current flat trend lays the groundwork for return of the cryptocurrency demand among buyers and sellers of goods and services, as the rates become more predictable.

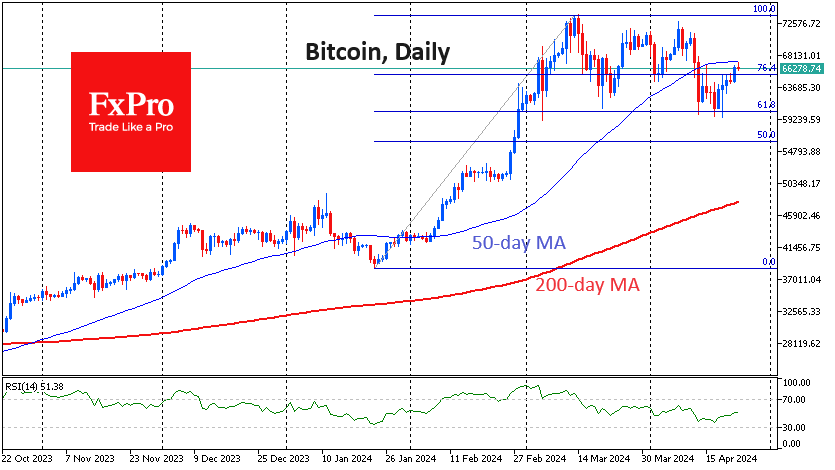

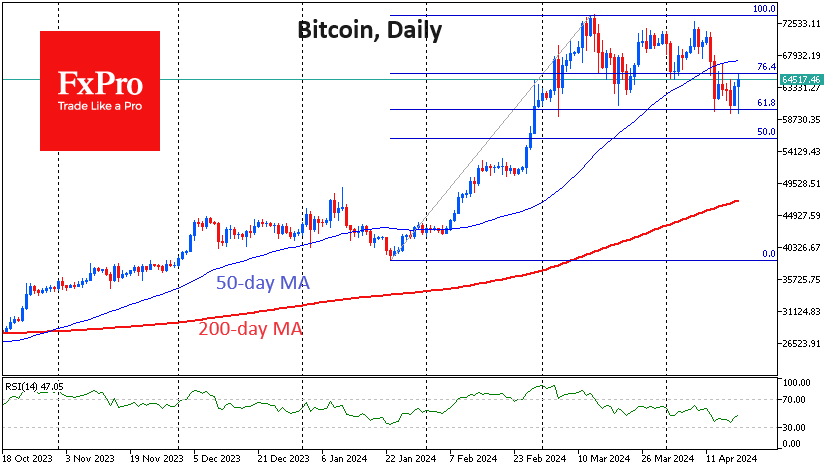

From the technical analysis perspective, at the end of last week Bitcoin turned to a decline from the $6,700 area, continuing the series of reversals from new “lower lows” ($11,500 in March, $9,700 in April, $8,200 in July and $7,400 in early September). Once again, the weakening raises questions: will the main cryptocurrency get the support from investors, in case of a new collapse to $6,000. The grips are tightening: the price remains within the convergent triangle. The exit can be quite unexpected, with the effect of a compressed spring and a powerful movement in one or another direction.